Shareholders don’t need to worry?

On July 26, 2024, the Ho Chi Minh City Stock Exchange (HOSE) announced the forced delisting of HNG shares of Hoang Anh Gia Lai International Agriculture Joint Stock Company (HAGL Agrico) due to the company’s negative after-tax profit in 2021, 2022, and 2023, amounting to 1.1 trillion VND, 3.5 trillion VND, and 1 trillion VND, respectively.

This outcome was mentioned by the HNG leadership during the 2023 Annual General Meeting of Shareholders, and even anticipated long before it became a reality.

As Chairman of the HNG Board of Management, Mr. Tran Ba Duong candidly admitted, “There is no other way but to accept the losses. Whatever was previously kept in the books, moving numbers from one place to another to avoid losses, just let it go and take the hit. We need to start afresh, and if delisting is necessary, we will do it to come back stronger.”

At this year’s meeting, the dollar billionaire reassured shareholders that if HNG shares were delisted and moved to UPCoM, the disclosure of information and transparency would remain unchanged. He emphasized that what matters is the company’s intrinsic value and potential, which would ensure that the share price would still increase even on UPCoM.

Mr. Tran Ba Duong – Chairman of HNG

|

HNG Chairman Tran Ba Duong: Accept the Losses and Start Afresh

HNG and Thaco Group officially formed a strategic partnership six years ago when they signed a cooperation agreement in 2018. This was also when Thaco’s representatives joined the HNG Board of Management.

Thaco committed to supporting the restructuring of HNG’s debt and raising capital to care for existing fruit-bearing areas, as well as developing and expanding fruit-bearing areas in 2019 and 2020.

In 2019, Thaco publicly became a major shareholder of HNG, holding 26.29% of its capital, after purchasing nearly 70 million shares and receiving nearly 222 million shares from convertible bonds. In the same year, Hoang Anh Gia Lai (HOSE: HAG) reduced its ownership in HNG from 57.81% to 40.83%.

In 2021, HAGL further decreased its ownership to 16.07% of HNG, and Mr. Tran Ba Duong officially took the position of Chairman of the HNG Board of Management. Currently, Mr. Duong holds 4.58%, while related parties, Thaco, and Tran Oanh Trading and Production Company hold 27.63% and 4.96%, respectively, with HAGL’s ownership now at 8.24%.

At an extraordinary general meeting of shareholders in early 2021, Mr. Tran Ba Duong shared that he became the Chairman of HNG reluctantly and only wished to help the company out of its dire situation and for the country to have a large-scale agricultural company operating with an industrial production model.

| Tran Oanh Company was established in 2008, with Ms. Vien Dieu Hoa, Mr. Duong’s wife, as General Director and legal representative. The company currently has a charter capital of VND 6,860 billion, of which Mr. Duong holds 76.13% and Ms. Hoa holds 23.87%. |

A Tough Nut to Crack?

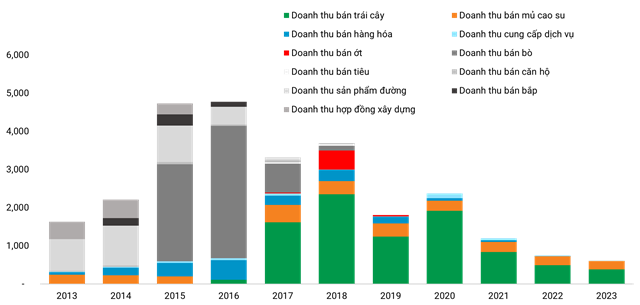

Solving the HNG equation seems challenging for Thaco, as the company’s revenue has consistently declined over the past six years. In 2019, revenue reached VND 1.8 trillion, half of what it was in 2018, and only increased to VND 2.3 trillion in 2020 before gradually decreasing. By 2023, revenue stood at VND 605 billion, the lowest since 2012.

HNG has repeatedly changed its business targets since its inception in 2010, especially after Thaco’s involvement. The company once relied on sugar product sales during 2013-2014. In 2015 and 2016, cattle breeding pushed revenue to a peak of over VND 4.7 trillion each year, but this figure has not been achieved since.

From 2017 onwards, fruit trees and rubber trees took center stage, followed by other types of trees, which were mostly eliminated. In 2018, revenue from fruit trees reached a high of over VND 2.3 trillion but could not be sustained and quickly declined to just VND 383 billion in 2023.

Meanwhile, rubber sales have been relatively stable for over a decade but have gradually decreased. HNG recorded its highest revenue of VND 454 billion in 2017, more than double what it was last year.

|

HNG’s business performance from 2013 (in VND trillion)

Source: Author’s compilation

|

Before Thaco’s participation, HNG maintained a very high gross profit margin, ranging from 37-41% in 2017-2018. However, this decreased to 12% and 6% in 2019 and 2020, respectively. For the past three years, the company has been operating at a loss.

For example, in 2022 and 2023, fruit sales revenue was VND 493 billion and VND 840 billion, respectively, while the cost of goods sold amounted to VND 1.4 trillion and VND 1.3 trillion.

In the past decade, HNG has been profitable in five periods, including 2013-2015 and 2017. Since Thaco’s involvement, 2020 was the only profitable year, with a meager VND 21 billion. The most significant loss was the record-high loss of VND 3.5 trillion in 2022.

In reality, the profits in 2017 and 2020 were mainly due to the liquidation of investments rather than business operations. For instance, in 2017, HNG earned VND 716 billion in profit from selling a group of sugar companies and Ban Me Rubber Joint Stock Company. Similarly, the figure for 2020 was VND 931 billion.

At an extraordinary general meeting of shareholders in 2021, HNG’s leadership acknowledged that the decision to dispose of a subsidiary at the end of 2020 was made solely to generate a profit and ensure that the company’s shares were not delisted.

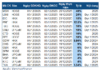

| Revenue from financial activities of HNG from 2012 – 2023 |

How Has Thaco Transformed HNG?

As of the first quarter of 2024, HNG’s total assets amounted to approximately VND 14.2 trillion, a more than 50% decrease compared to VND 30.5 trillion in 2018 when Thaco first appeared. Consecutive years of losses have resulted in negative retained earnings of over VND 8 trillion, with shareholder equity standing at VND 2.5 trillion, a loss of VND 8 trillion in six years.

| Financial situation of HNG from 2012 – 2023 |

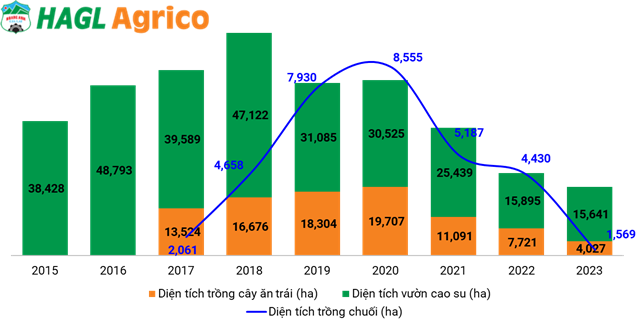

In reality, the total area of rubber and fruit plantations of HNG has continuously shrunk, from a peak of 64,000 ha in 2018 to nearly 20,000 ha in 2023, due to various reasons, mainly the company’s decision to divest from subsidiaries to reduce debt.

In 2019, HNG transferred several subsidiaries, including Dong Duong Investment and Development Joint Stock Company, Dong Penh Joint Stock Company, and Trung Nguyen Rubber One-Member Limited Company, to Thadi Agricultural Production and Processing Company, a member of the Thaco Group. This move reduced HNG’s revenue from fruit sales.

In the following two years, the harvest area of rubber and fruit trees decreased as HNG sold all its capital contributions in An Dong Mia One-Member Limited Company, Hoang Anh Quang Minh Rubber Joint Stock Company, Tay Nguyen Dairy Cow Joint Stock Company, and Hoang Anh Dak Lak Joint Stock Company to Thaco Agricultural Company (Thaco Agri).

|

Changes in HNG’s planting area from 2015 to the present (in ha)

Source: Author’s compilation

|

According to VietstockFinance, from 2016 to 2023, the company recorded at least VND 5.6 trillion in expenses, including costs related to writing off inefficient assets, canceling garden books, garden development costs, costs of changing the purpose of assets, and losses from re-evaluating inefficient assets. This amount accounts for approximately 50% of the company’s current charter capital.

Notably, the substantial loss in 2022 was due to the removal of a portion of the garden area at subsidiaries based in Laos and Cambodia, valued at over VND 2.1 trillion, from the books, and the write-off of VND 159 billion in inefficient assets.

In 2019, expenses related to garden development, including the evaluation of inefficient assets and the change of purpose to fruit trees, amounted to over VND 1.3 trillion. This figure was VND 542 billion in 2018.

Infusing Cash into HNG

Additionally, Thaco’s ecosystem has also incurred significant costs in its efforts to “restructure” HNG, beginning in 2018. Initially, Thaco provided a convertible bond worth over VND 2.1 trillion, based on a pledge but without interest, to invest in new fruit tree planting and financial restructuring.

Companies associated with Mr. Tran Ba Duong have continuously provided short-term and long-term loans to HNG. In 2018, they lent VND 746 billion to finance working capital. This amount increased to nearly VND 2.6 trillion in 2019, along with a long-term loan of VND 805 billion.

In 2020, Thaco Agri provided a short-term unsecured loan of VND 5.1 trillion to HNG, with an interest rate of 7-10.5%/year, to supplement working capital. In 2022, Thaco Agri provided a long-term loan of VND 2.8 trillion at an interest rate of 7.5-14%/year.

At the beginning of last year, Thaco Agri committed to purchasing agricultural products from HNG and continued to provide financial support through a long-term loan of over VND 5.1 trillion, with an interest rate of 9-14.5%/year. The repayment period is from May 2024 to the end of 2025.

According to Mr. Duong’s statement at the 2021 Extraordinary General Meeting of Shareholders, the total investment made by Thaco in HNG has reached VND 40,000 billion.

| HNG’s borrowing and repayment trends from 2012 – 2023 |

Twentyfold Revenue Increase by 2028?

HNG expects to continue making a pre-tax loss of VND 120 billion this year but has set a target to increase revenue by nearly 15%, reaching VND 694 billion. Nevertheless, Chairman Tran Ba Duong is optimistic that HNG has found a new model and predicts that the company will turn a profit by 2025.

In the next phase, HNG plans to return to cattle breeding by investing in seven breeding farms, a cluster of workshops for producing bedding and organic fertilizer, a cluster of warehouses for raw materials for animal feed and supplies, importing 5,800 female cows for breeding, planting 468 hectares of grazing grass, and 127 hectares of concentrated grass.

Additionally, the company’s large-scale fruit tree planting and cattle breeding project in Attapeu and Sekong provinces has received approval from the Lao government. The project covers an area of over 27,000 hectares and is expected to require an investment of VND 18 trillion over the period from 2024 to 2028. HNG’s leadership estimates that revenue from 2028 will reach approximately VND 13.5 trillion, twenty times the current figure. After deducting expenses, the project is expected to generate a profit of VND 2.4 trillion.

Will HNG succeed in returning to cattle breeding?

|

Will There Be a Second “Hung Vuong Seafood”?

HNG’s share price, which was already low, plummeted to the floor price of VND 4,340 per share (equivalent to a market capitalization of VND 4.8 trillion) on July 29, following the delisting announcement.

Since its listing on HOSE in 2015, HNG’s share price once reached nearly VND 35,000 per share at its debut (equivalent to a market capitalization of approximately VND 24 trillion), which was also the highest price ever enjoyed by long-term shareholders. However, less than a year later, the price quickly plunged below par value.

Mr. Tran Ba Duong’s involvement sparked a glimmer of hope, driving the share price back up to around VND 20,000 per share in 2019-2020. Since then, the price has not only failed to increase but has continued to decline, now equaling the price of a cup of iced tea.

“Unprofitable business, plummeting share price, Thaco’s intervention and installation of new management, share price recovery, delisting, persistent unprofitability, Thaco’s divestment, and share price stagnation” is a chain of events that has already occurred with “tra fish king” Hung Vuong (UPCoM: HVG). Will this scenario play out again with HNG?