The market opened on July 30 with a bearish sentiment and relatively lackluster trading. The main index fluctuated and faced strong selling pressure in the afternoon session. The VN-Index closed the day down 1.54 points (0.12%) at 1,245.06. Foreign investors continued to offload Vietnamese stocks, with net sell orders of around VND 326 billion.

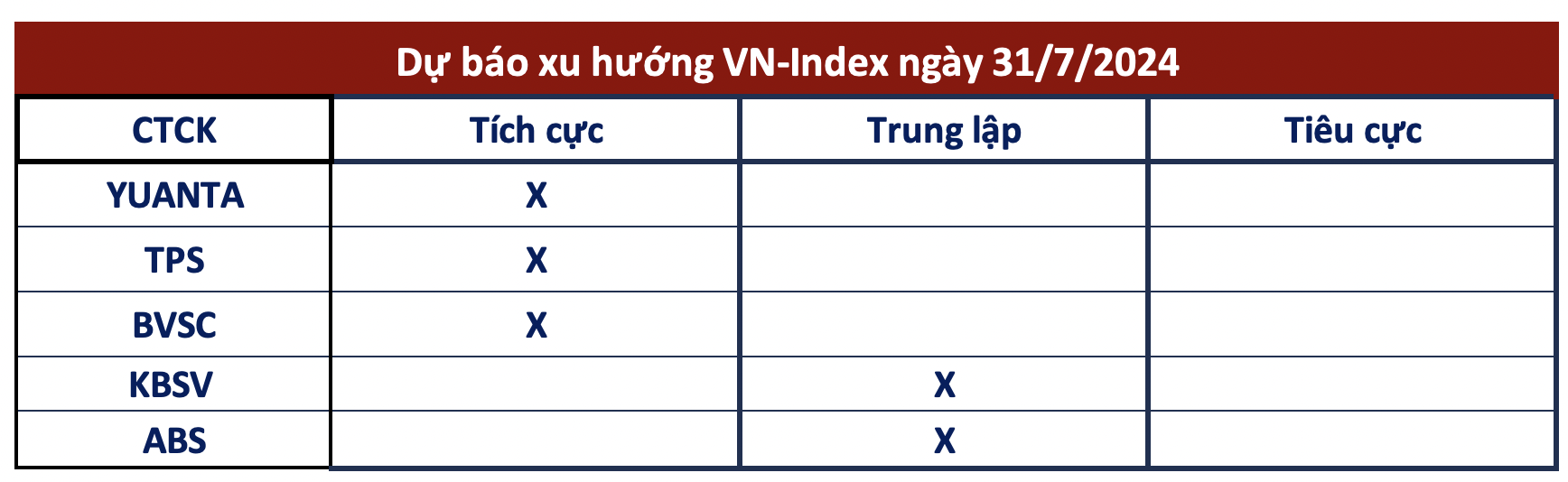

Brokerages anticipate a positive market trend in the next session due to improving buying demand. However, the main index is facing strong resistance, so investors should remain cautious and monitor the market closely to respond promptly to any changes.

TPS Securities noted that the VN-Index witnessed a cooling-off session, with a sharp decline at one point, but active buying toward the end of the session helped narrow the losses. TPS expects the index to move toward more positive scenarios and recommends investors to consider allocating more funds in the upcoming sessions.

Yuanta Vietnam Securities shared a similar sentiment, anticipating a return to an upward trajectory in the next session. The VN-Index is likely to fluctuate around the 1,250 level, and the rising trading volume toward the end of the session indicates improved buying demand at higher prices, suggesting a potential recovery in the next session. However, this recovery may be uneven, with large-cap stocks performing better while selling pressure persists in mid- and small-cap stocks, keeping investor sentiment cautious.

Yuanta advised investors to maintain a low equity allocation and prioritize a defensive strategy with a high cash balance. New purchases should be made with a low allocation.

According to Bao Viet Securities (BVSC), the VN-Index still has room for recovery but will face significant challenges at the 1,258-1,268 resistance zone. The support and resistance levels for the index are 1,220-1,225 and 1,255-1,260, respectively.

KB Vietnam Securities (KBSV) took a more cautious stance, noting that strong buying pressure toward the end of the session helped the index avoid a steep decline. However, the loss of the crucial support area around 1,24x points has pushed the VN-Index into a short-term downtrend, and selling pressure is likely to increase during the recovery process. Investors are advised to prioritize a defensive strategy, reducing their equity allocation to a low level during early recovery sessions.

ABS Securities predicted that the market could continue to correct toward the next support level. However, this correction presents an opportunity for investors who have not yet taken a position as stock prices become more attractive. With the Q2/2024 earnings season underway, investors should focus on stocks with strong growth potential or unique stories in the coming periods. ABS set the support level for the VN-Index at 1,080 – 1,140 points.

ABS recommended that investors closely monitor selling pressure in the upcoming sessions to respond promptly. For new, short-term trades, it is crucial to adhere strictly to trading discipline, bringing purchased stocks to breakeven points and lowering expectations during this market phase.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.