The global economy faced significant challenges in the first half of 2024, with inflation and interest rates remaining high. In this context, the Government and the State Bank of Vietnam (SBV) implemented a series of solutions to stabilize the macro-economy and curb inflation. With the SBV’s flexible and timely management, commercial banks, including Nam A Bank, continued to operate stably and maintain sustainable growth.

As the only bank in the system to list its shares on HoSE in the past six months, Nam A Bank has reaffirmed its sustainable development through positive operating results. Notably, the bank’s pre-tax profit for the first half of 2024 surged to over VND 2,200 billion (completing over 55% of the 2024 plan), with total assets reaching more than VND 228,000 billion (completing 98.7% of the 2024 plan). Additionally, the bank’s safety indicators in operations exceeded the SBV’s regulations.

Customers transacting at Nam A Bank

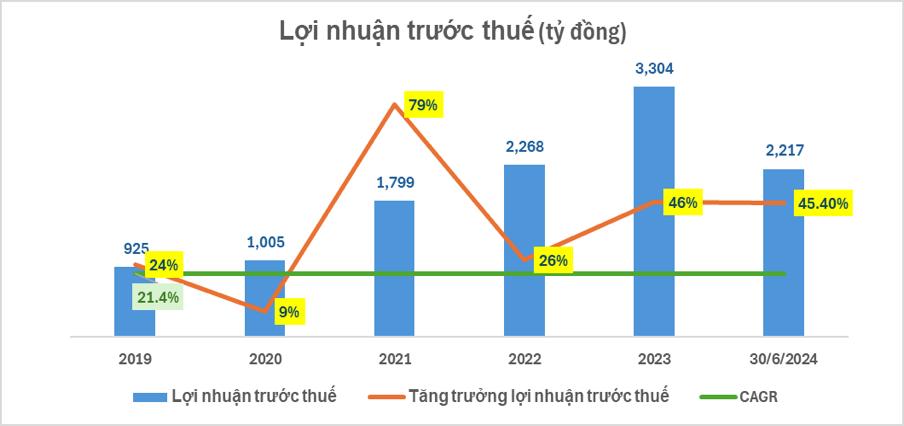

Specifically, Nam A Bank’s pre-tax profit for the first half of 2024 reached VND 2,217 billion, a 45.4% increase compared to the same period in 2023 and completing 55.4% of the 2024 plan. As of June 30, 2024, the bank’s total assets reached over VND 228,000 billion, a 14.3% increase compared to the same period in 2023 and completing 98.7% of the 2024 plan. Capital mobilization from individuals and economic organizations grew well, reaching nearly VND 173,000 billion, a 9.4% increase compared to the same period in 2023 and completing 97.1% of the 2024 plan. Customer loan balance grew in line with the credit growth limit permitted by the SBV, reaching nearly VND 157,000 billion, a 21.2% increase compared to the same period in 2023.

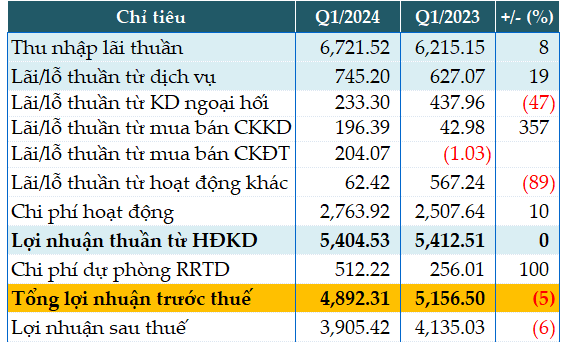

Notably, this is the second consecutive quarter that Nam A Bank has recorded a profit of over VND 1,000 billion. Net interest income increased by VND 834 billion, a 27% rise compared to the same period in 2023.

(Nam A Bank’s profit in the first half of 2024 increased by more than 45.4% compared to the same period in 2023 – Source: Nam A Bank’s Financial Statements)

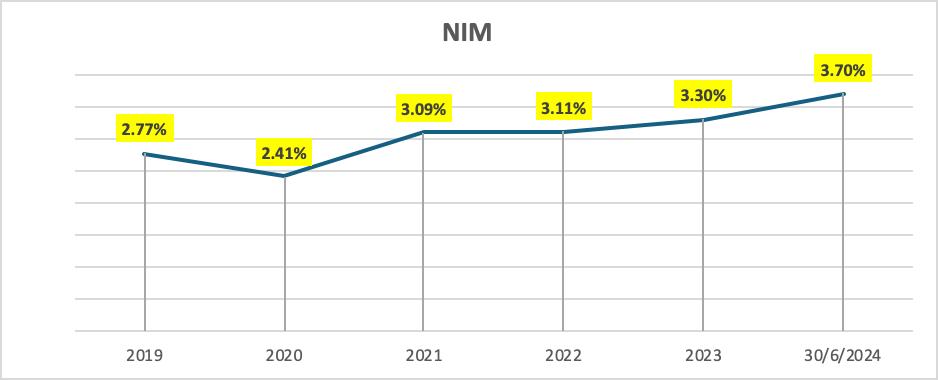

Positively, Nam A Bank’s NIM grew by 3.7% despite the narrowing interest rate spread between deposits and customer loans. This was achieved through solutions to optimize the structure of interest-bearing assets and funding sources.

Source: Nam A Bank’s Financial Statements

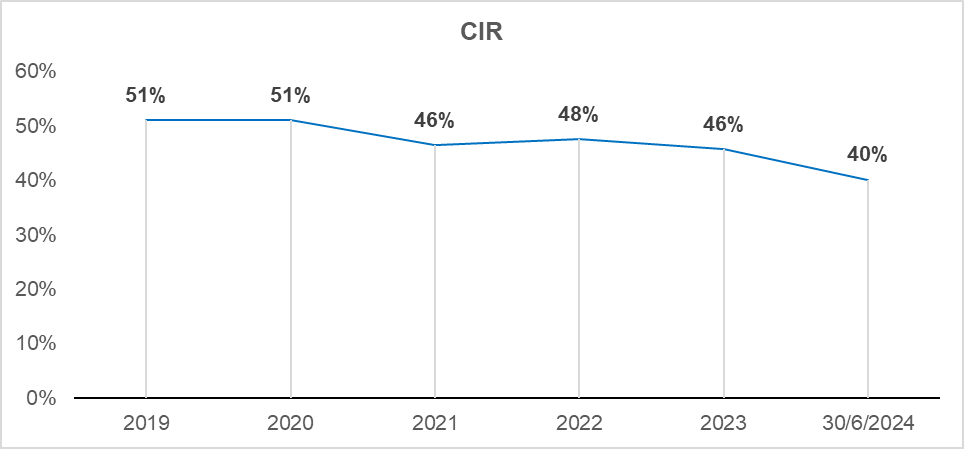

The bank’s cost-to-income ratio (CIR) in the second quarter of 2024 improved significantly, with CIR for the quarter approaching 40% – the lowest level in the past five years.

Source: Nam A Bank’s Financial Statements

For several years, Nam A Bank has been undergoing a strong digital transformation and expanding its operations across provinces and cities nationwide. While operating expenses have increased, the CIR has gradually improved over the years.

Furthermore, the bank’s safety indicators in operations far exceeded the SBV’s regulations. Nam A Bank has also complied with liquidity ratios and completed the implementation of risk management standards in accordance with Basel III. The capital adequacy ratio (CAR) stood at over 11.38% (minimum requirement by the SBV is 8%), the loan-to-deposit ratio (LDR) reached 76.06% (maximum requirement by the SBV is 85%), the liquidity coverage ratio (LCR) was 17.35% (minimum requirement by the SBV is 10%), the 30-day VND liquidity ratio was over 73.41% (minimum requirement by the SBV is 50%), and the ratio of short-term capital for medium and long-term loans was 14.13% (maximum requirement by the SBV is below 30%). Nam A Bank continues to maintain a stable and safe liquidity strategy, and non-performing loans are well controlled according to the SBV’s regulations (a decrease of 0.15 percentage points compared to the same period in 2023).

“Amid a challenging market environment, Nam A Bank has implemented the right strategies and demonstrated strong adaptability to create sustainable growth momentum in the first half of 2024,” said a representative of Nam A Bank. “This also lays a solid foundation for the bank to achieve its goals for the year and soon realize its vision of becoming one of the top 15 strongest banks in Vietnam.”

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.