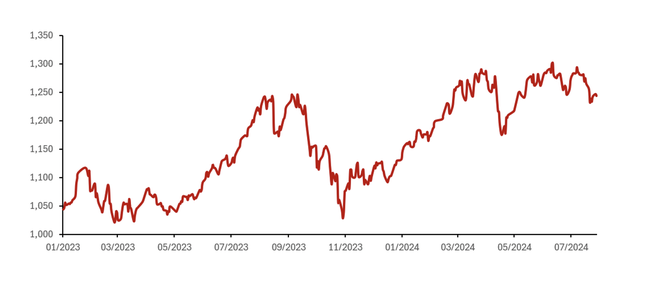

Vietnam’s VN-Index has risen by approximately 10% year-to-date, according to Michael Kokalari, Head of Macroeconomic Analysis and Market Research at VinaCapital. This surge is attributed to expectations of nearly 19% profit growth this year and robust domestic investor demand for equities.

Mr. Kokalari attributes the enthusiasm of domestic investors to persistently low interest rates on deposits in Vietnam, which remain below 5%, coupled with a somewhat stagnant real estate market. These factors have made the stock market and gold attractive investment avenues, prompting domestic investors to funnel their money into these assets.

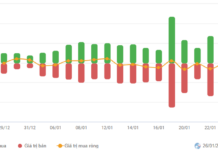

VN-Index Performance from the Start of 2023 to July 2024

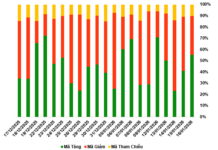

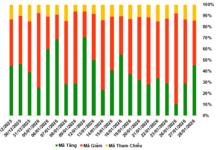

Additionally, individual investors account for the majority of stock market transactions in Vietnam, constituting an average of 90% of daily trading value this year. This robust domestic buying activity has offset the $2.4 billion worth of equities that foreign investors have sold net during the same period.

Explaining the foreign block’s net selling position, Mr. Kokalari cites profit-taking and concerns about the Vietnamese dong’s approximately 4% depreciation since the start of the year as key factors. Some foreign investors are also reportedly “waiting and watching” in light of recent political developments in the country.

Notably, however, up to a quarter of the foreign block’s sell-off has been driven by ETF outflows, including the liquidation of Blackrock iShares’ Frontier ETF in June. In fact, the record-high monthly net selling by foreign investors in June was partly due to the unwinding of this ETF.

Following the foreign block’s sell-off, the ownership ratio of foreign investors in the Vietnamese stock market has dropped to its lowest level in a decade. Nonetheless, the selling streak linked to the liquidation of Blackrock iShares’ Frontier ETF has come to an end.

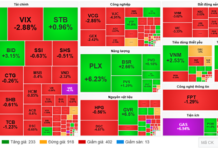

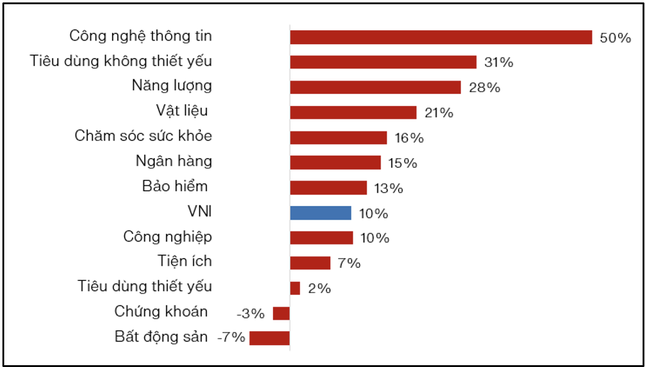

Stock Price Performance by Sector

“Some foreign investors have taken advantage of this situation to bolster their long-term strategic investments in Vietnam,” reveals Mr. Kokalari. He cites Capital Group, Fidelity, and other foreign institutional investors as examples of those who have reportedly increased their stakes in ACB Bank earlier this year.

Sector-wise, VinaCapital anticipates an 80% surge in profits for real estate developers this year. Additionally, non-essential consumer stock prices are expected to rise, with projected profit increases of 55% for companies in this sector in 2024.