Negative psychology dominated the stock market in the first session of January 8, with the market falling sharply and widening losses towards the end of the session. The VN-Index fell nearly 30 points at one point, falling to just above the 1,220 mark under intense selling pressure, causing hundreds of stocks to plummet.

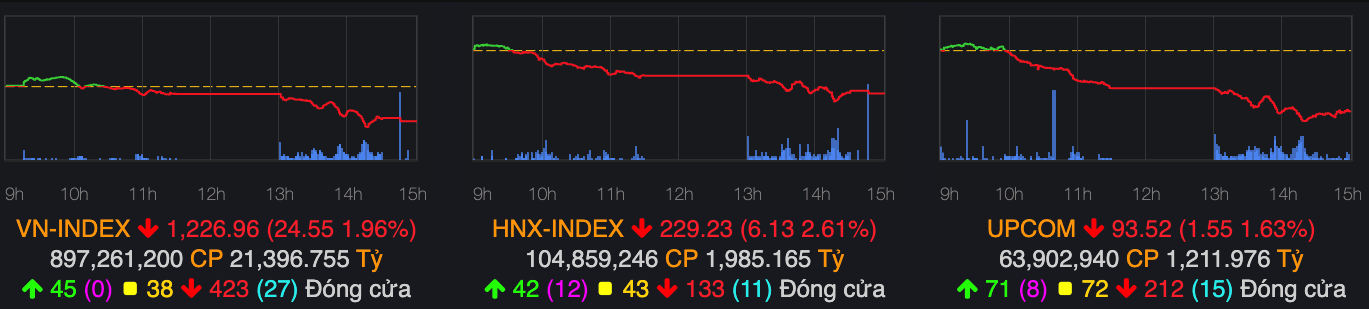

However, buying interest was triggered slightly when the index approached this threshold, helping the market to recover and narrow its losses. The VN-Index closed at 1,226.96 points, a decrease of 24.55 points (-1.96%). Liquidity improved compared to previous sessions, with nearly 900 million shares traded on the HoSE, with a value of nearly VND 21,400 billion.

Overall, there were 768 losing stocks on the market, including 53 stocks that fell to the maximum extent. Notably, the nearly 2% decline made the VN-Index the worst-performing stock index in Asia on August 1.

A series of large-cap stocks were heavily sold off during today’s session. 28 out of 30 codes decreased in the VN30 basket, of which up to 15 codes decreased by more than 2%, while BCM fell by the maximum daily limit of 7%. In contrast, only two bank stocks, VCB and SSB, recorded gains, but their contribution to the market was not significant.

Most groups of stocks in real estate, securities, retail, and technology sank into the red, with LHG, VRE, EVF, LDG, CMG, NHA, DPG, PDR, NTL, CTS, and VDS even hitting the daily limit down with no buyers.

Banking group shareholders also had an unhappy session, with half of the stocks falling by more than 2%, and large-cap stocks such as CTG, BID, MBB, TCB, and VPB all turning red.

Negative developments were also observed in steel stocks, with TLH and SMC falling to their daily limit, and HPG, HSG, and NKG recording significant losses. In the oil and gas group, only PVD, PVS, and PGD managed to stay in positive territory with slight gains, while BSR, OIL, PVB, PVS, and POS declined.

The first session of the month wiped out more than VND 100,400 billion in market capitalization on the HoSE, leaving a value of VND 5,022,955 billion.

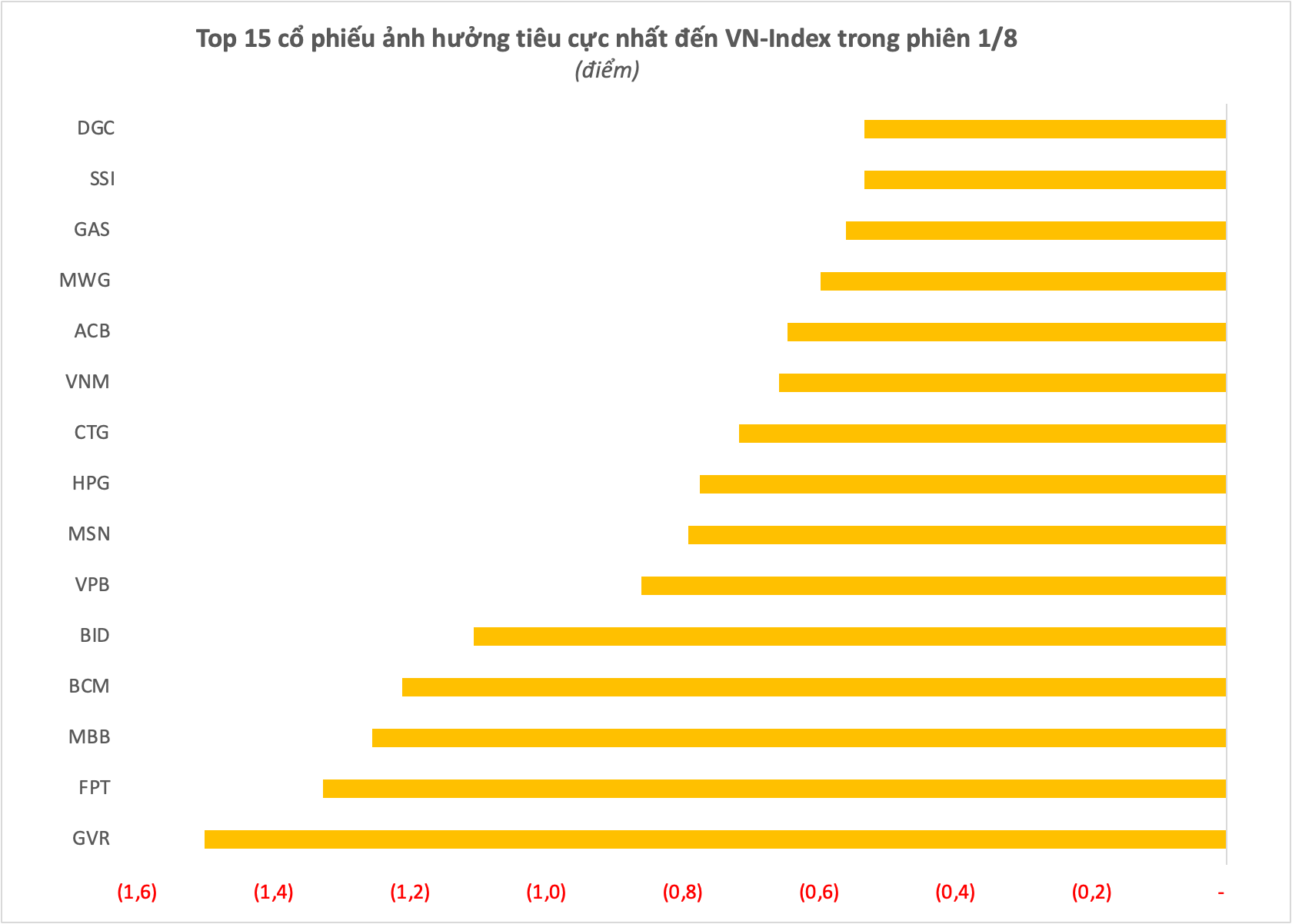

In terms of specific contributions, the blue-chip duo of GVR and FPT were the biggest culprits for the VN-Index’s decline, causing a total loss of 2.8 points in the first session of the week. Specifically, GVR fell 4.8% to VND 31,400 per share, causing the VN-Index to lose nearly 1.5 points, while FPT also corrected sharply by 3% to VND 124,800 per share, resulting in a loss of nearly 1.33 points for the VN-Index.

Additionally, BCM’s fall to its daily limit was a significant drag on the market, taking away 1.2 points from Vietnam’s main stock index.

The top 15 stocks that negatively impacted the VN-Index in this sharp decline also included blue-chips such as MSN, HGP, VNM, MWG, GAS, and SSI. Moreover, several bank stocks, including MBB, BID, and VPB, were also among the stocks that negatively influenced the market today.

The correction of the market’s pillar groups, such as banks, steel, and blue-chips in the manufacturing and technology sectors, caused the indices to plunge. Additionally, the lack of buying interest further weakened the market’s support.

On the other hand, the slight gains in some stocks, including VCB, SSB, PNJ, NAB, and DBC, were not enough to prevent the market from experiencing a significant decline.

In reality, the market has yet to break out, and selling pressure persists whenever the main index approaches resistance levels, making the recovery scenario more challenging. The unclear trend of the VN-Index discourages investors from increasing their investment at this stage.

One bright spot in the session on August 1 came from foreign investors, who net bought in the deep decline. However, the buying value was relatively low and insignificant compared to the persistent net selling in recent times.

Most analysts at securities companies remain relatively cautious about market trends. KB Vietnam Securities Co., Ltd. (KBSV), in its closing comments from the previous session, stated that short-term pressure is likely to create even greater pressure during the recovery process as the short-term downtrend is still being distributed. KBSV recommends that investors prioritize a defensive strategy and reduce their holdings to a low level during the early recovery phase.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.