Banks are under pressure to disburse loans from the beginning of the year, but the economy has not fully recovered yet. Photo illustration: L.V.

|

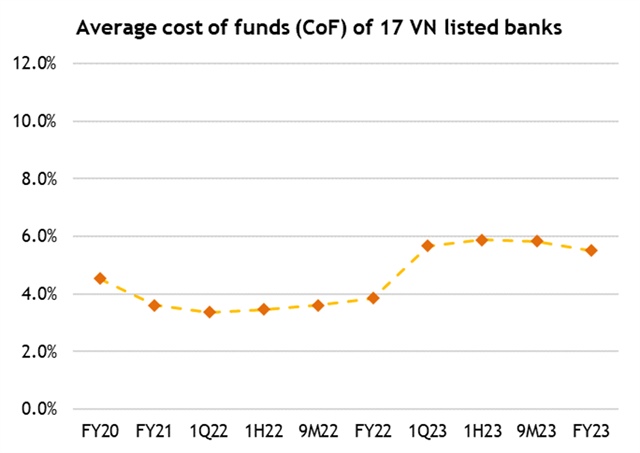

Capital costs are decreasing rapidly.

The trend of reducing interest rates is continuing both for deposits and loans. According to the latest data from the State Bank of Vietnam (SBV), as of January 31, 2024, the average interest rates for new transactions of commercial banks have decreased by about 0.15% per annum and 0.25% per annum respectively compared to the end of 2023.

Last year, deposit interest rates decreased significantly and continuously, but they are gradually stabilizing. In fact, according to the latest interest rate table as of February 20, a large private bank in Hanoi is offering deposit interest rates of around 4.6% per annum, which is equivalent to the interest rate offered by a state-owned bank at around 4.7% per annum.

Abundant liquidity is the basis for banks to significantly reduce deposit interest rates, while also providing opportunities to reduce capital costs, thus expecting to help reduce loan interest rates.

At the investor meeting to report business results in 2024 held at the beginning of February, Ms. Le Hoang Khanh An, Director of the Finance division of VPBank, said that favorable macro conditions have helped the bank continue to reduce capital costs thanks to cheaper funding sources. Therefore, by the end of 2023 and the beginning of 2024, maturing funds continued to help the bank reduce its capital costs, expected to be at least around 1-1.5%.

The representative of VPBank also added that the current capital costs in the whole market are relatively stable. The downward trend will continue in the current macroeconomic context, including the liquidity situation at banks.

In 2023, the total capital mobilized by the banking system witnessed strong growth, with customer deposits increasing by 12.5% compared to the same period. Mr. Quan Trong Thanh, Director of the analysis division at Maybank Investment Bank (MSVN), evaluated that the liquidity indicators remained healthy until the end of 2023, creating a good foundation for banks to promote asset growth and effectively control capital costs in the next 12 months.

According to Mr. Thanh, large state-owned banks had good growth in deposits. Meanwhile, private banks had a “leap” by restructuring and consolidating their deposit structure (increasing customer deposits and reducing interbank borrowing).

“We see that the majority of customer deposits were mobilized in the last quarter of last year, helping banks almost reprice their entire deposit balance with much lower interest rates. The average capital cost has significantly decreased and started to have a considerable impact on lending rates since mid-Q4 2023,” Mr. Thanh commented.

The average capital cost of 17 listed banks is gradually decreasing, according to MSVN’s statistics. |

Pressure on credit growth in 2024

The decrease in bank capital costs is an important foundation supporting the trend of reducing lending rates among banks, but there is another equally important reason, which is pressure on credit growth.

The latest report on credit growth as of the end of January 2024 decreased by 0.6% compared to the end of last year. Although it is believed to be influenced by seasonal factors of the Lunar New Year holiday, concerns lie in the recovery potential of loan demand as well as the concentration of efforts in the last month of the year, which brought certain risks.

At the online banking industry conference to promote bank credit and economic growth in 2024, bank leaders generally assessed that the market demand is still low, despite the current interest rate level being appropriate.

Mr. Nguyen Thanh Tung, General Director of Vietcombank, said that the scale of bank credit in January decreased by 2.3% compared to the end of the year, mainly due to wholesale credit with business characteristics. The main reason is still the difficult economic situation, decreased income, and the stagnant real estate market.

Meanwhile, according to Mr. Pham Toan Vuong, General Director of Agribank, interest rates are not necessarily an issue for borrowers when the interest rate structure, including mobilization and lending, has decreased to pre-Covid-19 levels. This bank is also actively promoting support packages, such as a VND 60,000 billion credit package for personal loans, and boosting exports with preferential interest rates.

The credit growth target set at the beginning of the year is 15%, but it will be flexible depending on market developments. The SBV has also announced credit growth limits for each bank to make the banks more proactive in their market liquidity injection plans.

The SBV’s leaders have also emphasized that setting the exact figure at the beginning of the year clearly demonstrates the banking industry’s determination to supply capital, taking into account the responsibilities of credit institutions in ensuring the capital needs of the economy.

According to Ms. Nguyen Hoai Thu, CEO of the Securities Investment Division of VinaCapital Fund Management Company, this 15% target is consistent with the GDP growth scenario of around 6-6.5% set for this year.

Although the SBV may not reduce the operating interest rate, commercial banks still have room to lower lending rates as their cost of capital is decreasing rapidly and faster than interest rates.

“The pressure on credit growth may lead banks to reduce lending rates to businesses and individual borrowers faster, thereby contributing to stimulating the economy,” Ms. Thu commented.

According to Mr. Thanh from MSVN, the current issue is the demand of the economy rather than the supply of credit because the systemic liquidity is currently good.

“Lending rates decreased faster in Q4 and may decrease further in 2024, supported by the decrease in capital costs and the competition among banks in supporting and retaining customers,” Mr. Thanh remarked.

In general, reducing interest rates is one of the important foundations, but it is not the only solution to promoting lending. There are still many other factors, from the international market to domestic issues such as restoring consumer confidence, foreign direct investment, public investment, and the real estate market. Amongst these, many experts evaluate that “stabilizing” the real estate market is one of the most important factors to maintain consumer and investor confidence.

Dung Nguyen