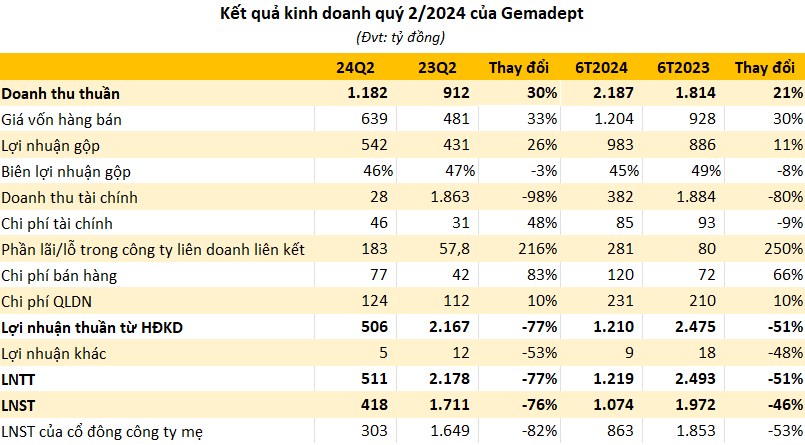

Gemadept Joint Stock Company (GMD) has released its Q2 2024 financial report, revealing impressive growth with a 30% year-on-year surge in net revenue to VND 1,182 billion. Despite a 33% increase in cost of goods sold, the gross profit margin remained strong at 46%, resulting in a 26% rise in gross profit to VND 542 billion compared to Q2 2023.

The company’s financial income for the period stood at VND 28 billion, a significant decrease of 98% from the previous year, mainly due to the recognition of an extraordinary gain from the sale of capital in Nam Hai Dinh Vu Port in Q2 2023.

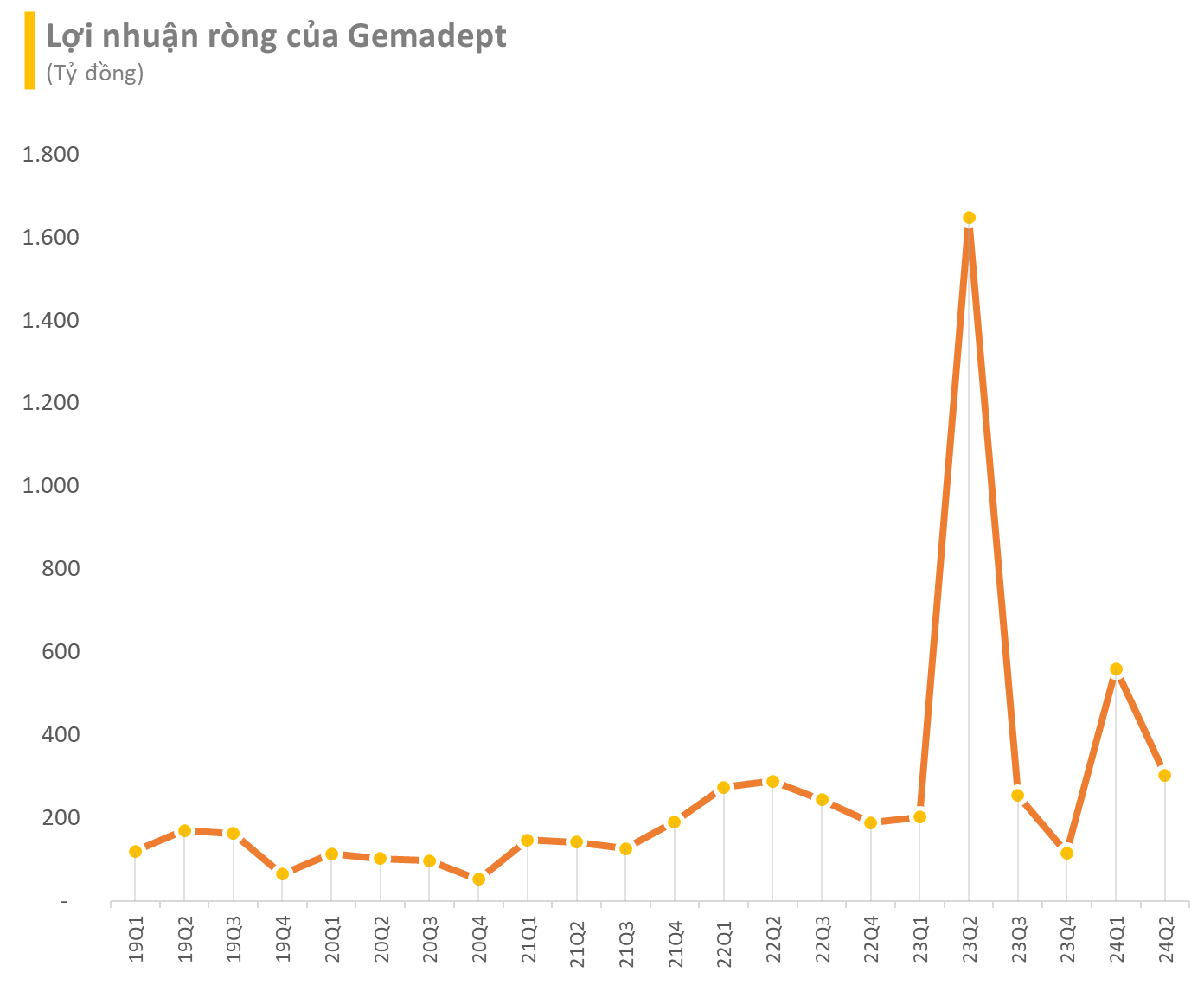

However, profit from joint ventures and associates witnessed a remarkable threefold increase to VND 183 billion. Consequently, Gemadept’s pre-tax profit for Q2 2024 was VND 511 billion, a 77% decline from the same period last year. Net profit reached nearly VND 418 billion, a 76% decrease, with a net profit of VND 303 billion attributable to the parent company’s shareholders.

For the first half of 2024, Gemadept’s net revenue climbed to VND 2,187 billion, a 21% year-on-year growth. Gross profit for the six-month period increased by 11% to VND 983 billion. After accounting for various expenses, GMD’s pre-tax profit stood at VND 1,219 billion, half of the extraordinary profit recorded in the previous year. Net profit amounted to VND 863 billion.

Gemadept is a leading Vietnamese company in the port and logistics sectors, with port operations contributing approximately 70-80% of its revenue and the remaining coming from its logistics business.

In the North, the company owns two ports, Nam Dinh Vu and ICD Nam Hai, while in the South, it operates two container ports, Gemalink – Vietnam’s largest deep-water port capable of accommodating the largest vessels currently in operation – and ICD Phuoc Long. Additionally, Gemadept also has a bulk cargo port in Dung Quat.

For the year 2024, Gemadept has set a record revenue target of VND 4,000 billion, a 4% increase from the previous year. The profit before tax target is more cautious, with a projected decrease of 46% to VND 1,686 billion. With the results achieved in the first two quarters, this “giant” in the port industry has accomplished 72% of its annual profit goal.

In the market, GMD shares closed at VND 79,000 per share on July 30, 2024, reflecting a 15% increase since the beginning of the year. The company’s market capitalization stands at approximately VND 25,000 billion (~USD 1 billion).

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.