**Vietnamese Manufacturing Sector PMI Highlights Strong Output and New Orders Growth in July 2024**

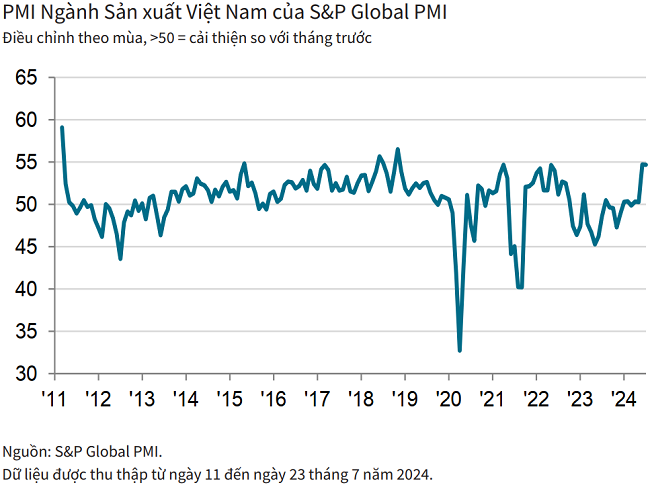

On August 1, 2024, S&P Global released the Vietnam Manufacturing Purchasing Managers’ Index (PMI) report for July 2024, highlighting three key points: the fastest output growth since March 2011, rising input costs, and near-record depletion of stocks of finished goods.

OUTPUT AND NEW ORDERS CONTINUE TO RISE

S&P Global’s report noted that Vietnam’s manufacturing sector maintained its strong growth trajectory in July, with new orders rising sharply, leading manufacturers to increase production. This growth rate was nearly on par with the record high achieved in the previous month. However, the surge in new orders outpaced production, causing companies to draw down their stocks of finished goods to a degree rarely seen before, despite efforts to boost employment and input purchasing.

Meanwhile, input costs and output prices continued to rise significantly, although inflation eased slightly compared to June.

The Vietnam Manufacturing PMI remained unchanged at 54.7 in July, indicating a substantial improvement in the country’s manufacturing business conditions. In fact, the last time faster growth was recorded was in November 2018. This improvement was observed across the consumer, intermediate, and investment goods sectors.

New orders increased for the fourth consecutive month in July, with the rate of growth only slightly slower than the near-record level in June. Survey respondents attributed this to stronger market demand and a higher number of customers. New export orders also rose, albeit at a weaker pace compared to total new orders. Some companies mentioned that export demand was impacted by high shipping costs.

With a sharp rise in new orders, manufacturers significantly increased their output in July. Moreover, the rate of output growth outpaced that of June and was the second-fastest on record, only behind March 2011.

BUSINESS CONFIDENCE REMAINS BUOYANT

Despite robust output, companies had to utilize their existing inventories to fulfill new orders. In fact, stocks of finished goods declined to the second-lowest level ever recorded, surpassed only by the level seen in February 2014.

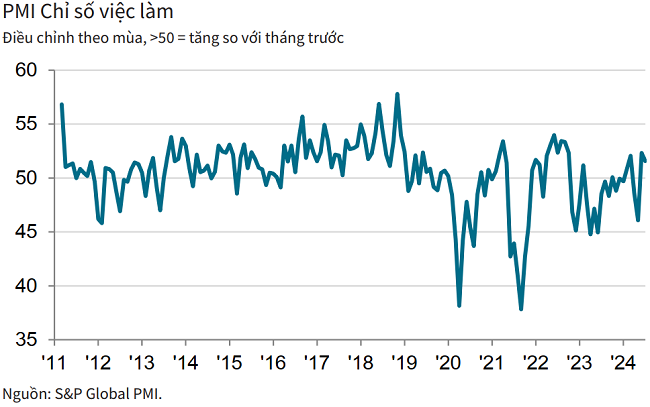

Firms attempted to boost capacity by increasing both input purchasing and employment at the start of the third quarter. Input buying rose considerably, with the rate of increase being the fastest since May 2022. On the other hand, employment levels rose only marginally and at a slower pace compared to June. Meanwhile, backlogs of work increased for the second month in a row.

Manufacturers found it easier to procure raw materials as suppliers’ delivery times shortened for the second month in a row, despite only minor improvements in vendor performance, with some reports of ongoing maritime transport delays. Inventories of purchases declined for the 11th consecutive month, with the rate of depletion being the fastest since April.

Input costs continued to rise sharply in July, with the rate of inflation only slightly weaker than the two-year high recorded in June. Suppliers were reported to have increased their selling prices, while higher transportation costs also played a role.

Facing rising input costs, manufacturers raised their output prices for the third month in a row in July. The rate of increase was robust, although slower than in the previous survey period.

Expectations of continued growth in new orders over the coming year bolstered business confidence in output prospects. Around 40% of respondents expressed optimism, but overall business sentiment eased to its lowest since January, falling below the historical average for the index.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, stated that Vietnam’s manufacturing sector built on the strong growth seen in June, fostering optimism about a phase of robust growth that could propel the economy forward.

The key challenge for companies now is keeping up with demand. While production has been ramped up, firms have had to rely on their inventories to meet new orders, leading to a sharp depletion of stocks. Manufacturers will need to accelerate hiring and ensure the continued procurement of raw materials if the current trend of new orders is to be sustained in the coming months.