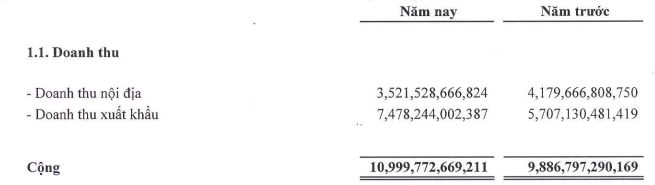

In its Q2 2024 financial report, Nam Kim recorded a revenue of over VND 5,660 billion and a net profit of VND 220 billion, an increase of 3% and 75%, respectively, compared to the same period last year.

Nam Kim’s Q2 Business Results

Unit: Billion VND

Source: VietstockFinance

|

The optimistic profit level was largely due to the company’s financial activities and cost-cutting measures, rather than growth in its core business.

In Q2 2024, Nam Kim’s financial revenue increased by 125% to VND 114 billion. At the same time, the company significantly reduced its financial expenses by 44% to nearly VND 70 billion. This included a 46% decrease in interest expenses to VND 43 billion.

Nam Kim also demonstrated flexibility in cost management by reducing its selling expenses by 20% to VND 33 billion.

Surpassing 2024 Full-Year Plan in the First Six Months

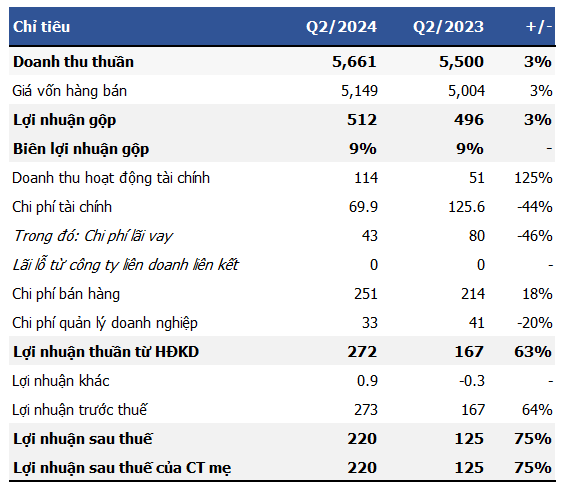

Nam Kim’s performance in the first six months of 2024 showed a strong recovery. The company recorded a revenue of VND 10,952 billion, an 11% increase compared to the same period last year. Nam Kim focused more on exports, with export revenue reaching nearly VND 7,500 billion, while domestic revenue was over VND 3,500 billion.

|

Nam Kim’s export and domestic revenue in the first six months of 2024

|

Notably, its pre-tax profit reached VND 460 billion, and net profit was VND 370 billion, nearly five times higher than the same period last year. This significant profit growth was due to the steel industry’s recovery and compared to the low base in the previous year.

With these results, the steel company in Binh Duong Province has exceeded its 2024 full-year pre-tax profit plan (VND 420 billion) by nearly 10%.

As of June 2024, Nam Kim held over VND 10,000 billion in short-term assets, including VND 770 billion in cash and financial investments. Its short-term receivables increased by 46% compared to the beginning of the year, reaching over VND 2,800 billion. Inventory levels remained relatively stable at VND 5,750 billion.

On the liabilities side, short-term debt increased slightly to nearly VND 7,100 billion, including VND 4,800 billion in short-term loans and finance leases.