Illustrative image

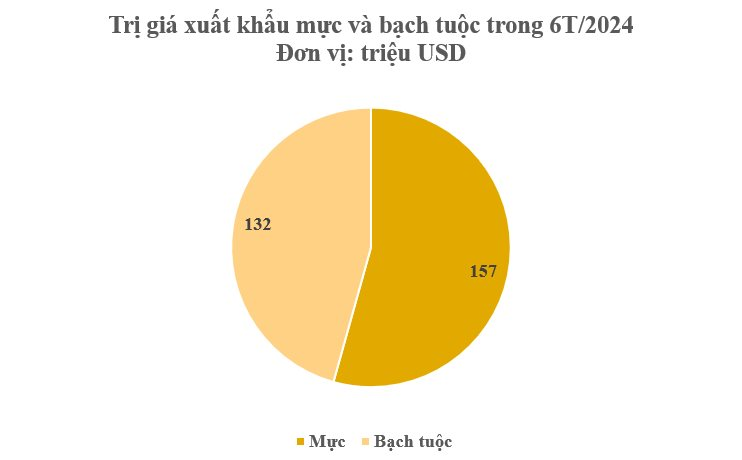

According to statistics from the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam’s exports of squid and octopus in the first half of the year brought in more than $289 million, a slight decrease of 1% compared to the same period last year. Squid exports saw a 6% decline, earning $157 million.

On the other hand, octopus exports witnessed a 6% increase, bringing in $132 million in the first half of 2024.

Vietnamese squid and octopus products have been exported to 58 markets, with South Korea being the largest market, accounting for $114 million, a 13% increase compared to the previous year.

Japan is the second-largest market, with $68 million, a 12% decrease. The third position is held by the group of China and Hong Kong, with $30 million, a 10% increase compared to 2023.

In South Korea, the largest export market for Vietnamese squid and octopus, data from kita.org reveals that Vietnam is the largest supplier of frozen octopus to the country, holding a 43% market share, followed by China in second place with a 41% share.

South Korea mainly imports frozen cut octopus, whole cleaned frozen octopus, iced octopus pieces, frozen processed octopus, dried skinned squid, frozen cleaned processed squid, frozen sushi squid, frozen cleaned squid tubes, frozen whole cleaned squid tubes, frozen squid rings, and other frozen squid products from Vietnam.

Japan, on the other hand, favors squid and octopus products from Vietnam due to declining domestic catch rates and increasing demand, especially for convenient and ready-to-eat squid and octopus products that suit modern, busy lifestyles with less time for cooking.

Exports of squid and octopus from Vietnam to South Korea are expected to continue on a positive growth trajectory in the coming period, as the ban on seafood imports from Japan into China remains in place.

Commenting on the export situation this year, the Ministry of Agriculture and Rural Development stated that 2024 will continue to be a year of unusual developments and declining seafood resources. The security situation at sea is complex and unpredictable, and countries in the region are tightening control over fishing activities, significantly reducing the fishing grounds for Vietnamese fishermen.

Given the challenges at home and abroad, the seafood industry needs to focus on crucial tasks such as removing the IUU “yellow card,” with local authorities strictly managing and supervising the fishing fleet. Businesses should diversify their markets and products to enhance competitiveness. Industry associations should actively promote trade, both domestically and internationally, and regularly update market information and demands to help farmers and fishermen organize production and exploitation efficiently.

Many entrepreneurs in the seafood industry predict that the Vietnamese seafood export market will stabilize in the third and fourth quarters due to increased festive and holiday season consumption. VASEP also forecasts that seafood export growth in the second half of 2024 will be about 15% higher than the same period last year, reaching over $5.5 billion. The total seafood export value for 2024 is expected to reach $10 billion.