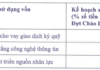

In recent news, RDP-coded Rang Dong Holding JSC has announced that Ho Duc Lam, the company’s Chairman of the Board, had 1.17 million RDP shares, equivalent to 2.39% of the company’s charter capital, forcibly sold on August 1st. As a result, Mr. Lam’s ownership has decreased from 4.1 million units (8.48% of capital) to 2.9 million units (6.09%).

Mr. Lam remains the largest shareholder of Rang Dong Holding. However, in the past, specifically in late 2020, the entrepreneur owned up to 64.2% of the company’s capital. Since then, he has gradually reduced his ownership stake.

However, from August 2023 until now, Mr. Lam has been consistently selling RDP shares at a rapid pace, reducing his ownership in Rang Dong Holding from 45% to 6.1% as of today. Thus, within just one year, the Chairman of Rang Dong Holding has sold a total of more than 19 million shares, equivalent to nearly 39% of the capital. During this period, Mr. Lam has been subject to both forced and voluntary sales.

Mr. Lam’s case reminds us of similar incidents in the past involving company leaders, such as Do Quy Hai, Chairman of Hai Phat Invest (HPX), Nguyen Van Dat, Chairman of Phat Dat (PDR), and Bui Thanh Nhon, Chairman of Novaland (NVL). However, in the cases of Mr. Nguyen Van Dat and Mr. Bui Thanh Nhon, the entrepreneurs only had a small percentage of their shares forcibly sold.

In the case of Mr. Do Quy Hai, the businessman continuously sold tens of millions of HPX shares, both voluntarily and forcibly, from November 2022 to September 2023. The Chairman of Hai Phat Invest reduced his ownership from 40.4% to 13.89% and has since stopped selling as of September 2023.

It can be seen that the rate at which Mr. Ho Duc Lam has reduced his ownership in Rang Dong Holding is significantly higher than that of Mr. Do Quy Hai.

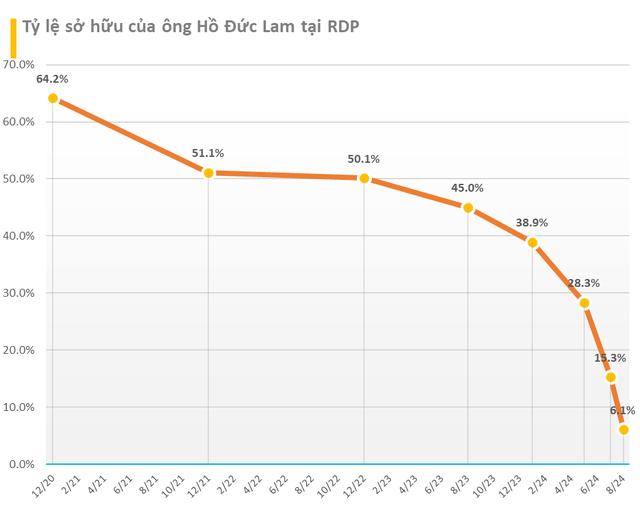

Mr. Lam’s continuous divestment from Rang Dong Holding comes at a time when the company is facing declining business performance. Specifically, the company recorded a decrease in revenue in 2023 and reported a loss of nearly VND 150 billion. In the first half of 2024, the company continued to incur a loss of over VND 65 billion. As of June 30, Rang Dong Holding had accumulated losses of VND 266 billion.

The turning point for the company’s decline was its loss in a lawsuit against foreign shareholder Sojitz Planet Corporation (a subsidiary of Japan’s Sojitz Corporation). Rang Dong Holding was ordered to repay nearly VND 157 billion along with related fees and charges. This lawsuit caused the company’s provisioning expenses to soar, resulting in a reported loss for 2023.

In 2016, Rang Dong signed a comprehensive trade cooperation agreement with Sojitz. Under the agreement, Sojitz would provide raw materials, transfer technology, management systems, and develop new products according to Japanese standards for Rang Dong. In 2017, the two companies held a ceremony to sign a strategic shareholder agreement. Additionally, Sojitz purchased 5 million ordinary shares of Rang Dong Long An Plastic Joint Stock Company, fully paying for the shares at a price of over VND 174 billion.

However, according to Sojitz, after the transfer of the above shares, Rang Dong violated some of its post-transfer obligations. Therefore, based on the share purchase agreement, Sojitz exercised its right to terminate the contract and requested Rang Dong to immediately refund 90% of the share purchase price, equivalent to nearly VND 157 billion.

As Rang Dong failed to make the refund, Sojitz filed a lawsuit at the Singapore International Arbitration Center (SIAC). On July 6, 2022, the SIAC Arbitration Council ruled in favor of Sojitz. The defendant, Rang Dong, was ordered to pay Sojitz the amount of nearly VND 157 billion in damages and an interest rate of 10%/year on this amount from April 1, 2020, until the payment date. In addition, Rang Dong had to pay the arbitration council’s fees and charges, as well as SIAC’s administrative fees and charges, amounting to hundreds of millions of dong.

The case dragged on until the end of 2023, as the People’s Court of Ho Chi Minh City decided not to recognize the SIAC arbitration award. However, upon reconsideration, the Ho Chi Minh City High People’s Court decided to accept Sojitz’s appeal, recognizing and enforcing the international arbitration award in Vietnam.

Amid financial challenges and the Chairman’s forced share sale, RDP shares have also been on a downward trend. Specifically, at the close of August 2, the RDP share price stood at VND 2,410 per share (less than the price of a glass of iced tea), a decrease of nearly 75% compared to the beginning of the year.

Rang Dong Holding, formerly known as Rang Dong Plastic Joint Stock Company, was listed on the Ho Chi Minh Stock Exchange (HoSE) in 2009. Mr. Ho Duc Lam is the brother of Mr. Ho Quynh Hung, Chairman of Dien Quang Lamp Joint Stock Company (DQC). Mr. Ho Duc Dung, Mr. Lam’s son, is a member of the Board of Directors of RDP.