Vietnam’s domestic stock market experienced a volatile week, with the VN-Index closing 1.8% lower at 1,242 points. The market received news that total margin debt at the end of Q2 2024 hit a new peak, leading to heightened selling pressure. It wasn’t until the last trading day of the week that selling pressure eased, buying interest recovered, and the VN-Index rebounded.

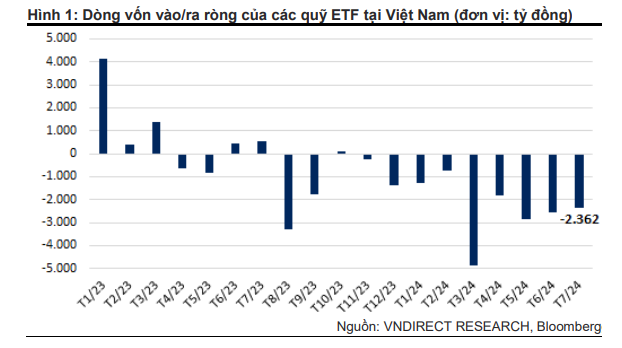

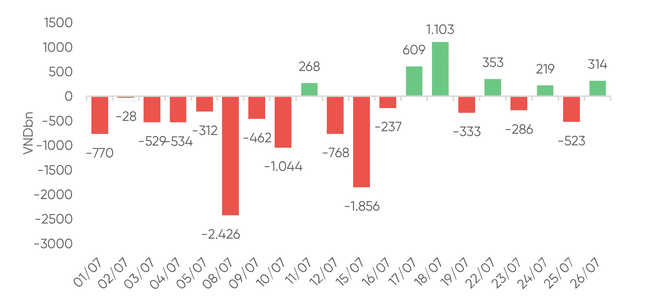

Liquidity declined sharply, with the trading volume on the HoSE falling 18.2% week-on-week. Notably, foreign investors net bought over VND 420 billion on the HoSE, focusing on stocks like KDC, SBT, VNM, and MSN.

This week, several sectors witnessed declines, including securities, with notable drops in SSI, VCI, VIX, BSI, CTS, and MBS, among others.

The banking sector also traded negatively, with LPB, MBB, ACB, and CTG undergoing adjustments. Most insurance stocks had a red week, as BVH, MIG, and BMI saw price declines.

In contrast, telecommunications, oil and gas, and food and beverage stocks traded positively.

The week saw notable movements in foreign capital flows, with net buying returning to the market.

Nguyen Huy Phuong, an expert from Rong Viet Securities (VDSC), opined that the sustained low liquidity indicates that supply has not significantly pressured the market. Despite the positive finish on Friday, there hasn’t been a notable improvement in market sentiment.

Consequently, the market is likely to remain supported and probe for supply. The resistance zone of 1,245-1,250 points is expected to pose challenges in the coming period. Investors are advised to maintain a cautious stance and keep their portfolio allocations at safe levels.

Analysts from VNDirect Securities stated that technically, the VN-Index showed signs of bottoming out and recovering after dipping to the lowest level of 1,218 points last week. Notably, selling pressure has eased, and buying interest has slightly improved in the final trading sessions of the week.

As we move into the next trading week, market trends may become clearer with the release of crucial information. Domestically, investors await monthly macroeconomic data and Q2 earnings reports from listed companies.

On the international front, investors are closely monitoring the Federal Reserve’s (Fed) updates from the late-July meeting regarding the path of interest rate cuts and quantitative tightening. In the base-case scenario, VNDirect expects the benchmark index to consolidate within the 1,230-1,260-point range next week. With valuations becoming more attractive, mid- to long-term investors can start building their portfolios for the next 6-12 months, focusing on sectors with improving business prospects, such as banking, consumer discretionary, and import-export sectors. Short-term traders, however, should await confirmation of the short-term trend and improved market liquidity before increasing their stock holdings.

In the near term, analysts from Saigon-Hanoi Securities (SHS) believe the VN-Index is likely to retest the price range around 1,255 points, which was the highest level in 2023.

On a positive note, for the index to improve its short and medium-term trends, it needs to surpass the resistance zone of 1,255 points. A positive development is the strong market divergence, with many stocks performing well and aiming to break their previous highs following positive Q2 earnings reports. This includes stocks in the industrial real estate, gas distribution, plastics, oil and gas transportation, and oil and gas sectors. Some technology stocks are also showing signs of recovery towards their previous highs.

Regarding the medium-term outlook, SHS maintains a less optimistic view, as the VN-Index failed to hold the price range of 1,245-1,255 points and the uptrend line established since November 2023.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.