Illustrative image

According to the latest data released by the leadership of the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), credit growth as of June 28 reached 5.83%.

Previously, at a recent conference, BIDV General Director Le Ngoc Lam shared that the bank’s credit growth as of June 17 reached 4.7%, corresponding to outstanding credit of VND 1,870,000 billion, an increase of VND 81,000 billion compared to the end of 2023.

Thus, in the last 10 days of June alone, BIDV’s credit outstanding balance expanded by 1.13 percentage points compared to the end of 2023. With a credit outstanding balance of more than VND 1,747,000 billion at the end of 2023, the amount of capital BIDV injected into the economy in the last 10 days of June was nearly VND 20,000 billion.

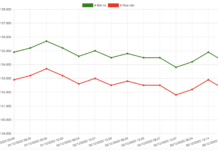

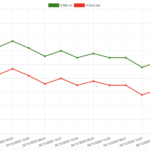

The credit growth trend at BIDV is quite similar to that of other credit institutions, as data from the State Bank of Vietnam (SBV) shows that credit growth in the economy recorded an impressive increase in June.

Specifically, as of the end of June, the total outstanding credit in the economy reached nearly VND 14,400,000 billion, up 6% compared to the end of last year. Previously, credit growth as of the end of May 2024 reached only 2.41% and reached 3.79% as of June 14.

Thus, in June alone, the economy received an additional amount of about VND 487,000 billion, higher than the total credit growth in the first five months of the year. In the last two weeks of June, the total outstanding credit in the economy expanded by nearly VND 300,000 billion.

Speaking at the online conference on solutions to promote credit growth in 2024, the BIDV General Director said that after a period of negative growth in January and February, credit started to grow in May and reached 4.7% by June 17. Only Hanoi, Ho Chi Minh City, and the South Central region had a good growth rate, while the rest were slow or even negative compared to the end of 2023.

The General Director of BIDV attributed the slow credit growth to the following reasons: enterprises were unable to absorb capital, financial capacity weakened, the number of enterprises withdrawing from the market or temporarily suspending business increased due to difficulties in the post-COVID-19 period, political conflicts in many parts of the world, and a stagnant real estate market, leading to a decrease in consumer loan demand among the population…

Mr. Le Ngoc Lam also emphasized that BIDV will continue to take measures to encourage its branches to actively promote credit growth in the last six months of the year; organize meetings, dialogues, and connections between enterprises and banks to identify difficulties and remove obstacles; and continue to deploy credit packages and reduce interest rates to support credit growth promotion in accordance with the programs and directions of the SBV.

Along with BIDV, some large banks also reported a strong acceleration in credit growth in the last weeks of June.

Sharing the same view at the online conference on solutions to promote credit growth in 2024, Vietcombank’s General Director Nguyen Thanh Tung said that as of June 17, the bank’s credit growth reached only 2.1%, or VND 29,000 billion, lower than in previous years. However, he expected credit growth to reach 4.3% by the end of June, 8.2% by the end of September, and 12% by the end of the year. In other words, the growth rate in the second half of June was almost equal to that of the previous five months.

Reporting at the conference, Agribank’s General Director Pham Toan Vong informed that as of May 31, the bank’s credit outstanding balance reached VND 1,570,000 billion, up only 1.24% compared to the end of last year. However, it is expected to reach 2.5% by the end of June, meaning that the growth rate in June will be equal to the total growth rate in the previous five months.

In the joint-stock group, the General Director of MB said that credit growth by the end of June could reach 6-6.5%, up from 4.5% in mid-June. VIB’s management also forecast a growth rate of about 2% by the end of the second quarter, up from 1.14% at the end of May.

Previously, credit growth had shown signs of recovery after recording negative growth in the first two months of the year. According to Ha Thu Giang, Director of the Credit Department for Economic Sectors at the SBV, the credit growth rate has gradually improved over the months, and the credit turnover provided by credit institutions to the economy in the first six months of 2024 was higher than in the same period in the last three years.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Deputy Head of Internal Audit Department of SBV appointed Deputy CEO of Agribank

After the new appointments, Agribank’s Executive Board now consists of 9 members, with Mr. Pham Toan Vuong as the CEO.