A luxury hospital opened in the western area of Hanoi, but before it became famous for its “5-star birthing” service, few knew that tens of thousands of medical examinations in the first year of operation mainly came from vaccination services.

In the past, residents or children who wanted to get vaccinated would go to the ward/commune health station or public hospitals and vaccination centers. Overcrowding, queuing, and, more importantly, vaccine shortages were frequently encountered. However, in the past 5-7 years, private enterprises have actively participated in the vaccination market, creating a significant change in the vaccination needs of Vietnamese people.

PLAYERS IN THE VACCINATION CHAIN MARKET

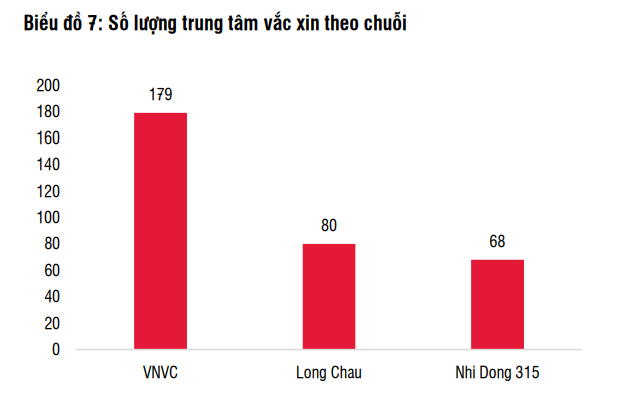

Vietnam Vaccine Joint Stock Company (VNVC) is currently the enterprise with the largest vaccination chain in Vietnam with 179 vaccination centers nationwide. According to data from VCBS, VNVC currently accounts for nearly 70% of the vaccination market share in Vietnam.

A vaccination center of VNVC.

Meanwhile, Long Chau and Nhi Dong 315 are expanding, respectively owning 80 and 68 vaccination centers nationwide. Among them, Long Chau, with the support of FPT Retail (FRT), aims to have 100 vaccination centers by the end of 2024 and then expand to 150 in the 2025-2026 period.

Source: SSI Securities Corporation Business Plan

Some private names such as Vinmec, Medlatec, and private hospitals also provide vaccination services. Recently, Thai Nguyen International Hospital Joint Stock Company (TNH) – with the ambition to advance from Thai Nguyen to big cities – also announced that it would open a vaccination department at the hospital.

ADVANTAGES OF EACH PLAYER

Among them, VNVC – the “elder brother” – was established in June 2017. By appearing early in the market and positioning its “5-star vaccination” service, VNVC quickly made a name for itself. At the time of its establishment, VNVC’s chartered capital was VND 10 billion. After many adjustments, as of July 10, 2020, VNVC’s chartered capital was increased to VND 140 billion.

VNVC’s advantage is that it has strategic partners from many large vaccine manufacturers such as Glaxosmithkline (Belgium), Sanofi Pasteur (France), Pfizer (USA), Merck Sharp and Dohme (USA), etc. Therefore, the company can directly negotiate and independently import a large number of genuine vaccines, especially those that are often in short supply.

Another advantage of this company is providing vaccination services on demand; package vaccination for children, pre-school children, adolescents, and young people, adults, and women preparing for pregnancy; mobile vaccination services for groups of agencies and enterprises. VNVC vaccination centers are usually located in commercial centers, apartment buildings, places with large floor areas, and crowded residential areas. VNVC is also in the healthcare ecosystem of tycoon Ngo Chi Dung to provide cross-services, bringing many benefits to customers.

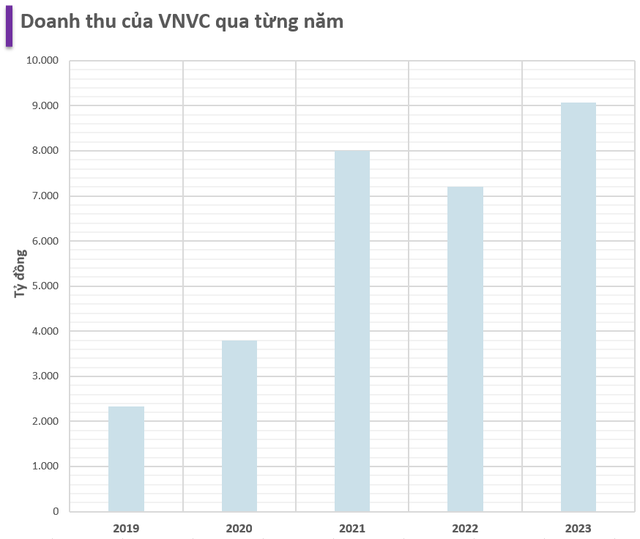

In terms of business results in 2023, the revenue of this vaccination chain increased by 26% over the previous year to nearly VND 9,200 billion.

FPT Retail – the parent company of Long Chau – has a strategy to open vaccination centers next to Long Chau drugstores. This is a significant advantage for the company as it can leverage its 16 million customers and nationwide drugstore network to cross-sell services.

While most vaccination chains mainly provide services for mothers and children, Long Chau may have a larger customer base by leveraging its existing customers from drugstores. Long Chau’s current customers are adults with chronic illnesses and weakened immune systems. Therefore, these customers are encouraged to get vaccinated against preventable diseases, such as pneumonia and influenza, so that these diseases do not weaken the patients’ immune systems.

At the 2024 General Meeting of Shareholders, the management of FPT Retail shared that the actual revenue of a vaccination center is currently about VND 2.5 billion, and the actual vaccination revenue is about VND 1.5 billion per month. This figure is much higher than the average revenue of a Long Chau drugstore (VND 1.1 billion). Therefore, VCBS also estimates the revenue in 2024 from this vaccination chain to be VND 3,600 billion.

A vaccination center of Long Chau.

Nhi Dong 315 was established in June 2019 and mainly targets children, managed by Chấn Văn Medical Joint Stock Company.

Nhi Dong 315 has taken advantage of its starting point in the field of medical examination, testing, and nutritional counseling for children at the polyclinics to expand and develop vaccination activities. However, this will create limitations in terms of floor area of the vaccination points.

Chấn Văn Medical Joint Stock Company was established in March 2019, with its main business being the operation of polyclinics, pediatric clinics, obstetrics and gynecology clinics, dermatology clinics, and internal medicine clinics (excluding inpatient treatment).

In addition to the Nhi Dong 315 vaccination system, Chấn Văn Medical is also the owner of the Nhi Dong 315 polyclinic system, the Phu San 315 polyclinic system, the Mat 315 polyclinic system, and the Lao Khoa 315 polyclinic system. This ecosystem will greatly enhance the competitiveness of Nhi Dong 315.

A facility of Nhi Dong 325.

VACCINATION MARKET OF 2 BILLION DOLLARS

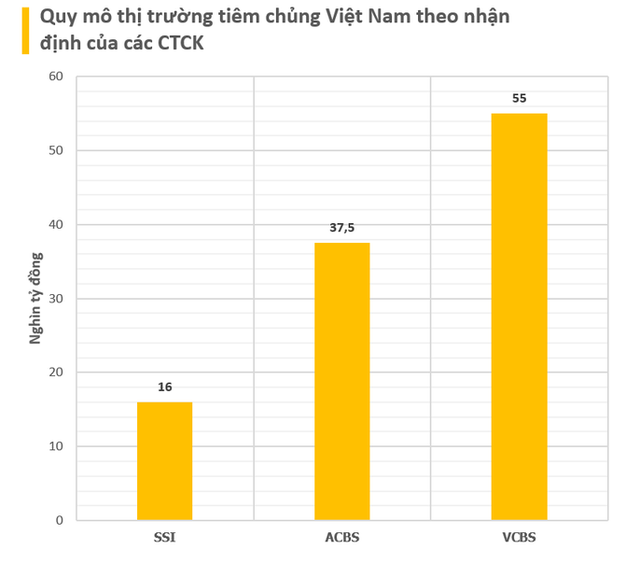

In a recent report by SSI Research, the scale of the vaccine market in 2023 in Vietnam reached VND 16,000 billion, up 14% over the same period last year.

Of this, the Expanded Immunization Program (EPI, the free vaccination program provided by the government) contributed VND 900 billion (estimated based on the budget allocated by the Ministry of Health for the 2021-2025 period). While the vaccination rate for diseases in the EPI reached 93-97% in 2017 (WHO data), the vaccination rate for diseases not included in the EPI remains low (below 5%).

However, this figure may only represent the scale of vaccines in the Mandatory Immunization category.

According to VCBS, the Vietnamese vaccine market is divided into two main parts: mandatory immunization (for children and pregnant women) and vaccination services. According to preliminary estimates, the scale of this market at the end of 2023 was about VND 55,000 billion (~USD 2.2 billion). With an annual birth rate of 1.5 million children in Vietnam, VCBS estimates the scale of the mandatory immunization segment to be VND 15,000 billion. The vaccination service segment (non-mandatory vaccines) has a scale of up to VND 40,000 billion.

According to ACBS, if we roughly assume that an adult may need to be vaccinated with at least 3 optional vaccines (assuming that the 10 mandatory vaccines have been completed), at a price of VND 250,000/dose, and the target of covering 50% of the country’s population (about 50 million people). Accordingly, the market size in this assumption is VND 37,500 billion (~USD 1.5 billion). This figure could be higher as private vaccination centers can also share the mandatory vaccine market.

With this scale, the revenue of modern vaccination chains accounts for only a small proportion of the whole market.

SSI Research believes that vaccine demand can maintain stable growth in the coming years due to the increasing demand for key vaccines such as HPV, pneumococcal, and influenza vaccines (accounting for 33%, 22%, and 10%, respectively, of the total vaccine market in Vietnam). This is because the vaccination rate in Vietnam is low (below 5%) as these vaccines have not been included in the EPI.

Therefore, SSI Research believes that private vaccination centers will have the opportunity to develop along with the increasing vaccination demand (growing at 10-15% in the next few years) and the trend of choosing private vaccination services instead of public ones.

Sharing the same view, ACBS also believes that the development of the market for other important vaccines such as influenza, varicella, rabies, and rotavirus vaccines can be another growth opportunity for private vaccination centers. This is due to the increasing awareness of healthcare and the growing population, with about 1 million children born each year.

RISKS

The critical factor for expanding the chain is capital. According to securities companies, with lower borrowing costs, Long Chau can accelerate the pace of opening new vaccination centers. FPT Retail also plans to raise capital to expand its vaccination business. The company plans to increase Long Chau’s equity by 10% through a private placement at the end of 2024.

Meanwhile, Nhi Dong 315 has received capital from many units. In April 2023, Nhi Dong 315 received a decision to invest USD 30 million in the Series B round from the Government of Singapore Investment Fund (GIC). Previously, Nhi Dong 315 had twice received capital from units such as BDA Capital Partners, TVS, Nisaetus and Samsara Holdings, Tremont Capital Ventures International, an unnamed Japanese healthcare group, and individual investors.

More importantly, this is a healthcare playground, and a vaccination room must meet strict standards from the management agency to operate.

SSI Research believes that the first risk is the handling of anaphylactic shock after vaccination, which is very complex and requires expertise. In this case, first-line hospitals can handle anaphylactic shock, while public and private vaccination centers/stations lack the expertise and infrastructure to handle such cases.

Second, vaccines must be stored at the correct temperature. Vietnam often faces power outages, affecting vaccine quality and even leading to anaphylactic shock after vaccination.

Third, the Ministry of Health aims to increase the vaccination rate in the long term. Therefore, the Expanded Immunization Program may expand the scope of vaccination with more types of vaccines, and private vaccination service providers may lose market share. However, this depends on whether Vietnamese companies can produce that type of vaccine due to the financial burden on the state budget.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.