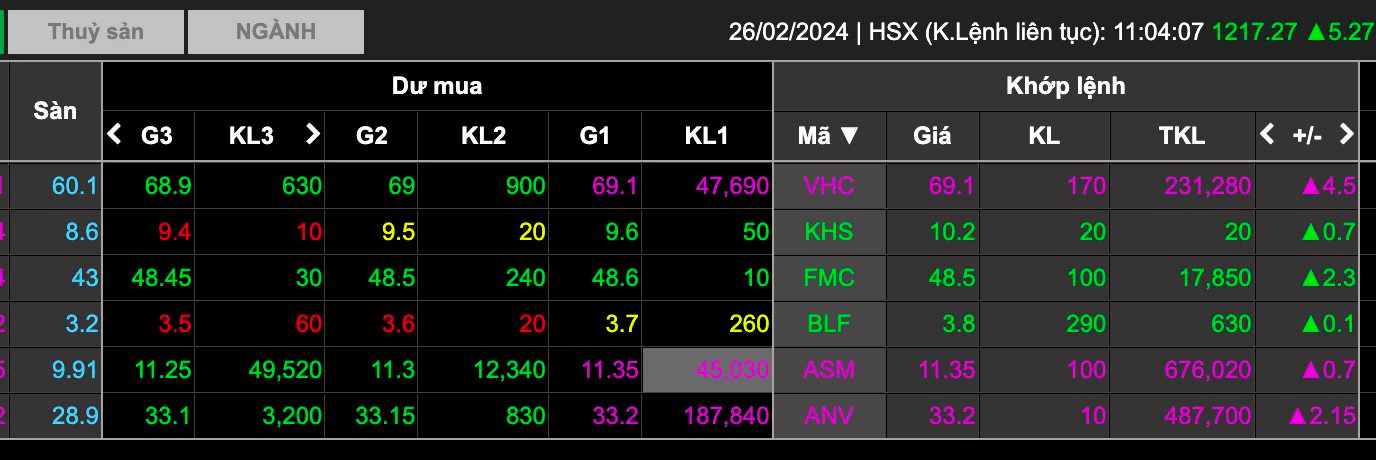

On the first session of Monday 26th February 2024, the seafood stock group unexpectedly rose sharply despite the overall market being in red. The entire group had an increase with the stock codes VHC of Vinh Hoan Seafood, ANV of Southern Vietnam Seafood and ASM of Sao Mai Corporation.

The strong increase in the seafood group happened in the context of the export situation in the first few months of the year for businesses, which has been and is forecasted to continue to perform well.

Specifically, VHC just announced its business performance in January 2024 with a revenue of 921 billion VND, an increase of 102% compared to the same period in 2023. The revenue in the company’s markets all experienced high growth rates, of which the Chinese and domestic markets both increased in triple digits, by +259% and +137%, respectively. Vĩnh Hoan’s revenue from exports to the US increased by 59% compared to the same period, and by 33% to Europe. In January 2024, the domestic market was the highest revenue market for VHC with 325 billion VND, followed by the US with 185 billion VND, Europe with 154 billion VND, and China with 117 billion VND.

VHC assesses that this year the export market will have positive developments. In particular, businesses benefit from the recent EU regulations that impose a 13.7% tax on Russian-originated minks and snow fish. This type of seafood directly competes with Vietnamese tra fish and includes products processed in China with origins from Russia, no longer enjoying the 0% tax incentive, and has opened up opportunities for Vietnamese tra fish exporters to the EU – the largest seafood importing market in the world.

Moreover, on December 22nd, 2023, the US expanded the ban on imports of Russian seafood products (salmon, snow fish, mink, crab), including processed products from abroad, meaning it does not allow Russian seafood into the US through a third country, opening up opportunities to boost Vietnamese tra fish exports.

VASEP – Vietnam Association of Seafood Exporters and Producers indicates that the seafood export in 2024 could gradually recover and become more optimistic in the second half of the year. The forecast is that in 2024, seafood export will return to the level of 9.5 billion USD – 10 billion USD, in which the shrimp sector is aiming to achieve 4 billion USD in revenue, tra fish exports at about 1.9 billion USD, and the rest is other seafood items that are forecasted to achieve revenue of about 3.6 – 3.8 billion USD.

The prospect report of securities companies also put forward positive views for the seafood group. For example, Vietcombank Securities (VCBS) stated that the fish inventory is gradually decreasing in large markets, and the Vietnamese seafood export industry will recover in the near future. Particularly noteworthy is the high cost of raw materials due to scarce fish breeds. Previously, the price of raw fish was at a low level, along with slow fish breeding demand, causing many fish farming households to reduce the release of new fish stocks. Therefore, the limited fish breed has pushed up the price of raw fish again.

VCBS also evaluates that in the context of restricted imports of Russian minh fish by Western countries, Vietnamese tra fish will benefit.

In the prospect report for the seafood industry by SSI Securities , the projected profit of the seafood industry in 2024 is forecasted to increase by 20-30% compared to the previous year, mainly in the second half of the year. Similarly,

KBSV Securities also gave an optimistic outlook for the seafood group, mainly in the second half of the year, specifically:

+ Regarding the shrimp industry, KBSV predicts that the shrimp supply from major countries such as Vietnam, Ecuador, and India will start to shrink in the first 6 months of 2024 due to farmers reducing their farming area due to losses. The demand is expected to recover from the last 6 months of 2024, when the pressure of inflation eases and the inventory level in importing countries decreases. With a shrinking supply in large shrimp-producing countries along with expected recovery in demand, it is expected that the export price of shrimp will increase in the last 6 months of 2024.

+ Regarding the tra fish industry, it is predicted that the inflation in major markets such as China and the US will subside, along with the decrease in inventory, which will drive the recovery of consumption demand from the last 6 months of 2024. Expectations are that leading tra fish businesses such as VHC and ANV will also recover in line with the overall trend of the industry.