Eximbank’s tumultuous journey: A tale of shareholder disputes and leadership instability

The mention of Eximbank often evokes memories of a financial institution plagued by a series of unsuccessful annual general meetings among the finance community. The “bad blood” between the bank’s shareholder groups has led to deep-seated disagreements and conflicts, resulting in a three-year-long struggle to organize a complete and successful annual general meeting, unlike other banks of similar scale.

It was not until 2022 that Eximbank finally managed to hold its 2021 annual general meeting, after a staggering eleven failed attempts. This year also witnessed the exit of prominent shareholders such as Thành Công Group, Âu Lạc, and VinaCapital, who completely divested their holdings in the bank.

Notably, Sumitomo Mitsui Banking Corporation (SMBC), once Eximbank’s largest shareholder with over 15% ownership, prematurely terminated its strategic alliance agreement with the bank in early 2022 and completed its capital withdrawal in 2023.

As long-term shareholders withdrew their capital, speculations arose in the market about a potential acquisition of Eximbank by a real estate giant or a smaller bank. It was not until the enactment of the new Law on Credit Institutions in 2024 that Eximbank was compelled to disclose its shareholder structure. On July 24, 2024, the bank finally revealed the list of shareholders owning at least 1% of its charter capital as of July 1, 2024.

Absence of Major Shareholders

|

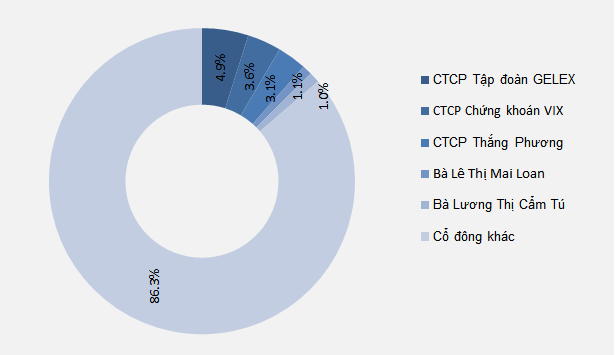

Eximbank’s Shareholder Structure as of July 1, 2024

Source: VietstockFinance

|

The disclosed list reveals that Eximbank does not have any major shareholders (owning more than 5% of the capital). The largest shareholder is CTCP Tập đoàn Gelex (HOSE: GEX), with a 4.9% stake, equivalent to 85.5 million EIB shares. Following closely is CTCP Chứng khoán VIX (HOSE: VIX), holding 3.58% of the capital, or 62.3 million shares. The third-largest shareholder is CTCP Thắng Phương, possessing 53.4 million shares, which equates to a 3.07% stake in Eximbank.

Additionally, individual shareholders with over 1% ownership include Lê Thị Mai Loan, Vice President (1.03%), and Lương Thị Cẩm Tú, Vice Chairwoman of the Board of Directors (1.12%). A group affiliated with Ms. Loan also holds 19,540 shares, representing 0.0011% of the capital.

Gelex and Chứng khoán VIX, the two new prominent shareholders of Eximbank, are easily identifiable as they are both listed on the HOSE stock exchange.

On the other hand, CTCP Thắng Phương has maintained a low profile as it is not yet a public company. Thắng Phương came into the spotlight when it sent a letter to Eximbank in 2020, reflecting and proposing certain adjustments to the bank’s operations.

According to our research, CTCP Thắng Phương was established in 2006 with an initial charter capital of VND 600 million. The enterprise was managed by Mr. Nguyễn Thế Tài (born in 1973), who served as the Chairman of the Members’ Council and held a 99% stake (valued at VND 594 million), while Ms. Lê Thị Mai Loan contributed the remaining VND 6 million.

The company operated in diverse fields, including automobile sales, insurance agency services, real estate management, and landscape care.

In 2016, Thắng Phương announced a change in its management, appointing Ms. Huỳnh Thị Hồng Hạnh (born in 1991) as the General Director and adding wood product trading to its list of business activities.

At the beginning of 2017, Thắng Phương increased its charter capital to VND 10 billion, with Ms. Hạnh and Ms. Phạm Thị Ngọc Thanh as shareholders, holding 70% and 30% stakes, respectively.

In August 2017, Thắng Phương further raised its capital to VND 50 billion, with Ms. Hạnh owning 57.4%, Ms. Thanh holding 24.6%, and CTCP Xuất khẩu Lao động Tracodi contributing the remaining 18%.

It is worth noting that CTCP Đầu tư Phát triển Công nghiệp và Vận tải (Tracodi, HOSE: TCD) is the parent company of CTCP Xuất khẩu Lao động Tracodi, holding a 70% stake.

Has Eximbank Finally Achieved Upper-Level Stability?

The persistent turmoil within Eximbank’s upper management has been a challenging issue for several years, stemming from deep divisions among shareholder groups. Consequently, the bank struggled to successfully hold an election for its Board of Directors. After three consecutive years of failures (2019-2021), Eximbank finally convened its 2021 annual general meeting in February 2022.

During this meeting, a seven-member Board of Directors for the term 2020-2025 was elected, comprising: Lương Thị Cẩm Tú (Chairwoman), Đỗ Hà Phương, Lê Hồng Anh, Võ Quang Hiển, Nguyễn Hiếu, Đào Phong Trúc Đại, and Nguyễn Thanh Hùng.

However, on June 28, 2023, Eximbank’s Board of Directors issued a resolution to relieve Lương Thị Cẩm Tú from her duties as Chairwoman. In her place, Đỗ Hà Phương, a member of the Board of Directors, was appointed as the new Chairwoman of Eximbank for the 2020-2025 term.

Following the announcement of the new Chairwoman, Eximbank had to convene an extraordinary general meeting in 2023 to reorganize its Board of Directors due to a request from a group of shareholders (holding 10% of Eximbank’s shares) to withdraw their authorization, nomination, and proposal for the removal of Đỗ Hà Phương from the Board of Directors.

At the extraordinary general meeting held on September 18, 2023, Eximbank’s Board of Directors for the 2020-2025 term was officially confirmed, consisting of: Đỗ Hà Phương (Chairwoman), Phạm Quang Dũng, Lê Thị Mai Loan, Lương Thị Cẩm Tú, Trần Tấn Lộc, Nguyễn Cảnh Anh, and Trần Anh Thắng (Independent Member).

During the 2024 annual general meeting, Eximbank relieved Lê Thị Mai Loan from her duties as a member of the Board of Directors and elected Nguyễn Hồ Nam, the former Chairman of the Board of Directors of Bamboo Capital Group, as a new member of the Board for the 2020-2025 term.

|

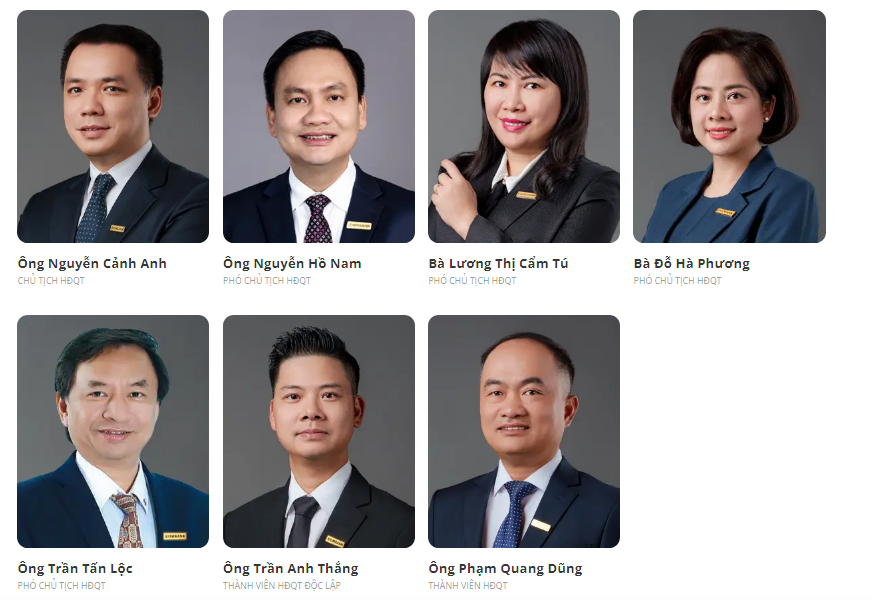

Eximbank’s Board of Directors for the Term 2020-2025

Source: Eximbank

|

According to Eximbank’s semi-annual governance report for 2024, the Board of Directors now comprises: Nguyễn Cảnh Anh (Chairman); four Vice Chairmen, including Nguyễn Hồ Nam, Lương Thị Cẩm Tú, Đỗ Hà Phương, and Trần Tấn Lộc; Phạm Quang Dũng (Member); and Trần Anh Thắng (Independent Member).

Wrapping up the first half of 2024, Eximbank achieved slightly over 28% of its annual profit target, with a modest 5% year-on-year increase in pre-tax profit, reaching over VND 1,474 billion. While net interest income rose by 23% to VND 2,870 billion, there was a significant 86% surge in credit risk provisions compared to the same period last year.

|

According to Article 63 of the 2024 Law on Credit Institutions, individual shareholders are not permitted to hold more than 5% of a bank’s charter capital, while organizational shareholders are limited to a maximum of 10%. Additionally, shareholders and their affiliates are not allowed to own more than 15% of the capital. A major shareholder of a credit institution and their affiliates are prohibited from owning more than 5% of the capital of another credit institution. Shareholders who currently hold shares exceeding the ownership ratios stipulated in Article 63 of the Law may retain their shares but are not allowed to increase their holdings until they comply with the ownership ratio regulations specified in the Law, except in cases of receiving dividends in the form of shares. |

A Eximbank Board Member Resigns

The resignation of Ms. Le Thi Mai Loan will be approved by the Shareholders’ General Assembly of Eximbank in accordance with the provisions of the law.

Ms. Le Thi Mai Loan Resigns from Eximbank’s Board of Directors

On January 31, 2024, Vietnam Export Import Commercial Bank (Eximbank, HOSE: EIB) announced that they have received the resignation letter from Ms. Le Thi Mai Loan, resigning from her position as a member of the Board of Directors of the bank for the VII term (2020 – 2025) due to personal reasons.