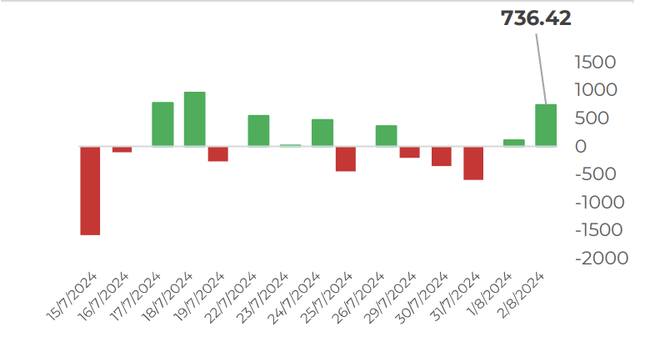

Since the previous peak, the main index has adjusted nearly 100 points before a broad recovery in the last trading session. Liquidity increased as the value of matched orders on the Ho Chi Minh Stock Exchange (HoSE) rose by nearly 9% this week.

Along with the emergence of bottom-fishing funds, foreign investors also remained steadfast in their buying activities despite the market correction. On August 2, foreign investors net bought nearly VND595 billion on the entire market, focusing on stocks such as VNM, DGC, and HPG.

Foreign investors continuously bought stocks during the market correction.

The food and beverage industry was among the positive contributors to the VN-Index’s recovery, with VNM, a leading food and beverage stock, gaining over 8% during the week. Oil and gas stocks reacted to the Middle East tensions between Iran and Israel, with BSR, PVC, and OIL seeing gains. The banking sector also contributed positively to the VN-Index, with VPB, TCB, SSB, NAB, and BID all trading higher.

Meanwhile, most chemical and fertilizer stocks experienced a downward trend, with DGC, CSV, DPM, and DDV undergoing adjustments. Steel stocks witnessed negative performance due to news of an anti-dumping investigation by the European Union, with HPG, NKG, HSG, TLH, and SMC declining. Vingroup’s stocks showed mixed performances, with VHM and VRE undergoing corrections, while VIC saw a slight increase following the announcement of VF3 battery and VinFast car prices.

Analysts from Saigon-Hanoi Securities (SHS) believe that the short-term trend of the VN-Index remains negative after failing to break through the resistance zone of around 1,255 points. However, in the last two sessions, many stocks that faced intense selling pressure have recovered well, especially those with strong fundamentals and positive second-quarter financial results. This indicates that the sharp fluctuations in these two sessions were largely short-term shake-offs of highly leveraged speculative positions, opening up opportunities for accumulating high-quality stocks.

In the near term, SHS expects the market to depend largely on the growth prospects of large-cap enterprises and GDP growth, as we enter August with a lack of new information about enterprises after the release of second-quarter reports.

Short and medium-term investors are advised to maintain a reasonable portfolio allocation at a moderate level and consider reducing the proportion of stocks that did not meet expectations in the second quarter of 2024, setting stop-loss levels if necessary, and rebalancing towards leading enterprises with strong fundamentals and positive growth in their financial results.

“New positions can be considered at reasonable prices for leading enterprises with strong fundamentals, based on second-quarter growth and expectations for a strong performance in the latter part of the year,” SHS experts recommended.

Analysts from Asean Securities predicted two scenarios for the VN-Index in August. In the first scenario, with the weakening pressure and the active participation of low-price demand in the range of 1,200-1,230 points, the VN-Index is likely to continue its sideways trend within the range of 1,200-1,300 points.

In the second scenario, if the VN-Index penetrates the support zone of 1,200-1,230 points, the risk of a deep correction will be confirmed. The main index may then seek a balance at lower price levels.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”