|

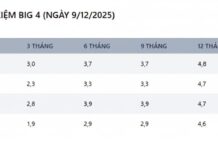

DHG’s Business Targets for Q2 2024

Source: VietstockFinance

|

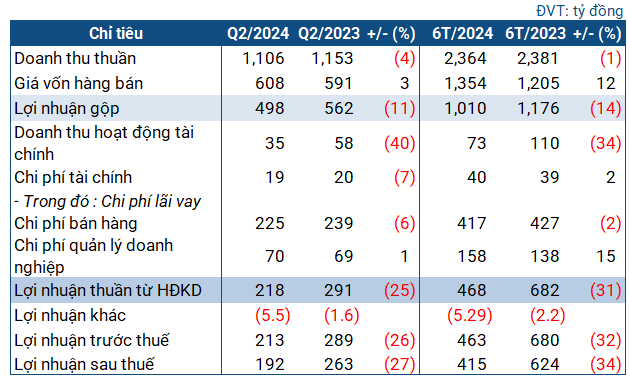

For Q2, DHC reported revenues of over 1,100 billion VND, a slight decrease compared to the same period last year. Conversely, cost of goods sold increased by 3%. After deductions, gross profit stood at 498 billion VND, an 11% decrease year-on-year.

Financial income for the period decreased by 40%, reaching 35 billion VND. Selling expenses remained high at 225 billion VND, despite a 6% decrease. Along with other losses amounting to 5.5 billion VND, DHG’s net income totaled 192 billion VND, a 27% decline.

In their explanation, DHG attributed the drop in performance to a significant reduction in consumer spending as individuals tightened their budgets. Additionally, a sharp decline in deposit interest rates led to a decrease in financial income. The company also commenced operations at its new Betalactam factory in May 2024, resulting in immediate cost recognition and increased expenses for the Nonbetalactam factory to upgrade to EU-GMP standards.

Consequently, DHG’s product costs rose due to proactive adjustments in production volume and inventory levels. The proportion of revenue from other goods (with lower profit margins) also increased compared to the previous year, leading to higher cost of goods sold and squeezing profits.

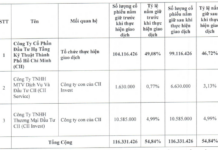

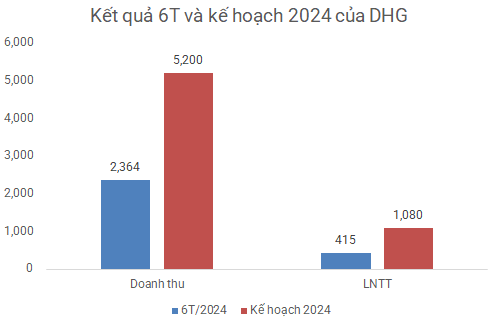

For the first six months, DHG’s revenue slightly decreased to over 2,360 billion VND, while net income reached 415 billion VND, a 34% drop. The company has achieved 46% of its revenue target and over 38% of its full-year net income plan.

Source: VietstockFinance

|

Despite the setbacks and unmet plans, DHG still holds some trump cards. At the Annual General Meeting, the company revealed that their current factories are not operating at full capacity as they are running parallel to the old ones, and there is spare capacity for future expansion. DHG anticipates utilizing 100% of their factory capacity for existing and new products, indicating significant growth potential. Moreover, upgrading to EU-GMP standards enhances their chances of winning bids and lays the foundation for international expansion.

Additionally, their antibiotics business, which competes directly with Imexpharm (HOSE: IMP), has a distinct advantage as IMP specializes in injectable drugs, while DHG’s strength lies in tablet forms.

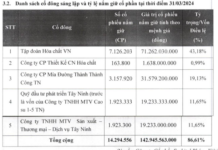

As of the end of June, DHG’s total assets showed a slight increase from the beginning of the year, reaching nearly 6,160 billion VND, with over 4,700 billion VND in short-term assets. Cash and cash equivalents increased by 17%, surpassing 2,700 billion VND. Inventories decreased by 10%, totaling nearly 1,400 billion VND.

Notably, long-term construction in progress decreased significantly to 132 billion VND (from nearly 554 billion VND at the beginning of the year), mainly due to reduced investment in the expansion project for the Pharmaceutical and Packaging factories.

On the liabilities side, short-term debt accounted for the majority of the company’s debt, amounting to 1,800 billion VND, a 54% increase. As the value of short-term debt is lower than the cash balance, there are no concerns about DHG’s ability to meet its financial obligations.

Regarding borrowings, the company had short-term bank loans totaling 811 billion VND, a 42% increase from the beginning of the year.