As of this morning, July 31, the SJC gold bar price at Saigon Jewelry Company (SJC) was listed at 77-79 million VND per tael for both buying and selling. State-owned banks and jewelry companies like DOJI and PNJ offered similar prices. Today, the four state-owned banks that buy SJC gold bars from the State Bank of Vietnam and sell directly to individual customers also set their selling price at 79 million VND per tael.

Previously, on the morning of July 30, after more than a week of stagnation, the SJC gold price dropped by 500,000 VND per tael. This 77-79 million VND per tael price has been maintained until today.

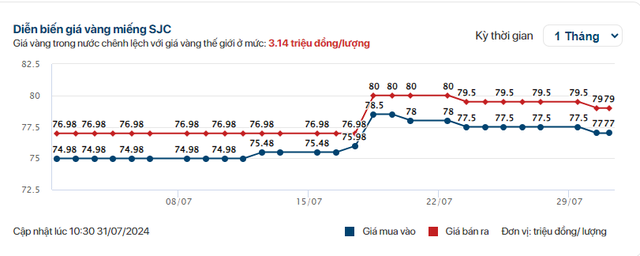

SJC gold price movement over the past month. Chart: CAFEF.

Looking at the fluctuations of the SJC gold price over the past month, the price has not changed continuously. This situation has actually occurred since the point one week after the four state-owned banks started selling gold directly to the people. This solution was introduced to narrow the gap between domestic and world gold prices after a period of sharp increases that caused people to rush to buy gold.

However, according to many people, buying gold has not been easy recently. Many gold businesses have been constantly reporting that they are “out of stock”. Buying gold online from the four state-owned banks is also not as simple as “placing an order”.

Notably, some conditions for online gold buyers have been introduced. For instance, in its latest announcement, Vietcombank stated that it would apply additional policies for customers registering to buy SJC gold bars online. Specifically, from July 29, individuals wishing to register to buy gold online at this bank must have a payment account opened at Vietcombank that is currently active.

According to Dr. Nguyen Tri Hieu, the domestic gold bar market is being tightly controlled under a price stabilization program. This is why investors need to be cautious.

When asked whether the current difficulties in buying gold would make this investment channel less attractive, Dr. Hieu thought that this could happen but the probability was not high. He explained that, for Vietnamese people, gold remains an attractive investment channel. This is because many people do not understand the stock market, cannot afford to invest in real estate, and with savings interest rates currently at only 6-7% per annum, the appeal of gold, with an average profit margin of 15-20% per annum, is huge. The habit of investing in gold is even harder to give up in the context of rising world gold prices.

According to Dr. Hieu, tight control of the gold market could lead to the development of a black market. “We are at a crossroads. When we choose to follow a market economy, we need to follow the principle of supply and demand, and prices are also determined by this factor. If the formal market cannot meet the needs of customers, the black market will form, leading to an inability to stabilize the market sustainably. This is something to note.”

From his perspective, economic expert Dr. Le Xuan Nghia predicted that the gold bar price would continue to increase. The reason for his prediction is that the world’s gold supply is very limited, only about 1% per year. This is why gold prices will not decrease in the long run. However, Dr. Nghia advised that this may not be a profitable investment channel in the coming time as the gold price fluctuation range is not wide.

Gold prices: SJC gold and plain gold rings surge simultaneously

On the morning of January 31st, the prices of SJC gold and 24k smooth gold rings in Vietnam saw a simultaneous increase compared to the previous day.