Dr. Can Van Luc, Dr. Dang Ngoc Tu and the Research Team at BIDV Training and Research Institute have released a report assessing the impact of the recent wage increase on economic growth and inflation for the period 2024-2029. We are pleased to share the detailed report with our readers.

——-

During the 7th session, the National Assembly agreed to entrust the Government with adjusting the base salary (from 1.8 million VND to 2.34 million VND/month, a 30% increase), retirement pensions, and allowances, effective from July 1, 2024. According to the Ministry of Finance’s estimates, the budget for the base salary, pension, and allowance increases for the next three years (2024-2026) is approximately 900 trillion VND, exceeding the initial estimate by 340 trillion VND. Assuming this additional expenditure is evenly distributed over the years, the spending in 2024 (for half a year) will be 68 trillion VND higher than expected, while the spending in 2025 and 2026 will each be 136 trillion VND higher. Below, the Research Team estimates the impact of this higher-than-expected expenditure on economic growth and inflation under two scenarios.

1. Methodology for Impact Estimation

The Research Team’s approach to estimating the impact on GDP growth and inflation includes the following key points:

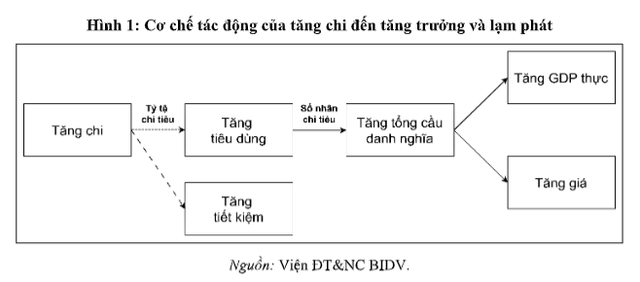

First, the mechanism by which the increase in expenditure (from wage increases) affects GDP growth and inflation is illustrated in Figure 1. Initially, higher government spending leads to increased income for the beneficiaries. However, these beneficiaries do not spend all the additional income but save a portion of it. The additional spending, through a consumption multiplier, will boost nominal aggregate demand (or aggregate demand at current prices) for the entire economy, not only in the year of increased spending but also in subsequent years, with a diminishing impact over time. This increase in aggregate demand subsequently translates into higher real GDP (or GDP in comparable prices) and higher overall inflation.

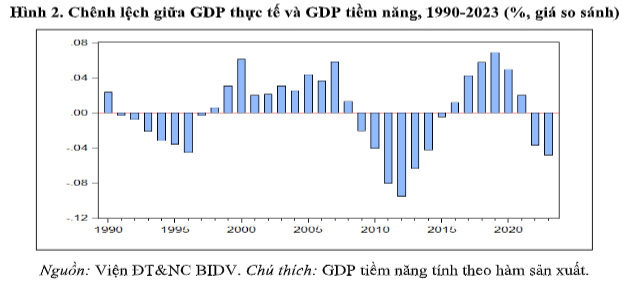

Second, depending on the state of the economy (whether real GDP is above or below its potential), an increase in nominal aggregate demand will lead to either higher GDP growth or higher inflation. Research on potential GDP using the production function by the BIDV Training and Research Institute indicates that the economy is in a cycle where real GDP is below its potential, and this cycle could persist until 2029 without a breakthrough (Figure 2). Therefore, the Research Team assumes that the increase in nominal aggregate demand will lead to higher real GDP growth rather than higher inflation.

Third, the Research Team also assumes that the expected level of expenditure has already been considered in the National Assembly and the Government’s projections for GDP growth and inflation, as well as in market expectations. Therefore, in this article, the Research Team focuses on assessing the impact of the higher-than-expected expenditure on the initial estimates of GDP growth and inflation.

2. Impact on Aggregate Demand

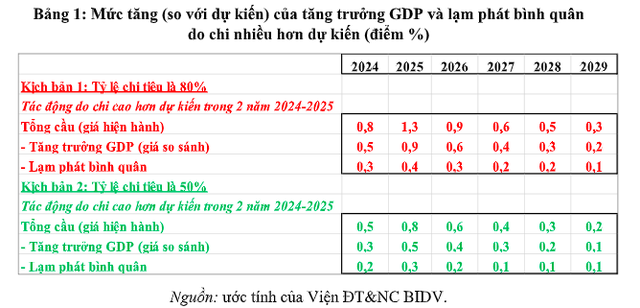

The spending behavior of those benefiting from the base salary increase (in the public sector) may differ from the overall economy. Therefore, to provide a comprehensive assessment, the Research Team presents two scenarios regarding the consumption behavior of the beneficiaries: (1) they spend 80% of the additional income, which is in line with the overall economy (based on World Bank’s 2022 findings); and (2) they spend 50% of the additional income, which is lower than the overall economy.

Scenario 1: Consumption Rate of 80% of the Additional Income

(1) From higher-than-expected spending in 2024:

According to the World Bank (2022), the savings rate (as a percentage of GNI) for the economy up to 2021 was around 20%. Therefore, the Research Team assumes that the beneficiaries in 2024 will spend 80% of the additional income, amounting to 54.4 trillion VND out of the aforementioned 68 trillion VND wage increase. Based on the long-term consumption multiplier for the economy from Nguyen Thi Hoa’s (2022) research, a 1% increase in regular spending leads to a 0.54% increase in aggregate demand in the long run. Thus, the above spending level will result in a 2.3% increase in aggregate demand in the long run (from 2024 to 2029). This increase in aggregate demand is distributed over the years from 2024 to 2029, with a diminishing impact over time.

(2) From higher-than-expected spending in 2025 and 2026:

In 2025, the spending level is double that of 2024, leading to a further increase in the rate of aggregate demand growth for that year. However, in 2026, the spending level is the same as in 2025, so it does not lead to an additional increase in the rate of aggregate demand growth for that year.

Scenario 2: Consumption Rate of 50% of the Additional Income

(1) From higher-than-expected spending in 2024:

The beneficiaries in 2024 spend 50% of the additional income, amounting to 34 trillion VND out of the aforementioned 68 trillion VND wage increase. Based on the long-term consumption multiplier for the economy, this spending level will result in a 1.5% increase in aggregate demand in the long run.

(2) From higher-than-expected spending in 2025 and 2026: similar to Scenario 1.

3. Impact on GDP Growth and Inflation

The higher-than-expected aggregate demand will lead to higher GDP growth and inflation (compared to the initial projections). Given the current economic cycle, as mentioned earlier, with the same increase in aggregate demand, GDP growth will increase more than inflation. The specific results are presented in Table 1 below. Thus, the impact of the wage increase on GDP growth and inflation starts in 2024 but peaks in 2025 before gradually decreasing in subsequent years.

4. Conclusion and Recommendations

Implementing the wage reform in line with Resolution No. 27-NQ/TW of the 12th Party Congress, dated May 21, 2018, on wage policy reform, is a sound decision in terms of both magnitude and timing. Firstly, the wage increase will improve the living standards of officials, civil servants, and public employees, especially as real wages are declining due to inflation and changing employment conditions, narrowing the income gap between the public and private sectors. At the same time, the wage increase will stimulate consumer demand, which is currently lagging compared to investment and production, thereby boosting economic growth (as assessed above). In the long run, higher wages will also encourage improvements in labor productivity in the public sector and the economy as a whole.

To minimize the side effects of the wage increase on inflation (as assessed above), the Research Team offers the following five recommendations:

Firstly, the Government should review the plan (especially the magnitude and timing) for adjusting the prices of some public services and electricity for this year and the next two years to avoid excessive synergy with the wage increase, which could put significant pressure on inflation.

Secondly, strengthen communication, propaganda, inspection, and supervision to minimize the impact of psychological factors, hoarding, price gouging, and bandwagon effects, etc. Regarding the policy of increasing wages for the public sector, the public needs to be informed through communication channels to understand the objectives and significance of this policy, as mentioned earlier.

Thirdly, improve the efficiency of policy implementation and coordination (especially between monetary, fiscal, pricing, and other macroeconomic policies) to promote growth, stabilize the macro-economy, stabilize exchange rates and interest rates, and ensure the stability of the financial and monetary market, as well as social security. Fiscal policy should play a leading role, expanding in a focused and targeted manner, linked to promoting public investment disbursement; monetary policy should play a supportive role, being proactive, flexible, and improving credit access while controlling risks and handling bad debts; priority should be given to upgrading the stock market in 2025 and controlling systemic risks (interconnectedness between banks, securities, and real estate). At the same time, ensure an adequate supply of goods and services (especially essential goods) to prevent unnecessary shortages.

Fourthly, maintain flexibility in the inflation target to create room for the wage increase and promote growth (in the context of the past three years – 2020, 2021, and 2023 – with low GDP growth rates compared to the set targets). In the current context, an inflation rate of around 4-4.5% for this year and the next two years is acceptable.

Fifthly, continue to improve and effectively implement labor, wage, and labor relation policies in both the public and private sectors to improve the income and living standards of workers. Research and promptly implement policies and solutions on wages in conjunction with human resource management solutions (recruitment, placement, training, and evaluation of officials…) and labor productivity improvement as outlined in the Master Plan for Productivity Improvement based on Science, Technology, and Innovation for the period 2021-2030, issued together with Decision No. 36/QD-TTg dated January 11, 2021, by the Prime Minister. Accordingly, promptly establish the National Productivity Committee to contribute to the effectiveness of wage reform policies and improve labor productivity and national competitiveness.

Positive Signs in Exports and Imports: Early 2024

Vietnam’s total import-export turnover in January 2024 reached nearly $64.22 billion, representing an increase of 37.7% compared to the same period last year. This positive signal in the trade of goods shows a promising start to the year 2024.