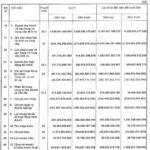

Vietnam Industrial and Commercial Bank (VietinBank)’s financial reports indicate an increase in non-performing loans (NPLs), with a total of over VND 24,100 billion as of the end of the second quarter. This represents a more than 20% rise compared to the first quarter. Notably, the bank’s doubtful debt, which refers to loans overdue between 181 and 360 days, has more than doubled in just three months, surpassing VND 13,400 billion.

Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) also experienced an increase in NPLs, with a total of VND 12,548 billion at the end of June, a 14.2% rise compared to the end of 2023. Consequently, Sacombank’s NPL ratio increased from 2.28% to 2.43%.

The rising challenge of NPLs in the banking sector.

Asia Commercial Bank (ACB)’s NPLs as of June 30th stood at over VND 8,122 billion, with a slight increase across all three debt groups, including the group with potential loss. ACB’s NPL ratio increased from 1.21% at the beginning of the year to 1.49%, which is still considered low compared to other joint-stock commercial banks. Specifically, the potential loss group accounted for over VND 5,525 billion, up from VND 3,897 billion at the start of the year, while the doubtful debt group exceeded VND 1,309 billion, and the substandard debt group totaled VND 1,287 billion.

The potential loss group witnessed a significant increase of more than VND 1,628 billion, or 29.46%, in just six months, making up 68% of the total of the three NPL groups. Notably, there has been a shift in the debt portfolio, with a considerable decrease in doubtful debt, which fell 1.9 times to VND 2,425 billion, while potential loss debt surged 1.7 times to VND 8,409 billion.

Mr. Dao Minh Tu, Deputy Governor of the State Bank of Vietnam, highlighted the upward trend in NPLs, noting that the ratio of on-balance sheet NPLs has reached nearly 5%. When including potential NPLs, sold NPLs to the Vietnam Asset Management Company (VAMC), and other factors, the NPL ratio climbs to approximately 6.9%.

According to the Deputy Governor, NPLs pose a challenge not only to the banking sector but also to the entire economy. The State Bank of Vietnam will take measures to ensure credit quality and make provisions for NPLs to maintain financial stability.

Based on data from the State Bank of Vietnam, Rong Viet Securities Company estimates that on-balance sheet NPLs have increased by approximately VND 75,900 billion compared to the end of 2023. Notably, restructured debt with unchanged debt groups (according to Circular No. 06/2024 amending Circular No. 02/2023) has seen a significant increase, with the total value of principal and interest rising by 25.5% to VND 230,400 billion. Additionally, the number of customers availing of debt restructuring and maintaining their debt groups has increased from 188,000 to 282,000 as of the end of June this year.

Surging Profits from Associated Joint Venture, Nam Long (NLG) Reports After-Tax Profit of over 800 billion VND in 2023

According to NLG, the primary revenue for the entire year came from the sale of houses and apartments, from two major projects Izumi and Southgate. Additionally, in the third quarter, NLG also had the Mizuki project, which was a significant handover project.