BCG Energy has released its consolidated financial report for the first half of 2024, with remarkable growth in revenue and profit.

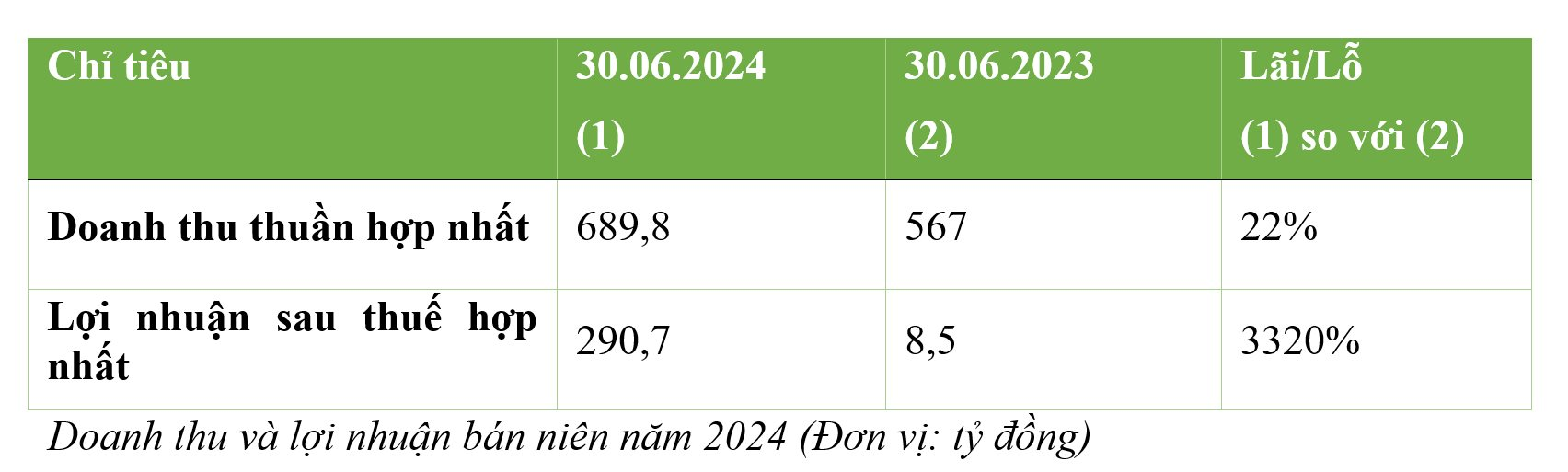

The company’s revenue for the six-month period reached VND 689.8 billion, a 22% increase compared to the same period in 2023. This growth is mainly attributed to the commercial operation of the Phu My Phase 2 Power Plant with a capacity of 114 MW since June 2023. Additionally, their solar power projects have been successfully operating with a total capacity of 594.4 MW, including plants such as BCG Long An 1 (40.6 MW), BCG Long An 2 (100.5 MW), BCG Phu My (330 MW), and BCG Vinh Long (49.3 MW). BCG Energy’s rooftop solar projects have also performed efficiently, contributing to the overall revenue increase.

Looking ahead, BCG Energy’s revenue is expected to continue its upward trajectory in 2024. This projection is based on the completion of procedures for the commercial operation of the Krong Pa 2 solar power project with a capacity of 21 MW/49 MW in Gia Lai, along with contributions from ongoing rooftop solar projects.

The financial report for the first half of 2024 reveals a significant surge in BCG Energy’s consolidated after-tax profit, reaching VND 290.7 billion. This remarkable 33-fold increase compared to the same period in 2023 is mainly due to effective cost-saving measures, particularly a substantial reduction in interest expenses. With these impressive results, BCG Energy has already achieved 59% of its profit plan for the full year of 2024.

As of June 30, 2024, BCG Energy’s consolidated total assets reached VND 19,964.8 billion, reflecting a 5% growth compared to the beginning of the year. This increase is mainly due to new investments, notably the investment in the Tam Sinh Nghia waste-to-energy plant in Thai My, Cu Chi district, Ho Chi Minh City.

Total liabilities also increased to VND 9,944.1 billion, representing a 7% growth. This rise is primarily associated with liabilities related to the purchase of BCG Energy’s shares from Tam Sinh Nghia Investment and Development Joint Stock Company by former shareholders.

BCG Energy’s debt-to-equity ratio has shown significant improvement and maintained stability over the years. It stood at 1.9 as of December 31, 2022, decreased to 0.96 by December 31, 2023, and reached 0.99 as of June 30, 2024. Simultaneously, the company’s loan-to-equity ratio has been on a downward trend, with a ratio of 1.25 as of December 31, 2022, decreasing to 0.66 by December 31, 2023, and further dropping to 0.64 as of June 30, 2024.

The standalone financial report of BCG Energy’s parent company recorded a decrease in revenue and profit compared to the same period in 2023. This is because, in the first half of 2024, the company did not receive financial revenue in the form of dividends from its subsidiaries. However, with the robust revenue growth from renewable energy projects and their expected efficient operation in the future, the dividends flowing back to the parent company are anticipated to increase.

Beyond its financial performance, BCG Energy has been fostering relationships with major credit institutions and banks, as well as international partners. In February 2024, the company signed a cooperation agreement with SUS Vietnam Holding Pte. Ltd. for the implementation of projects by Tam Sinh Nghia Investment and Development Joint Stock Company. Successfully attracting foreign investors with strong financial capabilities and experience in waste-to-energy projects not only ensures the company’s success in venturing into this new field but also promises to bring new financial resources.

With a robust portfolio of ongoing projects totaling 229 MW in capacity and future projects expected to reach 670 MW, BCG Energy is poised to achieve even more positive business results in the coming years. The company aims to attain a total capacity of 2 GW by 2026 while diversifying its renewable energy investment portfolio with low investment costs and an average IRR of 10% to 14%.

One of BCG Energy’s key strengths lies in its ability to mobilize capital domestically and internationally. This enables the company to meet capital demands during the initial project development phase and to obtain reasonable refinancing once the projects are operational. The registration for trading on the UPCoM exchange is a significant step in BCG Energy’s development, facilitating its capital mobilization for new energy projects.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.