Circular 12/2024/TT-NHNN (Circular 12), issued by the State Bank of Vietnam’s Governor, amends several articles of Circular 39 from 2016 regarding credit institutions’ lending activities to customers and took effect on July 1st, 2024.

Consequently, two significant changes introduced by this circular are: borrowers from credit institutions are required to provide personal and related organizational information, and for small loans (under VND 100 million), borrowers are not obligated to submit a feasible capital usage plan.

Ms. Nguyen Linh Phuong, Deputy Director of the Monetary Policy Department (State Bank of Vietnam), stated that by exempting loans under VND 100 million from the requirement of a feasible capital usage plan, borrowers only need to provide minimal information on legal capital usage and financial capacity before receiving the loan from credit institutions. This move is expected to stimulate the development of consumer finance.

Loans under VND 100 million will not require borrowers to have a feasible capital usage plan. Illustration.

Deputy Governor Dao Minh Tu of the State Bank of Vietnam also shared that this regulation is not a lax one but rather aims to boost consumer finance and facilitate access to consumer credit for the people, especially those in remote areas and low-income earners.

“Circular 12 will definitely facilitate consumer lending, as these are usually small amounts of under VND 100 million,” said Mr. Tu.

Mr. Dao Minh Tu added, “Some commercial banks, such as Agribank and LPBank, have been actively promoting consumer lending in the past. Even banks like Vietcombank and VietinBank, which used to focus on corporate lending, are now shifting towards consumer lending.”

Consumer lending currently accounts for about 20% of total outstanding debt

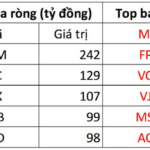

Consumer lending currently accounts for about 20% of the total outstanding debt in the industry, equivalent to VND 2.8 quadrillion. 16 credit institutions (including banks and finance companies) with the largest consumer lending portfolios are offering up to 30 consumer lending products.

Back in March 2024, when this document was still in draft form, the State Bank of Vietnam explained that the Law on Credit Institutions of 2024 included provisions on amending and supplementing regulations regarding credit approval, monitoring of loan usage, and simplification of procedures for small-value credit extensions.

Loans with small values not requiring a feasible capital usage plan will help curb “black credit.” Illustration.

From a prudent perspective, the State Bank of Vietnam proposed that for loans with a value of up to VND 100 million, borrowers would not have to provide a feasible capital usage plan or information about related individuals. Instead, credit institutions would implement measures to monitor and supervise borrowers’ usage of loan funds and repayment capabilities, ensuring the full and timely recovery of principal and interest according to the agreed-upon terms and conditions, as well as the proper usage of loan funds.

This regulation aligns with the characteristics of small loans and contributes to creating more favorable conditions for customers to access bank credit with simplified procedures. It also helps expand lending activities for personal and consumer needs, thus curbing the prevalence of “black credit.”

A capital usage plan is defined in Clause 6, Article 2 of Circular 39/2016/TT-NHNN, issued by the State Bank of Vietnam, regarding credit institutions’ lending activities and foreign bank branches’ lending to customers as follows:

A capital usage plan refers to a collection of information about a customer’s capital usage, which must include the following details:

a) Total capital sources required, including a breakdown of the types of capital sources (including the amount to be borrowed from the credit institution); purpose of capital usage; and duration of capital usage;

b) The customer’s source of debt repayment;

c) Plan or project for business activities (excluding capital needs for personal consumption)