|

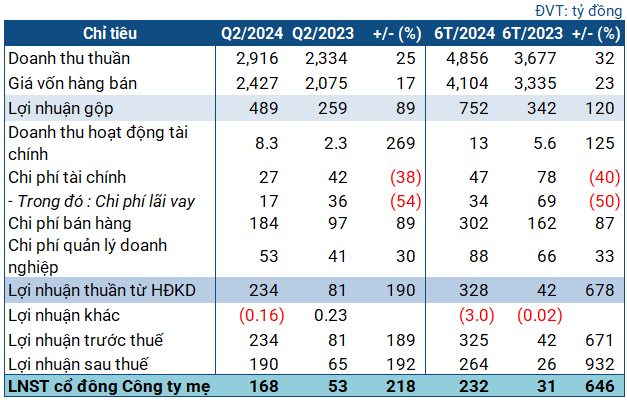

BFC’s Financial Targets for Q2 2024

Source: VietstockFinance

|

In Q2, BFC reported a 25% year-over-year increase in revenue, surpassing 2,900 billion VND, with the majority derived from domestic sales. Gross profit, after deducting cost of goods sold, reached 489 billion VND, up by 89%. Gross profit margin improved significantly from 11% to nearly 17%.

Financial income surged to 8.3 billion VND, a 3.7-fold increase compared to the same period last year. Selling and administrative expenses also rose, but the growth in gross profit prevailed. Ultimately, BFC recorded a net profit of 168 billion VND, tripling that of the previous year. This was also the highest quarterly profit in the past decade for BFC, even surpassing the 2021-2022 period when the fertilizer and chemical industry boomed due to the global commodity surge.

| Business Performance before Q2 2024 |

BFC is the next company in the Vinachem group (Vietnam Chemical Group) to report impressive profits for Q2. Previously, another member, DDV (DAP – Vinachem Joint Stock Company), announced explosive figures with a profit of 64 billion VND, 72 times higher than the previous year. DDV attributed this to increased sales volume and prices, along with decreasing raw material costs. While BFC has not provided an explanation, the reason is likely similar, considering the growth in revenue and cost of goods sold (25% and 17%, respectively) in Q2.

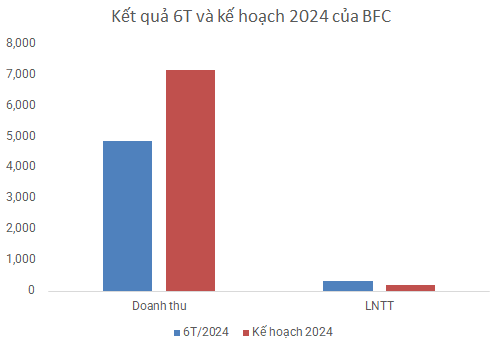

For the first half of the year, BFC achieved nearly 4,900 billion VND in revenue, a 32% increase year-over-year; net profit stood at 132 billion VND, 7.5 times higher than the same period last year. Compared to the plan approved by the 2024 Annual General Meeting of Shareholders, BFC has accomplished 68% of the revenue target and exceeded the full-year profit before tax goal by nearly 55%.

Source: VietstockFinance

|

According to the recently announced plan, BFC aims for nearly 1,700 billion VND in revenue and 46 billion VND in pre-tax profit in Q3. The production and sales targets are set at 130,000 tons and over 135,000 tons, respectively. If these goals are met, BFC will significantly surpass its annual plan.

As of the end of Q2, BFC’s total assets amounted to over 3,500 billion VND, a slight increase from the beginning of the year, with nearly 2,860 billion VND in short-term assets, up by 4%. Cash and cash equivalents decreased by 27% to 460 billion VND.

Accounts receivable from customers increased significantly to nearly 1,160 billion VND, double that of the beginning of the year. Inventories decreased by 20%, totaling over 1,200 billion VND.

On the capital side, short-term debt remained unchanged from the beginning of the year and still accounted for the majority of total debt at over 2,140 billion VND. The current and quick ratios stand at 1.33 and 0.8, respectively, indicating a potential risk if the company has to meet all its short-term debt obligations.

In terms of borrowings, the company has over 1,000 billion VND in short-term debt, a 31% decrease from the beginning of the year, all of which is bank debt.

Surging Profits from Associated Joint Venture, Nam Long (NLG) Reports After-Tax Profit of over 800 billion VND in 2023

According to NLG, the primary revenue for the entire year came from the sale of houses and apartments, from two major projects Izumi and Southgate. Additionally, in the third quarter, NLG also had the Mizuki project, which was a significant handover project.