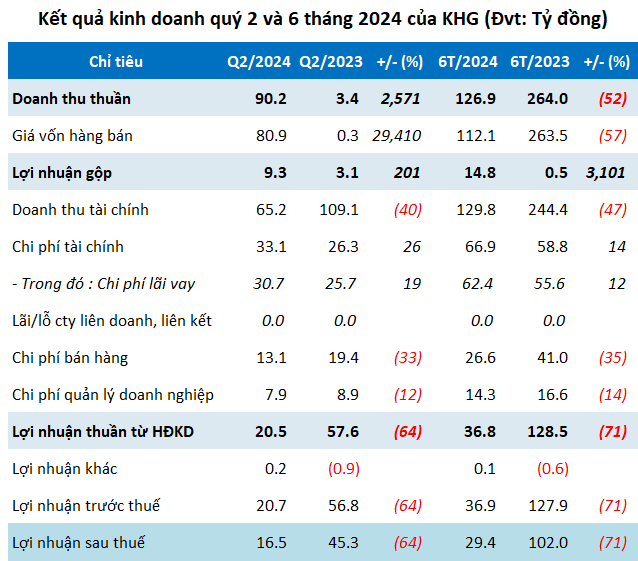

Khải Hoàn Land Group (HOSE: KHG) reported its Q2 2024 financial results, with revenue surpassing VND 90 billion, a 26.7x increase year-over-year. The majority of this revenue came from real estate sales contracts, amounting to over VND 66 billion, and brokerage activities, contributing VND 24 billion.

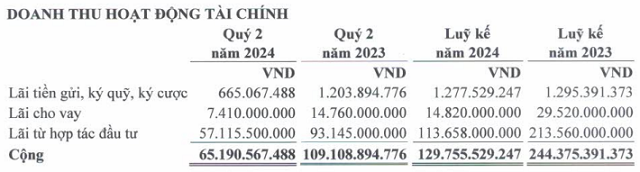

Gross profit, after deducting cost of goods sold, stood at over VND 9 billion, triple that of the same period last year. However, financial income decreased by 40% to VND 65 billion due to the absence of significant investment cooperation profits seen in Q2 2023 (VND 93 billion) and a 50% decline in lending profits to over VND 7 billion.

|

KHG’s Q2 2024 profit from investment cooperation decreased by nearly 40% year-over-year

Source: KHG

|

Total expenses slightly decreased to VND 54 billion, with interest expenses accounting for nearly VND 31 billion. Ultimately, Khải Hoàn Land’s net income reached VND 16.5 billion, a 64% decline compared to the previous year’s same period.

Attributing the decrease in profits to market challenges, KHG stated that the overall difficulties in the real estate market impacted the company’s performance.

Source: VietstockFinance

|

For the first six months of the year, KHG’s revenue was nearly VND 127 billion, and net income exceeded VND 29 billion, reflecting a 52% and 71% decrease, respectively, from the same period last year.

Looking ahead to 2024, Khải Hoàn Land has set ambitious targets, aiming for VND 1,600 billion in revenue and VND 256 billion in net income. These goals represent nearly a fivefold increase in revenue and a over tenfold surge in net income compared to the previous year’s performance. However, with the first half of the year coming to a close, KHG has only achieved 6% of both revenue and net income targets.

As of the end of June, KHG’s total assets stood at VND 6,331 billion, a slight decrease from the beginning of the year. Short-term receivables amounted to nearly VND 1,193 billion, a 23% decline, while inventory decreased by 3% to VND 205 billion. This inventory comprises real estate properties from commercial area, villa projects in Long Hau, Can Giuoc District, Long An Province, and mixed-use commercial office and residential projects in My Hao Town, Hung Yen Province. Construction work in progress remained unchanged from the beginning of the year at VND 212 billion.

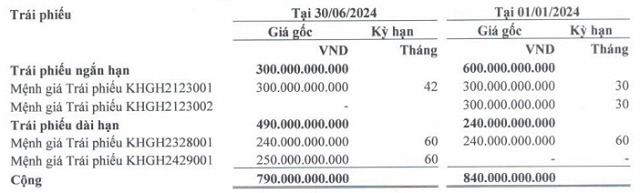

Khải Hoàn Land’s total liabilities stood at over VND 1,136 billion, including financial debt of VND 920 billion, an 8% decrease from the start of the year. This financial debt comprises VND 130 billion in short-term bank loans from SHB and VND 790 billion in bond debt.

Source: KHG

|

Khải Hoàn Land successfully raises VND 250 billion through bond issuance

SHB achieves excellent cost control with a CIR of only 23% in 2023, with profits exceeding 9,200 billion VND.

Saigon – Hanoi Bank (SHB) has recently released its consolidated financial report for the year 2023, showcasing stable business growth and strong safety indicators amidst a challenging market.