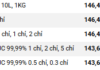

Hoang Anh Gia Lai Agriculture Joint Stock Company (HAGL Agrico) released its second-quarter consolidated financial statements for 2024, reporting a 48% year-on-year decline in net revenue to 79 billion VND. The sharp increase in cost of goods sold led to a gross loss of 271 billion VND, compared to a loss of 47 billion VND in the same period last year.

Additionally, the company’s financial income tripled from the previous year, reaching nearly 39 billion VND. Financial expenses decreased by 11% to 87 billion VND, while selling and management expenses were also reduced by 74% and 66%, respectively, totaling 2 billion and 7 billion VND.

HNG’s Q2 2024 Financial Statement

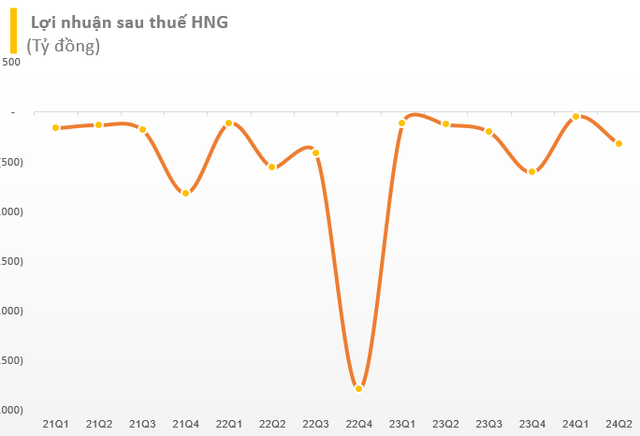

As a result, HAGL Agrico posted a net loss of nearly 323 billion VND, compared to a loss of 135 billion VND in the same period last year. This quarter’s loss extends the company’s streak of 14 consecutive quarters of losses. The parent company’s net loss amounted to 323 billion VND. For the first six months of the year, HAGL Agrico recorded a net revenue of 147 billion VND, a 47% decrease year-on-year, with a net loss of 370 billion VND.

Looking at the full year, HAGL Agrico aims to achieve a net revenue of 694 billion VND, a 14.5% increase from 2023. The company expects a net loss of 120 billion VND for the year. After the first half, HAGL Agrico has accomplished 21% of its revenue target but is significantly behind in terms of profitability.

In other news, the Ho Chi Minh City Stock Exchange has announced the mandatory delisting of shares of Hoang Anh Gia Lai International Agriculture Joint Stock Company (HAGL Agrico) due to negative after-tax profits for the years 2021, 2022, and 2023, amounting to 1,119 billion VND, 3,576 billion VND, and 1,098 billion VND, respectively.

At the 2024 Annual General Meeting of Shareholders held on May 4, HNG’s Chairman, Mr. Tran Ba Duong, assured shareholders that even if the company’s shares are delisted and moved to UPCOM, they will continue to disclose information transparently to their 33,000 shareholders, just as they did when listed on HOSE. He added that they aim to relist on HOSE as soon as they meet the requirements.

“Shareholders may be concerned about the delisting, but I believe that transparency and forming a true value are crucial. Even on UPCom, if we perform well, the share price can still rise,” said Mr. Tran Ba Duong.

Mr. Duong also clarified that there is no confusion between Thaco Agri and HAGL Agrico in terms of their commercial brand. In reality, the group’s management team continues to manage both companies, ensuring a clear separation between the two. “Thaco Agri only supports HAGL Agrico. What does HAGL Agrico have? It’s just a shell,” he added. He also mentioned that he and Thaco hold only a few dozen percent of HNG’s shares but are betting big on the company. “HNG’s current value is 11 trillion VND, but it has lost 8 trillion VND, leaving only 3 trillion VND. Still, we continue to invest and will further invest in 2024,” he stated.

At the meeting, billionaire Tran Ba Duong shared that HAGL Agrico, under Thaco’s leadership, is focusing on three main segments: fruit trees, rubber, and cattle farming, across a total area of 27,000 hectares. Thaco Agri is currently in charge of the agricultural segment of the Thaco Group.

In the stock market, HNG shares have been under strong selling pressure following a recovery phase from late April to early July. Currently, HNG is trading around 4,020 VND per share, representing a 24% decline in less than three weeks.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”