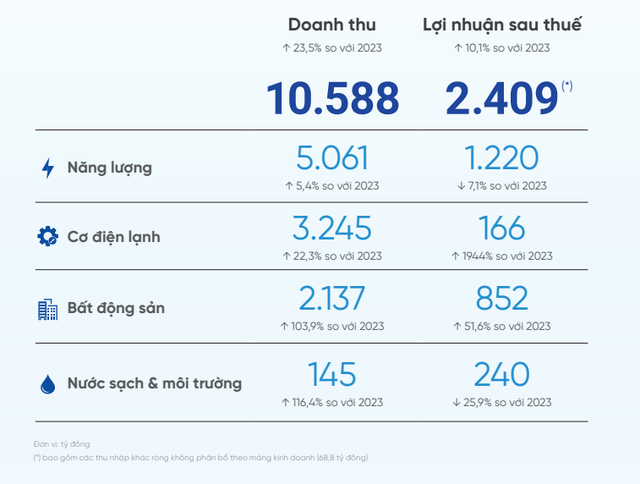

CTCP Cơ Điện Lạnh (mã chứng khoán: REE) has just released its annual report for 2023. In it, the company sets a target of VND 10,588 billion in revenue and VND 2,409 billion in pre-tax profit for 2024, representing a 23.5% and 10.1% increase, respectively, from 2023.

The CEO of REE believes that 2024 will be a challenging year for the Vietnamese energy sector.

Reviewing each business segment, starting with Energy, the CEO of REE believes that the business environment and policies in the energy sector will continue to impact business operations in 2024. The El Nino phenomenon will be prominent in the first three months of 2024 and is likely to persist until June 2024, significantly affecting water flow to hydroelectric reservoirs.

In addition, REE expects that the alpha coefficient for hydroelectric plants will increase from 90% in 2023 to 98% in 2024, and the ceiling price for the electricity market will be reduced by VND 231.1 per kWh compared to 2023, according to Decision No. 158/QD-DTDL dated December 29, 2023. These factors will impact the production activities of power plants. With hydroelectric plants accounting for over 50% of the total installed capacity, REE proposes a cautious business plan for the energy segment in 2024.

The second segment is HVAC. REE projects that the air conditioning business will continue to face fierce competition in terms of technology, pricing, and promotional policies. Maintaining market share in air conditioning sales will remain a top priority for the company, through the expansion of its nationwide distribution network.

“2024 is a milestone year for the HVAC segment to define a new direction for business expansion and enhance its competitive position; preparing for the recovery of the economy”, REE’s leadership stated.

The third segment is Water and Environment. According to the CEO of REE, M&A activities in the water sector have shown signs of slowing down. In accordance with Decision No. 1479/QD-TTg issued by the Prime Minister on November 29, 2022: The state will maintain the current shareholding in water companies operating in the fields of water exploitation, wastewater treatment, and water distribution in provinces and cities until 2025.

Finally, in the Real Estate segment, despite a somewhat optimistic plan, REE acknowledges that 2024 will still be challenging for the real estate industry. The company is expected to complete the handover of a commercial residential project in Bo Xuyen Ward, Thai Binh City, Thai Binh Province in March 2024. The company will also complete land clearance and obtain construction permits for a residential project in Phu Hoi Commune, Nhon Trach District, Dong Nai Province. In addition, the company will proceed with the design and completion of construction permit procedures for a commercial building – office tower in Phu Huu Ward, Thu Duc City, Ho Chi Minh City.

At the upcoming annual General Meeting of Shareholders, REE also plans to propose the annual dividend plan for 2023 with a rate of 25%, including 10% in cash (expected to be paid in April 2024) and 15% in shares (in 2024). The dividend plan for 2024 is expected to be implemented at a rate of 10%.

Specifically, the company plans to spend VND 355 billion on cash dividends at a rate of 10% (shareholders will receive VND 1,000 for each share). At the same time, the company will issue an additional 61.3 million new shares to pay dividends to shareholders. Currently, REE’s charter capital stands at VND 4,097 billion. If the dividend payment is completed, the company’s charter capital will increase to about VND 4,710 billion.

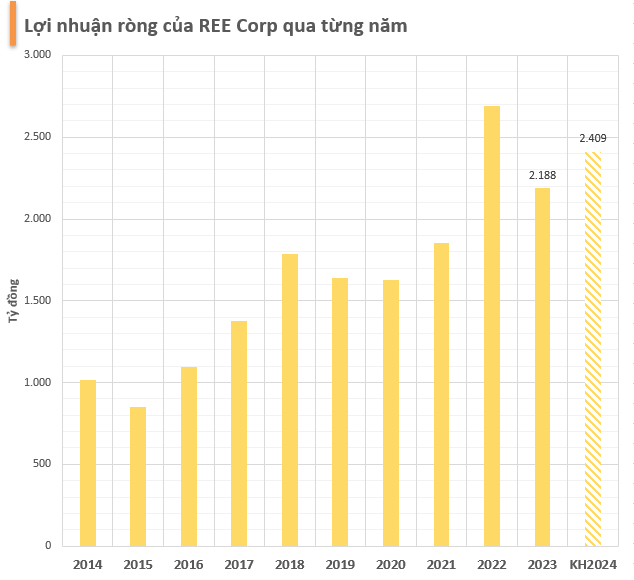

In terms of business performance, in 2023, REE achieved a total net revenue of VND 8,570 billion and a post-tax profit of VND 2,786 billion, a decrease of 9% and 21% compared to the previous year. These results did not meet the target revenue of VND 10,962 billion set by the leadership at the beginning of the year. However, the company still managed to achieve a post-tax profit of VND 2,700 billion.