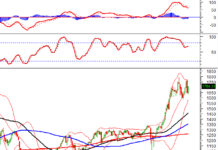

Global gold prices plummeted during the overnight session and into the early hours of this morning (July 19th) as the US Dollar index surged from its four-month low. Some experts predict that if former US President Donald Trump is re-elected, his economic policies will bode well for gold prices.

At the close of trading on US markets, spot gold fell by 13.3 USD/oz compared to the previous session’s close, equivalent to a 0.54% drop, settling at 2,445.5 USD/oz, according to data from Kitco Exchange.

By 9:00 am Vietnam time, spot gold prices in the Asian market had dropped a further 23.3 USD/oz compared to the New York close, equivalent to a 0.95% decline, trading at 2,422.2 USD/oz.

When converted using Vietcombank’s USD selling rate, this price equates to approximately 74.3 million VND per tael, a decrease of 1.3 million VND per tael from yesterday morning’s rate.

Gold prices retreated as the US Dollar rebounded strongly on Thursday, after plunging to a four-month low in the previous session. The Dollar Index, a measure of the greenback’s value against a basket of other major currencies, rose 0.5% to close at 104.17.

This morning, the US Dollar continued its upward trajectory, with the Dollar Index reaching 104.25 at around 9:00 am Vietnam time.

The greenback regained strength following the release of the latest economic data from the US.

According to a report from the US Department of Labor, initial jobless claims for the week ending July 13 rose by 20,000 from the previous week to 243,000, higher than the 230,000 claims predicted by economists in a Reuters poll. However, this is not considered a significant weakening of the labor market.

Additionally, a measure of manufacturing activity in the mid-Atlantic region showed stronger-than-expected growth in July, thanks to an increase in new orders.

Gold prices also declined as investors locked in profits following gold’s record-breaking rally on Wednesday.

Nonetheless, Russell Shor, an analyst at Tradu Company, believes that the long-term outlook for gold prices remains bullish. “The Fed is poised to cut interest rates based on the belief that inflation is under control,” Shor said. Geopolitical tensions and central bank demand are also positive factors for gold in the long run, he added.

According to the FedWatch Tool from CME Group, there is a 93.5% probability that the Fed will lower rates by the end of September. However, in a report released on July 18th, the International Monetary Fund (IMF) advised the US to wait until the end of 2024 before cutting rates.

The European Central Bank (ECB) kept interest rates unchanged at its meeting on Thursday, as expected. However, ECB President Christine Lagarde hinted at a possible rate cut in September, causing the euro to weaken against the US dollar.

Arslan Ali, an analyst at FX Empire, stated that the primary factor supporting gold prices at this time is the expectation of an upcoming Fed rate cut.

“Additionally, Trump’s stance on lowering taxes, reducing interest rates, and increasing tariffs also bodes well for gold prices. If these policy positions become a reality in the event of a Trump victory, they could trigger inflationary pressures and potentially weaken the US dollar, enhancing gold’s appeal as a safe-haven investment,” the expert elaborated.

From a technical perspective, Mr. Ali suggested that investors should monitor the 2,462.54 USD/oz level as a key support for gold prices. “If this level holds, gold could advance towards the nearest resistance level at 2,484.03 USD/oz, followed by 2,495.38 USD/oz and 2,508.05 USD/oz,” he added.

Conversely, a break below 2,462.54 USD/oz could trigger a “sell-off towards the support levels of 2,451.33 USD/oz, 2,434.87 USD/oz, and 2,420.02 USD/oz,” Mr. Ali cautioned.

Weekend Ending Sees Significant Gold SJC Price Drop

After surging to nearly 79 million dong per tael on February 2nd, the price of SJC gold is now plummeting towards the 78 million dong per tael mark this weekend.