The Vietnamese stock market witnessed another volatile trading session on August 2, with the benchmark VN-Index plunging over 16 points to close at 1,210 points. This continues the downward trend seen since the beginning of the week, resulting in a total loss of approximately 36 points.

Amid this market-wide decline, shares of KSV, owned by the Vietnam National Mineral Corporation (Vimico), defied the odds by surging for the fourth consecutive session, reaching the daily limit-up of 10%. This remarkable performance pushed the stock price to VND52,500 per share, representing a staggering nearly 46% gain over just one week. Accompanying this price surge was a significant increase in trading volume, soaring from a few thousand units to a few hundred thousand.

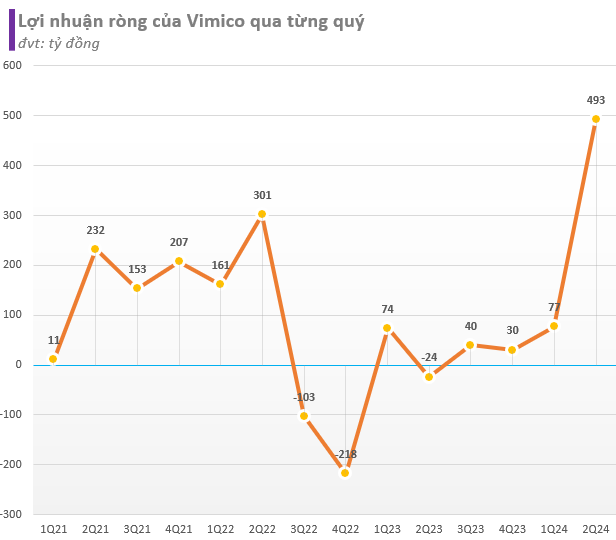

The extraordinary rally in KSV shares followed Vimico’s announcement of its remarkable financial results for the second quarter of 2024. During this period, the company recorded revenue of VND3,432 billion, reflecting a modest 5.7% increase year-over-year. However, a nearly 15% decrease in cost of goods sold significantly boosted gross profit, which quadrupled to reach VND832 billion.

Additionally, a 50% reduction in financial expenses further bolstered the company’s performance. Consequently, Vimico reported a remarkable turnaround in profitability, with a net profit attributable to the parent company of nearly VND493 billion for the quarter, compared to a loss of VND24 billion in the same period last year. This quarterly profit represents a record high for the company.

For the first six months of 2024, Vimico’s strong performance continued, with revenue reaching VND6,583 billion and net profit attributable to the parent company standing at VND566 billion. These figures represent impressive year-over-year growth rates of 18% and 757%, respectively.

As of June 30, 2024, the company’s total assets amounted to VND10,482 billion, reflecting a substantial increase of over VND1,000 billion from the beginning of the year. Nearly half of these assets were in fixed assets, valued at VND4,463 billion. Inventory stood at VND2,896 billion.

Vimico, formerly known as the Vietnam National Mineral Corporation, was established in 2005 as a subsidiary of Vinacomin. The company specializes in mineral exploration and processing, including rare earths, precious metals, zinc, copper, and aluminum. It boasts the country’s leading position in copper mining and processing, backed by its rights to exploit the largest copper mine in Vietnam, the Sin Quyen mine.

Additionally, Vimico manages and operates the Dong Pao mine, the country’s largest rare earth mine, located in Lai Chau province. With a total geological reserve of over 11.3 million tons, the Dong Pao mine accounts for more than half of Vietnam’s rare earth reserves. Other sources of rare earths are found in Nậm Xe (Lai Chau), Mường Hum (Lao Cai), and Yên Bái.