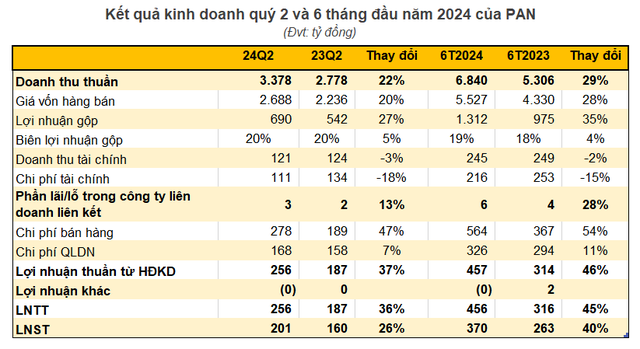

PAN Joint Stock Company (code: PAN) has just announced its Q2 2024 financial statements, with net revenue reaching VND 3,378 billion, a 22% increase compared to the same period last year. After deducting the cost of capital, gross profit was recorded at more than VND 690 billion, up 27% year-on-year, with a stable gross profit margin of 20%.

In addition, financial income decreased slightly by 3% to VND 121 billion; similarly, financial expenses were also reduced by 18% to VND 111 billion. Profit from associates increased slightly by a few hundred million VND compared to Q2 2023, bringing in nearly VND 3 billion.

After deducting other expenses, PAN’s pre-tax profit reached nearly VND 256 billion, a 36% growth compared to the same period.

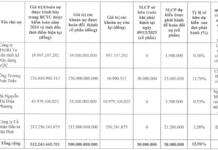

For the first six months of the year, PAN recorded net revenue and pre-tax profit of VND 6,840 billion and VND 456 billion, respectively; corresponding to a 29% and 45% increase compared to the same period last year. Thus, PAN has achieved 46% of its annual revenue plan. The pre-tax profit, after-tax profit, and after-tax profit to parent company reached 43%, 42%, and 39% of the 2024 targets, respectively.

As of June 30, 2024, PAN’s total assets reached VND 23,364 billion, a significant 16% increase compared to the beginning of the year. Of this, cash, cash equivalents, and deposits were valued at VND 1,614 billion, accounting for 7% of total assets. Notably, trading securities were worth more than VND 10,576 billion, an increase of VND 3,900 billion from the beginning of the year, and this item accounted for over 45% of total assets. However, the company did not provide specific explanations for these investments.

On the other side of the balance sheet as of June 30, 2024, PAN’s payables stood at VND 14,218 billion, an increase of VND 3,350 billion from the beginning of the year, mainly due to a significant increase in short-term borrowings of nearly VND 4,000 billion, reaching VND 12,377 billion. The company also had long-term borrowings of VND 406 billion. The company’s equity was VND 8,369 billion, with undistributed profits of nearly VND 1,400 billion.

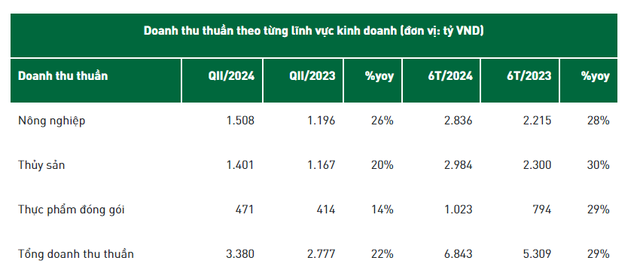

Agriculture Sector Leads in Revenue Growth

In its Q2 2024 business results announcement on July 25, the PAN Group reported that the agriculture sector achieved the highest growth rate, increasing by 26% year-on-year, while the seafood and packaged food sectors grew by 20% and 14%, respectively. In the first six months of the year, these core business sectors all achieved double-digit growth rates, ranging from 28% to 30%.

The momentum in the seafood sector came from the recovery of export orders, along with improved inflation and purchasing power in the US and European markets.

Meanwhile, the growth in agriculture revenue continued to be driven by Vietnam Fumigation Joint Stock Company (HSX: VFG), as it further captured market share in the plant protection chemicals market from its competitors. In the first half of 2023, Syngenta continued its partnership with VFC in introducing new products, thereby expanding the company’s product portfolio and enhancing its competitiveness in the market.

“In the packaged food sector, Bibica (HSX: BBC) focused on the export channel, which positively contributed to its business results, as export sales in the first six months increased by over 50% year-on-year,” PAN stated.

Expectations for a Breakthrough in the Seafood Sector in the Upcoming Peak Seasons of Q3 and Q4

In the second half of 2024, the Group anticipates a continued recovery in the export market, not only in terms of orders but also in pricing. Along with the harvest of self-farmed shrimp in Q3, the Group expects the seafood sector to have many advantages and make a breakthrough in the peak seasons of Q3 and especially Q4 2024.

According to PAN, the packaged food sector, specifically the confectionery segment, will continue to boost exports after initial contracts with customers from South Korea, Japan, and China. Newly launched products will positively contribute to business results for the next phase, making it entirely possible to exceed the 2024 business plan.

The Group also expects the Agriculture sector, including the plant protection chemicals and crop seeds segments, to leverage its market position and the large Q3 and Q4 business seasons to maintain and achieve high growth, similar to the first half of the year (VFC).

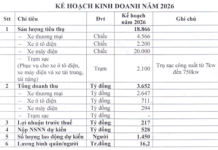

Vietjet Air achieves revenue of 62.5 trillion VND in 2023, cash surplus doubles

Last year, Vietjet safely operated 133,000 flights, transporting 25.3 million passengers (excluding Vietjet Thailand), including over 7.6 million international travelers, marking a remarkable 183% increase compared to 2022.