|

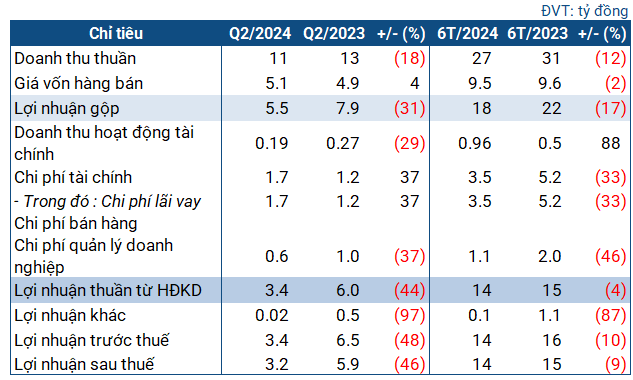

SVH’s Q2 2024 Financial Results

Source: VietstockFinance

|

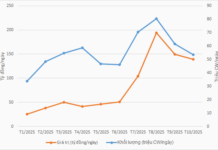

In Q2, SVH’s revenue decreased by 18% year-over-year to 11 billion VND. In contrast, cost of goods sold increased by 4%. After deductions, the company reported a gross profit of 5.5 billion VND, a 31% decrease from the previous year.

Other metrics fluctuated but did not significantly impact the final results. At the end of Q2, SVH’s net income was 3.2 billion VND, a 46% decline. SVH attributed this to unfavorable weather conditions in central Vietnam since the beginning of 2024, which affected both revenue and profitability. In the same period last year, SVH provided a similar explanation when profits were more than double that of Q2 2022.

The El Nino phenomenon, which caused drought conditions since 2023, has negatively impacted the business of hydropower companies. However, it is predicted that the phenomenon will weaken and transition to La Lina in Q3 2024, bringing hopes for improved performance in the second half of the year for the hydropower group.

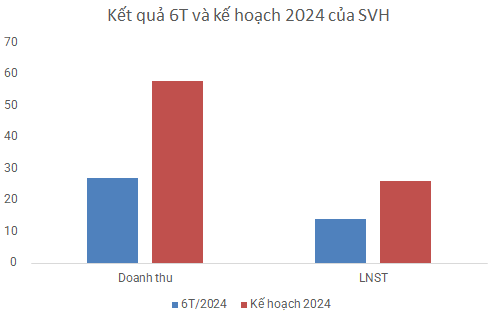

For the first six months of 2024, SVH achieved 27 billion VND in net revenue, a 12% decrease year-over-year, and 14 billion VND in net income, a 9% decline. Compared to the plan approved by the 2024 General Meeting of Shareholders, the company has achieved 47% of its revenue target and over 54% of its net income target for the year.

As of the end of Q2, SVH’s total assets increased by 14% from the beginning of the year to 464 billion VND. Short-term assets accounted for just over 50 billion VND, a 41% decrease. Cash increased by 36% to 4 billion VND, while short-term receivables decreased by more than 50% to 37 billion VND.

Construction in progress was recorded at nearly 227 billion VND, a 76% increase from the beginning of the year, but the company did not provide a detailed explanation for this item.

On the liabilities side, total liabilities increased by 20% to nearly 260 billion VND. Short-term liabilities exceeded 108 billion VND, a 37% increase from the beginning of the year. The current and quick ratios were both 0.46, indicating that the company may face challenges in meeting its short-term debt obligations.

The company also had short-term debt of nearly 26 billion VND owed to Ms. Tran Thu Huong and long-term debt of over 151 billion VND to OCB, a 10% increase from the beginning of the year.