For Q2 2024, PVI Finance recorded a remarkable performance with nearly VND 14 billion in net revenue, a tenfold increase compared to the same period last year. The company attributed this impressive growth to a significant rise in revenue from real estate business operations and more effective securities investment activities.

Meanwhile, the slower growth in cost of goods sold (COGS), which increased only 3.2 times compared to the previous year, resulted in a gross profit of nearly VND 10 billion, an astounding 85-fold increase year-over-year.

After deducting expenses, PVI Finance achieved a net profit of over VND 9 billion, an 8.6-fold increase compared to the same period in 2023.

For the first half of 2024, the company’s cumulative performance continued to shine, with nearly VND 81 billion in net revenue, almost 50 times higher than the same period last year. The faster growth in revenue compared to COGS (22 times) contributed to a net profit of over VND 29 billion, a remarkable turnaround from a net loss of over VND 1 billion in the previous year.

Looking at the full-year targets, PVI Finance has set ambitious goals for 2024, aiming for nearly VND 90 billion in revenue, a 3.9-fold increase from 2023. This target comprises a breakdown of 5% from hotel services, 12% from financial investment activities, and a significant 83% from real estate. The company forecasts a net profit of nearly VND 11 billion, surpassing the 2023 performance by 5.1 times.

With the outstanding results in the first half of the year, the company is well on track to achieve its annual targets, having already met its revenue goal and surpassed its net profit objective by 174%.

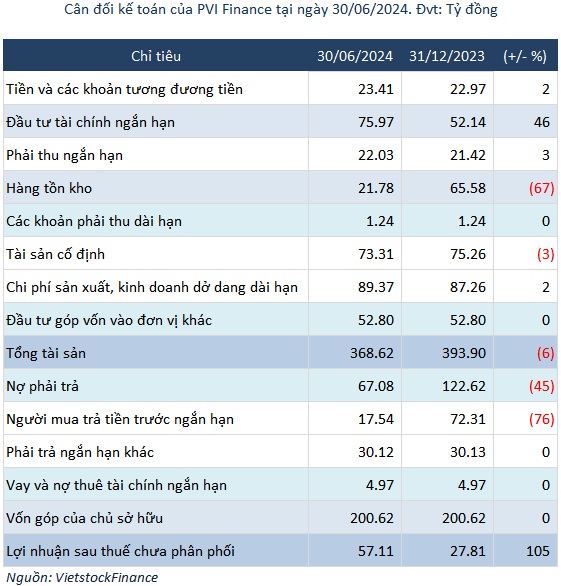

As of the end of Q2 2024, the company’s total assets were valued at nearly VND 369 billion, a 6% decrease from the beginning of the year, mainly due to a 67% reduction in inventory to nearly VND 22 billion. On the other hand, short-term financial investments increased by 46% from the start of the year to nearly VND 76 billion.

Among the short-term financial investments, there were short-term holdings related to capital entrustment to individuals in 2023, with interest rates agreed upon based on bank rates or higher, and these entrustments were all secured by assets.

The company’s payables as of June 30, 2024, showed a significant decrease of 45% from the beginning of the year, totaling over VND 67 billion, mainly due to a 76% drop in short-term advance payments from buyers to VND 18 billion.

|

PVI Finance was established on November 6, 2007, by its founding shareholders: Vietnam Oil and Gas Insurance Joint-Stock Corporation (PVI) and Vietnam-Soviet Oil and Gas Joint Venture (VSP). The Petroleum Finance Joint-Stock Company (PVFC) later became a founding shareholder in June 2010. Subsequently, PVI Finance transferred its entire capital contribution to Kinh Thanh Commerce Joint-Stock Company. The company’s goal is to become a professional entity in the fields of financial investment, real estate, and hotel and tourism services. |

Khang Di

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.