The financial reports for the first half of 2024 from real estate businesses continue to attract attention with figures of tens of thousands of billions of dong in inventory. The largest inventories are in real estate under construction (under investment) and completed products awaiting sale. Reports from 10 listed companies show that total inventory value as of June 30 was nearly VND 270,000 billion, up about 3% over the same period. Of which, Novaland still leads with more than VND 142,000 billion, accounting for more than half of the inventory.

Real estate inventory increases

About 10 listed companies, inventory as of the first half of 2024 was at nearly VND 270,000 billion. (Illustration photo: HL)

The report of No Va Real Estate Investment Group Joint Stock Company (Novaland – NVL) shows that as of June 30, the enterprise has more than VND 142,000 billion in real estate inventory. Compared to the beginning of the year, the company’s inventory increased by more than VND 3,000 billion. Of which, real estate under construction accounts for nearly VND 134,000 billion, while at the beginning of the year it was nearly VND 130,000 billion.

According to Novaland, real estate under construction by the end of June 30 mainly includes land use fees, design consulting fees, construction costs, and other expenses related to the project.

In addition to the large inventory from real estate under construction, the inventory of completed real estate for sale is also significant, accounting for more than VND 8,380 billion. This figure decreased by more than VND 850 billion compared to the figure of VND 9,238 billion at the beginning of this year.

The report also shows that the value of inventory as of the end of June used as collateral for loans was VND 57,910 billion. As of June 30, Novaland had total assets of more than VND 240,000 billion and liabilities of nearly VND 195,000 billion.

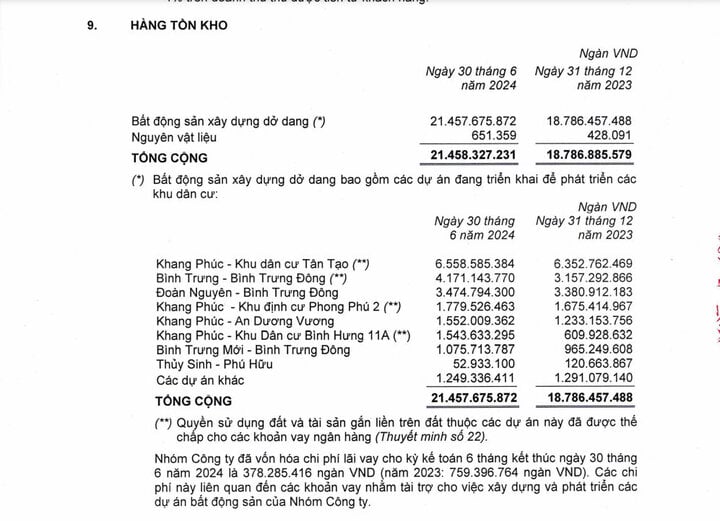

The notable increase in inventory in the first half of the year was also recorded at Khang Dien House Trading and Investment Joint Stock Company (KDH). As of June 30, the company’s inventory was at VND 21,457 billion, up more than VND 2,670 billion from the beginning of the year, mainly due to real estate under construction. KDH’s financial report explains that the increase in inventory value is mainly due to projects that were formed before. Many projects have inventory levels ranging from more than VND 3,000 billion to over VND 6,000 billion.

Khang Dien’s inventory rose to more than VND 21,457 billion, up more than VND 2,760 billion in just the first six months of 2024. (Source: Financial Statements)

For example, at the Khang Phuc – Tan Tao Residential Area project, as of June 30, the inventory was more than VND 6,558 billion. The Binh Trung – Binh Trung Dong project currently has an inventory of more than VND 4,171 billion, up more than VND 1,000 billion compared to the beginning of 2024; the Doan Nguyen – Binh Trung Dong project also has an inventory of more than VND 3,474 billion.

KDH’s financial report also shows that most of the land use rights and assets attached to the land in these projects have been used as collateral for the company’s loans at the bank.

Notably, KDH recorded a large amount of pre-payments from real estate buyers, with more than VND 2,939 billion, mainly from customers who paid for real estate according to the progress of the project.

Nam Long Investment Joint Stock Company (NLG) is also a business with an increase in real estate inventory compared to the figures announced at the beginning of the year. Nam Long’s inventory as of June 30 was at VND 19,232 billion, up about VND 1,877 billion compared to the figure of more than VND 17,353 billion at the beginning of the year, mainly due to real estate under construction.

According to the company’s financial report, the largest inventory is at the Izumi project, accounting for more than VND 8,655 billion. The Waterpoint Phase 1 project also has an inventory of more than VND 3,837 billion; the Hoang Nam (Akari) project has an inventory of more than VND 2,425 billion…

Meanwhile, the Waterpoint Phase 2 project has an inventory of more than VND 2,036 billion; the Can Tho project has an inventory of more than VND 1,492 billion. In addition to projects with large inventories, Nam Long has nine other projects with inventories ranging from a few billion to hundreds of billions of VND. Some land use rights of these projects have also been mortgaged for loans.

Nam Long’s real estate inventory has increased continuously from 2023 to the first half of 2024. (Photo: NLG)

The report also recorded that as of the end of June, this real estate enterprise had liabilities of more than VND 16,425 billion. On a positive note, the company received advance payments of more than VND 4,519 billion from customers, an increase of more than VND 1,000 billion compared to the beginning of the year. This is money paid by homebuyers who have not yet received their apartments, houses, or villas.

Dat Xanh’s inventory slightly decreased compared to the beginning of the year, but the figure of more than VND 13,896 billion as of June 30 is still notable. Of this, inventory of real estate under construction accounts for more than VND 11,152 billion, completed real estate ready for sale accounts for more than VND 2,229 billion, and real estate goods account for more than VND 503 billion. At the beginning of the year, Dat Xanh’s inventory was VND 14,139 billion.

As of June 30, 2024, Dat Xanh’s total assets reached nearly VND 29,000 billion, meaning that the company’s inventory accounts for nearly half of its total assets.

In the financial report for the first half of 2024, Vinhomes also reported an inventory of more than VND 56,310 billion as of the end of June, an increase of about VND 1,000 billion compared to the beginning of the year. Of which, real estate under construction accounts for more than VND 48,618 billion; completed real estate ready for sale is more than VND 411 billion. Notably, Vinhomes has a large amount of pre-payments from homebuyers, totaling more than VND 41,714 billion.

Vingroup Group also recorded an inventory of more than VND 114,381 billion as of June 30, of which real estate under construction for sale accounts for more than VND 65,904 billion; completed real estate products ready for sale are more than VND 3,442 billion, an increase compared to the figure of more than VND 2,146 billion at the beginning of the year.

Quoc Cuong Gia Lai also recorded an inventory of more than VND 7,028 billion as of the end of the first half of the year. This figure remains almost unchanged compared to the data as of January 1, 2024, of which real estate under construction accounts for more than VND 6,525 billion, and completed real estate accounts for about VND 464 billion.

Market absorption capacity

Sharing at the 2024 Annual General Meeting of Shareholders held on July 30, Mr. Nguyen Quoc Cuong, General Director of Quoc Cuong Gia Lai, said that the inventory of projects that have completed their financial obligations will be a competitive advantage for the enterprise under the new Land Law 2024. However, the “liberation” of inventory depends on the market’s absorption capacity.

The inventory of real estate enterprises in the following quarters is always higher than in the previous quarter, but it is unreasonable that the supply in the market is shrinking. (Illustration photo)

To sell products, or in other words, to “liberate” inventory, real estate prices must be affordable for the majority of homebuyers.

Financial and real estate expert Su Ngoc Khuong believes that while the inventory of enterprises is very large, most of it is tied up in legal issues or other regulations, and is not ready to be released to the market.

This has led to a situation where, despite strong demand, new supply is limited, and the products on the market are priced very high, unaffordable for the majority of buyers. As a result, the inventory of enterprises has continued to increase quarter after quarter, while the purchasing power of the people remains limited, leading to low expectations of increased liquidity.

Regarding expectations of stronger investment from foreign investors after the implementation of new laws, Mr. Khuong said that at this point, foreign investors are not keeping their money idle but are looking for investment opportunities. However, they are prioritizing assets that generate cash flow, such as operating commercial centers, office buildings, etc.

Vietnam Airlines sees promising results in its quest for financial balance

By the end of 2023, this business has incurred a total loss of over 5.8 trillion VND despite a 30% increase in revenue.