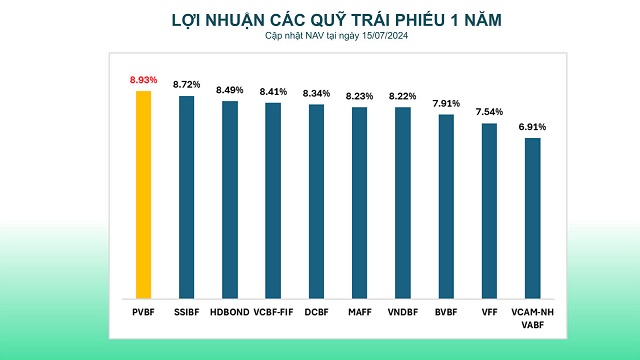

According to statistics from F-market, as of July 15, 2024, PVBF’s one-year profit reached 8.93%/year, and in three years, it achieved an impressive 25%. These outstanding results solidify PVBF’s position in the top-performing open-end bond funds in the market in terms of profitability, demonstrating its stability and sustainable growth trajectory. To maintain this momentum, PVBF has implemented a disciplined investment strategy to generate consistent income, diversifying its investment portfolio and effectively managing risks. The investment decisions are based on expert analysis of macroeconomic conditions, interest rate trends, and company fundamentals, allowing for strategic asset allocation to meet the fund’s objectives.

One-year bond fund returns as of July 15, 2024 – F-market Statistics

|

The PVBF open-end fund focuses on investing in fixed-income assets, including securities and fixed-income investment instruments, bonds issued by companies with strong fundamentals, experienced management, and a long-term vision. The fund’s investments span the financial, essential consumer goods, real estate, and utility sectors. The investment portfolio and strategy cater to investors seeking stable returns, with a medium to long-term investment horizon, accepting short-term market fluctuations.

Mr. Truong Dac Huy, CFA, Portfolio Manager at PVCB Capital, shared his insights: “The PVBF bond fund invests in securities and bonds of companies with solid fundamentals, strong financials, and attractive profit distribution capabilities. By leveraging PVCB Capital’s deep expertise and standardized processes, we identify the best businesses to deliver superior long-term returns to our investors.”

Additionally, investors can benefit from the PVBF – SIP (Systematic Investment Plan) program, which offers a smart way to invest in the PVBF open-end fund. With PVBF-SIP, investors need only commit a fixed amount at regular intervals to work towards their financial goals. PVCB Capital’s bond fund offers the advantage of compound interest, generated from continuous reinvestment of profits, with a minimum investment of just 1,000,000 VND. This program also provides flexibility, allowing investors to stop, increase, or decrease their investment at any time, with the convenience of online transactions through the PVcom Capital application.

PVCB Capital is a trusted investment and asset management company in Vietnam, attracting domestic and foreign investors. In addition to open-end funds, PVCB Capital manages member funds, discretionary accounts, and green growth investment funds, serving a diverse range of clients. With a goal to prosper alongside its customers, PVCB Capital continuously strives to meet the varied needs of all customer segments.

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.