The Vietnamese stock market has just witnessed a surprising trading session. Investors expected another sharp decline in the VN-Index, but a remarkable turnaround after 2 pm local time pushed the index back into positive territory. A broad-based influx of cash propelled stocks higher, with some even hitting the daily limit-up. Large-cap stocks also seized the opportunity to recover, as evidenced by the VN30, which saw 22 constituents advancing against only 8 declining.

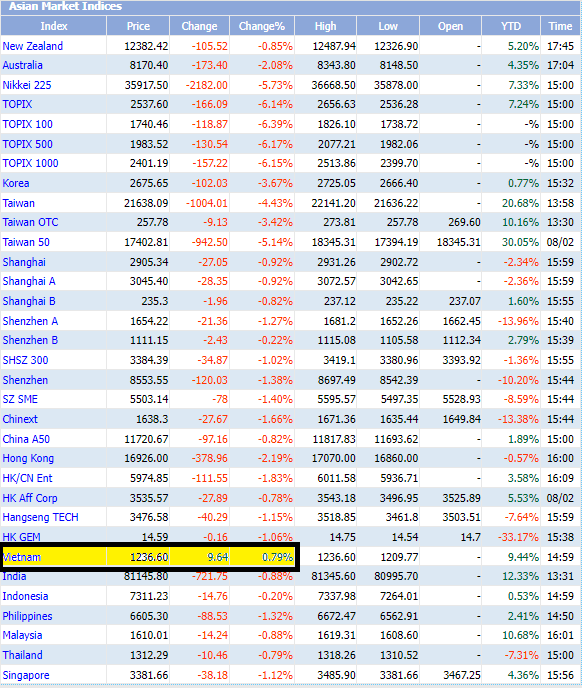

VN-Index: The Only Gainer Among Asian Markets on August 2nd

The VN-Index closed at the session’s high, climbing 9.64 points, or 0.79%, to 1,236.60. Consequently, it emerged as the sole gainer among major Asian stock markets on August 2nd.

Today’s advance helped recoup approximately VND 40 trillion in market capitalization on the HoSE, following a massive VND 100 trillion evaporation in the previous session. The rebound was also supported by foreign investors, who resumed net buying, injecting nearly VND 800 billion into Vietnamese stocks after consecutive sessions of aggressive selling.

Despite the recovery, the VN-Index remains nearly 5% below its mid-June peak of 1,300 points. In a recent comment, Mr. Nguyen The Minh, Director of Analysis at Yuanta Vietnam Securities, shared his insights: “The VN-Index has entered an oversold territory in terms of valuation. After recent sharp corrections, the market’s P/E has dropped to 13.5 times, matching the April lows. Moreover, the projected P/E for 2024 has declined to 11.5 times, indicating an attractive equity risk premium of 9-10%. From now until the end of the year, I believe it will be challenging to find an investment avenue offering higher returns than the stock market.”

According to Mr. Minh, in addition to compelling valuations, the market is also anticipating a potential Fed rate cut in September. Additionally, the easing of currency pressures will likely discourage foreign investors from aggressive selling and encourage a return to net buying.

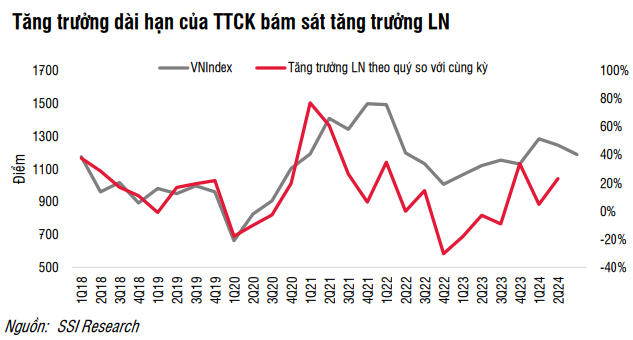

Looking ahead, SSI Securities Company foresees continued growth in Vietnam’s stock market for 2024. Meanwhile, MBS Research, in its Mid-2024 Investment Strategy Report, predicts the VN-Index to reach 1,350 – 1,380 points by year-end, driven by a 20% earnings growth in the 2024 fiscal year and a target P/E of 12 – 12.5 times.

MBS highlights several factors supporting the Vietnamese stock market in 2024. Firstly, they anticipate a 16.8% earnings growth for listed companies in 2024, underpinned by an improved macroeconomic environment. Secondly, low-interest rates will motivate foreign investors to seek growth opportunities in emerging markets, including Vietnam. Thirdly, the resolution of legal hurdles for real estate projects in Ho Chi Minh City and Hanoi sets the stage for a recovery in the property market. Lastly, the introduction of the KRX system will provide the foundation for implementing new trading solutions, bringing Vietnam closer to an upgrade in its market status.

Echoing the optimism, foreign investment funds also believe that earnings growth will be the key driver of the stock market’s performance in 2024.

Mr. Petri Deryng, manager of the Finnish fund Pyn Elite, forecasts a record-breaking year for listed companies in Vietnam, with revenue growth exceeding 20%. He points out that the stock market has yet to reflect the pace of corporate earnings growth and the impact of declining interest rates. Pyn Elite Fund even projects the VN-Index to soar to 1,700 points by year-end.

Who is the richest stock market leader in Vietnam?

Do you think Pham Nhat Vuong is the richest person in Vietnam? This may be true, but if we only consider the scale of the Vietnamese stock market and based on the percentage of individual stock ownership, Mr. Vuong still loses to another figure.