The Chairman of the Hanoi People’s Committee, Tran Sy Thanh, has signed a decision to issue land price adjustment coefficients for 2024. These coefficients will be applied in cases as stipulated by law and serve as a basis for calculating land rent, determining the starting price for land use right auctions, and collecting land use fees for households and individuals with state-recognized land use rights.

The decision also sets out the coefficients for calculating the value of land use rights during the equitization of state-owned enterprises that lease land from the state within the city.

According to the decision, the adjustment coefficient for agricultural, forestry, and aquatic land is set at 1.0.

The coefficient for adjusting the price of agricultural land (including garden and pond land adjacent to residential land) used as a basis for calculating the difference between the land use fee for the new purpose and the agricultural land use fee is K=1.0.

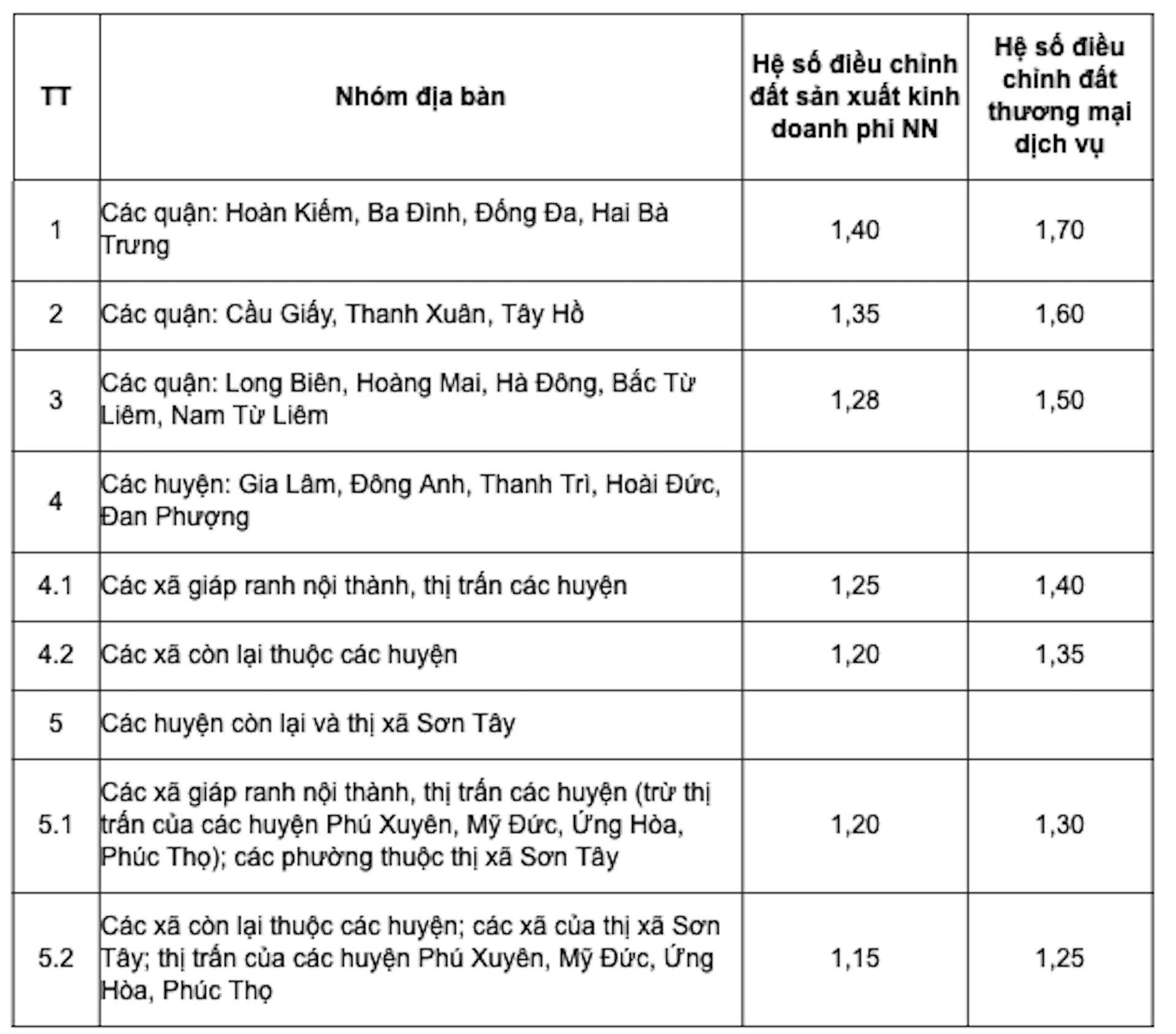

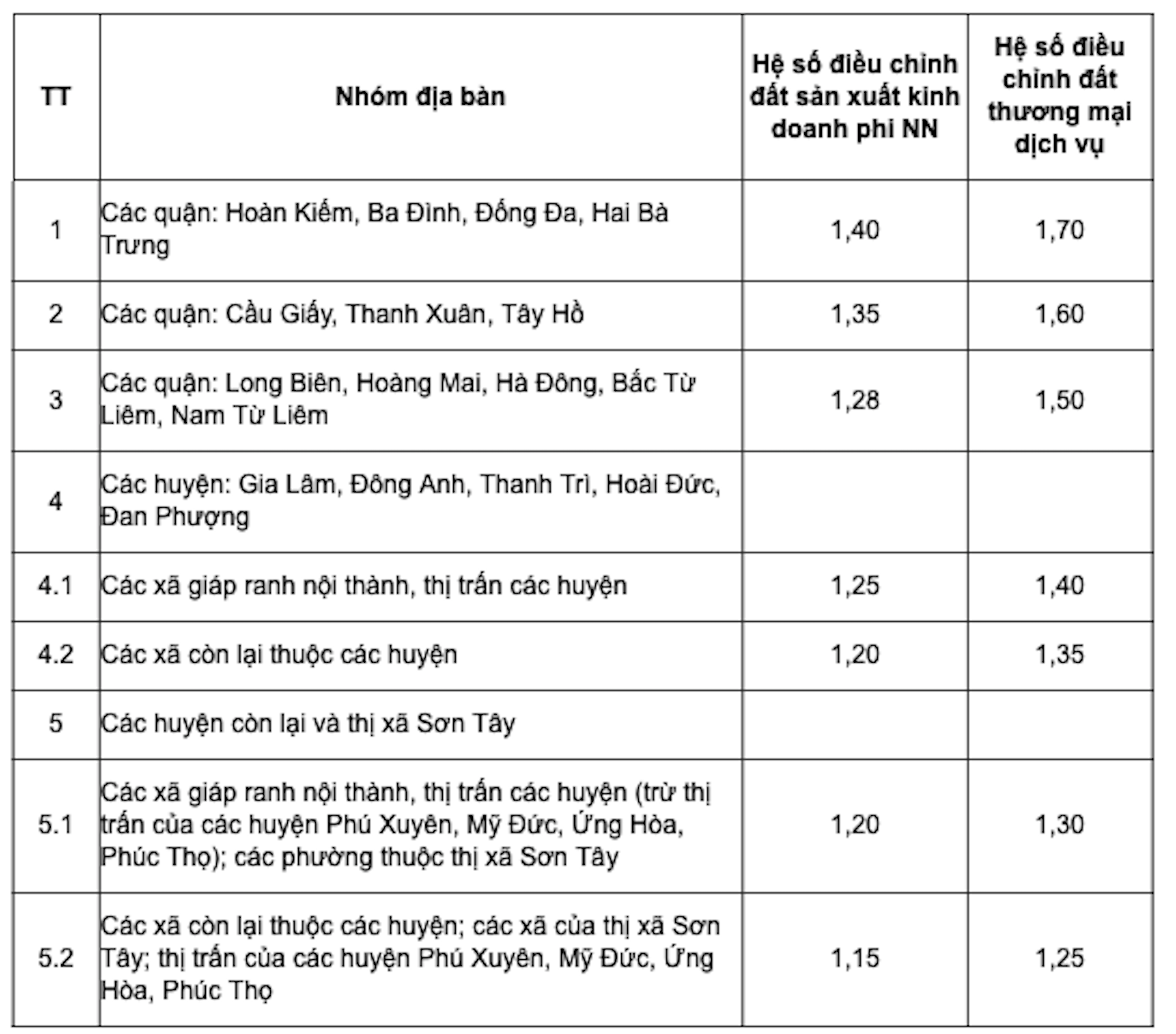

The adjustment coefficients for non-agricultural production and business land, as well as commercial service land, are categorized into different groups of areas.

Table: Adjustment coefficients for non-agricultural production and business land, and commercial service land. |

Specifically, the four inner districts of Hoan Kiem, Ba Dinh, Dong Da, and Hai Ba Trung have an adjustment coefficient of 1.40 for non-agricultural production and business land, and 1.70 for commercial service land.

For Cau Giay, Thanh Xuan, and Tay Ho districts, the coefficients are set at 1.35 for non-agricultural production and business land and 1.60 for commercial service land.

In Long Bien, Hoang Mai, Ha Dong, Bac Tu Liem, and Nam Tu Liem districts, the coefficients are 1.28 for non-agricultural production and business land and 1.50 for commercial service land.

The lowest adjustment coefficients for non-agricultural production and business land, and commercial service land, are 1.15 and 1.25, respectively, and apply to areas such as the communes of Son Tay town and the townships of Phu Xuyen, My Duc, Ung Hoa, and Phuc Tho districts.

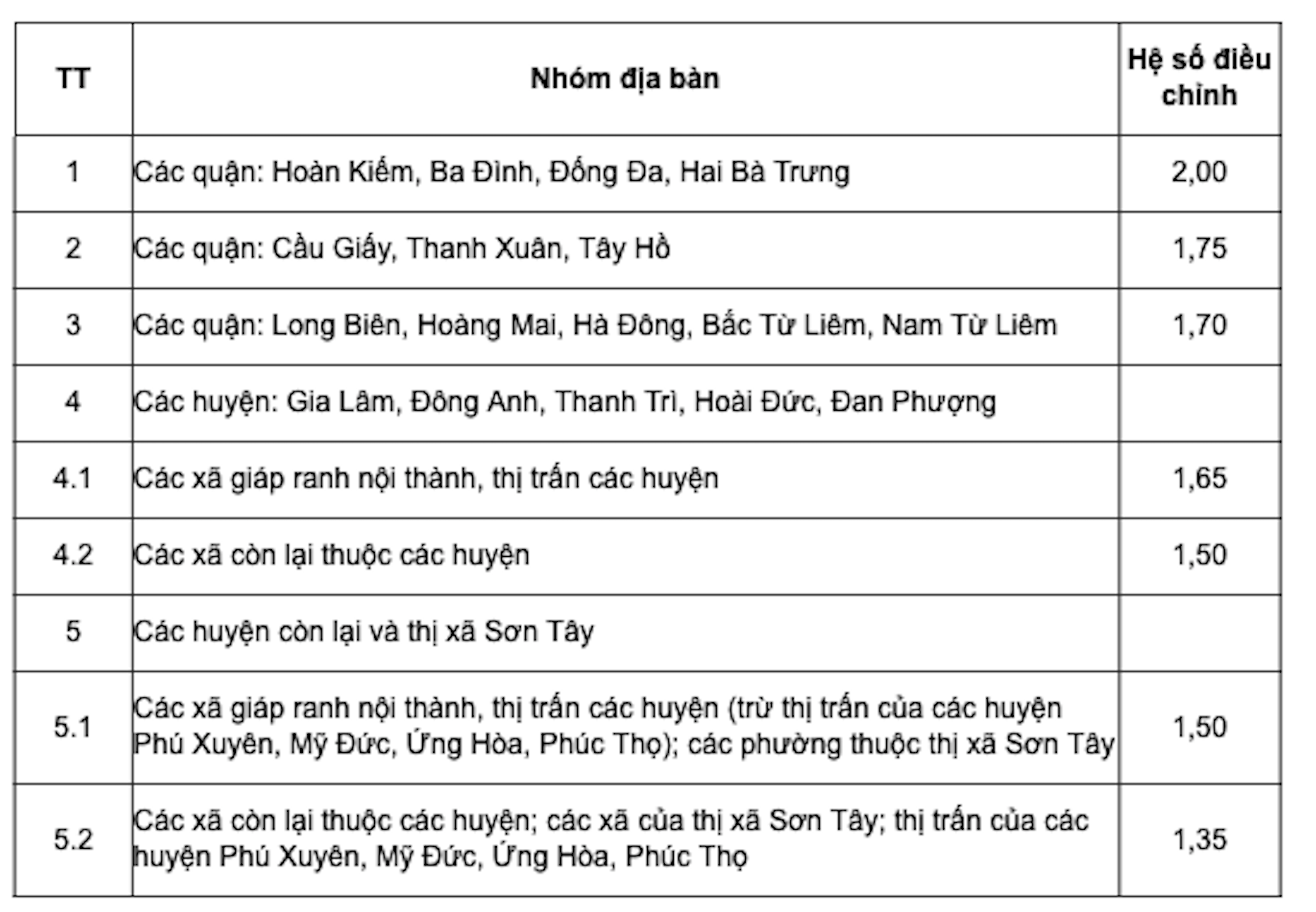

The adjustment coefficients for calculating land use fees for households and individuals with state-recognized land use rights and for those who are allowed to change the purpose of land use for residential land exceeding the limit are categorized into five groups of areas.

Table: Adjustment coefficients for calculating land use fees. |

The highest coefficients are in the four inner districts of Hoan Kiem, Ba Dinh, Dong Da, and Hai Ba Trung, at 2.00.

For Cau Giay, Thanh Xuan, and Tay Ho districts, the coefficient is set at 1.75. For Long Bien, Hoang Mai, Ha Dong, Bac Tu Liem, and Nam Tu Liem districts, it is 1.70.

For Gia Lam, Dong Anh, Thanh Tri, and Hoai Duc districts, as well as communes adjacent to the inner city and townships of the districts, the coefficient is 1.65. For the remaining communes in these districts, the coefficient is 1.50.

For communes adjacent to the inner city and townships of the districts (excluding townships of Phu Xuyen, My Duc, Ung Hoa, and Phuc Tho districts), and wards of Son Tay town, the coefficient is 1.50.

For the remaining communes in the districts, the communes of Son Tay town, and the townships of Phu Xuyen, My Duc, Ung Hoa, and Phuc Tho districts, the coefficient is set at 1.35.

From July 29, Hanoi increases land price adjustment coefficients. Chart: Hong Khanh

In cases where there are differences in land characteristics, such as land use coefficients (building density, height of structures, etc.) from the average level of the area or road, the district-level People’s Committees shall be responsible for reviewing and reporting to the Department of Finance for compilation and proposal of adjustments to the issued land price adjustment coefficients.

Previously, Hanoi applied the land price adjustment coefficients according to Decision No. 35 (2023), which took effect from January 1, 2024.

Decision No. 45, which has just been issued, takes effect from July 29, 2024, and replaces Decision No. 35 of 2023.

Hong Khanh