|

POW’s Business Targets for Q2 2024

Source: VietstockFinance

|

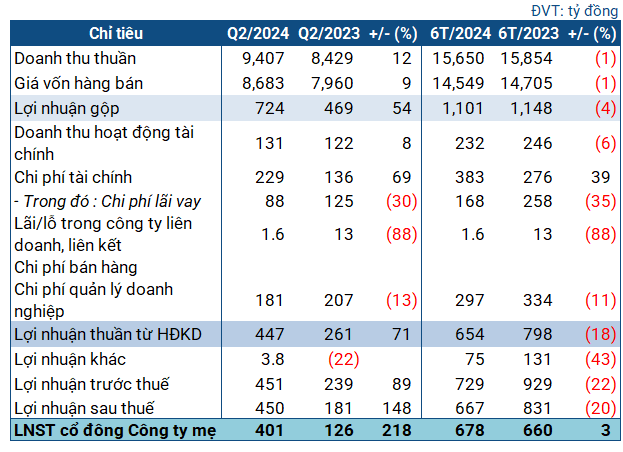

For the second quarter, POW recorded net revenue of 9.4 trillion VND, a 12% increase year-over-year. Cost of goods sold grew at a lower rate of 9%, resulting in a 54% surge in gross profit to 724 billion VND. This improvement was attributed to the main business operations of the parent company and enhanced profits from the Dakdrinh Hydropower Plant.

Financial income for the period rose by 8% to 131 billion VND, while financial expenses soared by 69% to 229 billion VND, mainly due to foreign exchange losses. Conversely, selling and administrative expenses decreased by 13% to 181 billion VND. Ultimately, POW’s net income tripled year-over-year to 401 billion VND.

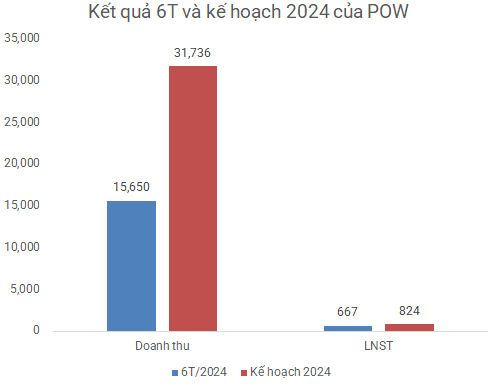

For the first half of the year, POW’s net revenue slightly dipped by 1% to nearly 15.7 trillion VND, while net income grew by 3% to 678 billion VND. The company has accomplished 49% of its revenue target and nearly 81% of its net income goal for the year, as approved by the 2024 Annual General Meeting of Shareholders.

Source: VietstockFinance

|

While a portion of the profit increase was derived from hydropower, POW stated at the 2024 Annual General Meeting of Shareholders that the development of this segment is no longer a key focus. Instead, they are investing in smaller projects through subsidiaries engaged in renewable energy. The overall strategy prioritizes gas-fired power and LNG, with the upcoming Nhon Trach 3 and 4 Power Plants as the main projects.

According to POW, these are two key national projects. As of May 15, 2024, the projects have completed the temporary connection plan and reverse power transmission to the SPP 220kV substation. The test run schedule has been planned, with Nhon Trach 3 expected to be operational by the end of 2024 and Nhon Trach 4 by mid-2025. The projected capital recovery period is 14-16 years.

Returning to the Q2 performance, as of the end of June, POW’s total assets reached nearly 81 trillion VND, a 15% increase from the beginning of the year. Short-term assets accounted for over 32.5 trillion VND, a 12% increase, including over 12.5 trillion VND in cash, a 16% rise, held in the form of cash or savings deposits.

Accounts receivable from customers increased by 14% to nearly 14.6 trillion VND, with the majority being electricity receivables from the Power Trading Company under EVN. Inventories also witnessed a slight increase, reaching nearly 2.3 trillion VND.

The majority of POW’s assets are long-term, totaling 16.6 trillion VND, an 84% increase, mainly due to the construction-in-progress costs for Nhon Trach 3 and 4.

On the capital side, short-term debt accounted for the lion’s share of total liabilities, surpassing 35 trillion VND, a 32% increase. The current and quick ratios were below 1, at 0.92 and 0.85, respectively, indicating a slight risk in POW’s ability to fulfill its short-term debt obligations.

In terms of borrowings, short-term debt more than doubled to over 11 trillion VND, while long-term debt rose by 31% to nearly 9.4 trillion VND, with both being bank loans.

Châu An

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

SHB achieves excellent cost control with a CIR of only 23% in 2023, with profits exceeding 9,200 billion VND.

Saigon – Hanoi Bank (SHB) has recently released its consolidated financial report for the year 2023, showcasing stable business growth and strong safety indicators amidst a challenging market.