Illustrative image

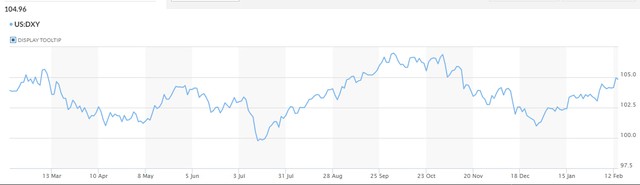

According to data from MarketWatch, the US Dollar Index (DXY) – a measure of the strength of the USD in the international market – hit a three-month high and approached the 105 level. In the latest session, this index increased by 0.76% – the best daily gain since the beginning of February.

The USD index rose after higher-than-expected US inflation data raised concerns that the US Federal Reserve (Fed) will keep interest rates high for longer.

Data released on February 13 showed that the US consumer price index (CPI) increased by 0.3% in January 2024, slightly higher than the forecasted 0.2% increase provided by Reuters analysts. Compared to the same period last year, inflation has risen by 3.1%, higher than the estimated 2.9% increase.

Dec Mullarkey, CEO at SLC Management in Boston, said the main message that the market received was that the CPI was increasing at a slower pace but still higher than expected. This result has reinforced/affirmed the Fed’s decision to wait for a stronger assurance that inflation is being well controlled.

According to London Stock Exchange Group (LSEG)’s forecast, after the latest US inflation data, the likelihood of the Fed cutting interest rates in March is less than 50% and the chance of interest rates being cut in May 2024 is even lower. The first interest rate cut by the Fed is currently expected to take place at the June 2024 meeting, with a probability of around 80%.

The market has also factored in the possibility of three interest rate cuts this year, in line with the Fed’s interest rate forecast, or the so-called “dot plot” released in December 2023.

US Dollar Index movement in the past year (Source: MarketWatch)

On the domestic front, the banking market is still in the holiday season. Previously, the price of USD at banks had dropped sharply in the first week of February, following a strong increase in January. Compared to the peak recorded on January 26, the price of USD at Vietcombank decreased by 0.8% and settled at the range of 24,200 – 24,570 VND/USD before the Lunar New Year holiday. On the black market, the USD is currently trading in the range of 24,900 – 25,000 dong/USD.

In a newly published macroeconomic report, Vietcombank Securities (VCBS) said that in January, foreign currency demand started to increase again thanks to improvements in import and export activities, and thus significantly pushed up the exchange rate at the banking system with an increase timing of over 1%. At the end of January, VND depreciated by about 0.72% against the USD. In particular, the rate of price decline was significantly narrowed around the pre-Tet holiday period mainly due to favorable factors from remittances reaching 16 billion USD in 2023 (+30%).

VCBS believes that the interest rate landscape continues to hit record lows, which puts constant pressure on the exchange rate as the DXY remains at a high level. Accordingly, the possibility of VND depreciation still exists, and exchange rate movements will depend largely on foreign currency supply at each point in time with factors related to direct and indirect investment flows, remittances, etc.

Rong Viet Securities (VDSC) also believes that the USD/VND exchange rate still faces significant upward pressure in the early months of 2024 due to the recovery of the greenback on the international market and the positive interest rate differential between USD and VND.

According to VDSC, although the economic context of 2024 is different, a comparison of the volatility of oil prices, USD, and gold prices during the Fed’s easing cycle (2019-2021) and tightening monetary policy (2022-2023) suggests some implications.

Firstly, during the period when the Fed implemented a tight monetary policy, the USD experienced a strong price increase in the early stage and maintained its strength for a period of time afterwards when interest rates remained high.

Secondly, during the period when the Fed cut interest rates, the first rate cuts did not bring many changes to the trend of the USD, and the decline of the USD only occurred later when the rate cut cycle came to an end.

Thirdly, the volatility of oil prices and gold prices during the easing and tightening periods of the Fed’s monetary policy is quite interesting. Specifically, crude oil experienced sharp fluctuations but the overall trend was an increase during the Fed’s easing period and a decrease during the period of tightening monetary policy. Meanwhile, gold prices increased in both periods.

“Looking back at history can help forecast part of the exchange rate volatility in the future, and the fact that the USD remains high in the early stage of the monetary policy easing cycle may put pressure on the USD/VND exchange rate, and this trend is likely to last at least in the first half of 2024,” VDSC forecasted.