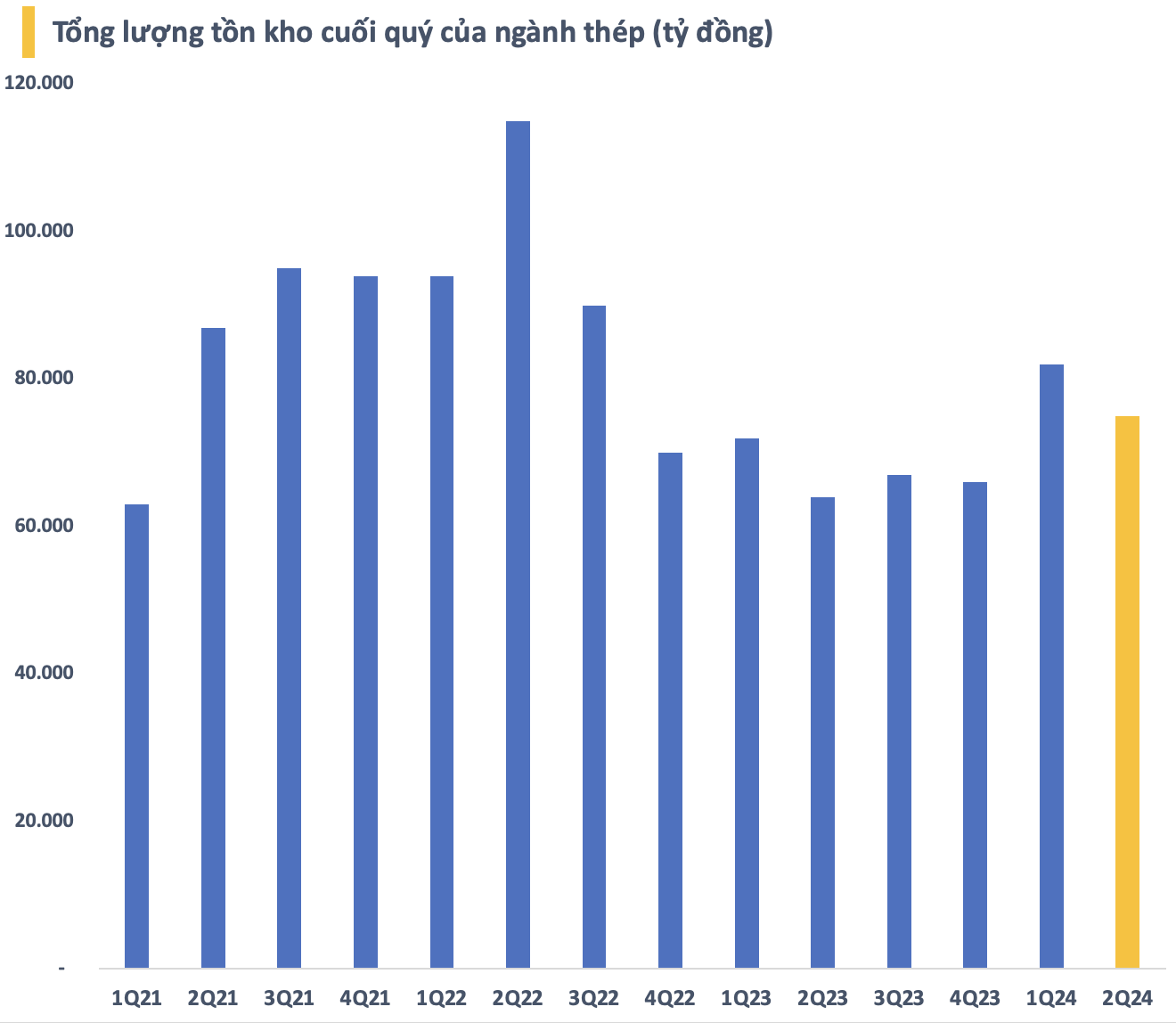

Steel companies have significantly reduced their inventory levels in Q2 2023, following a peak in the previous quarter. As of June 30, the total inventory value of the steel industry on the stock market was estimated at VND 75,000 billion, a decrease of about VND 7,000 billion from the end of Q1. However, this is still the second-highest inventory level in the past seven quarters.

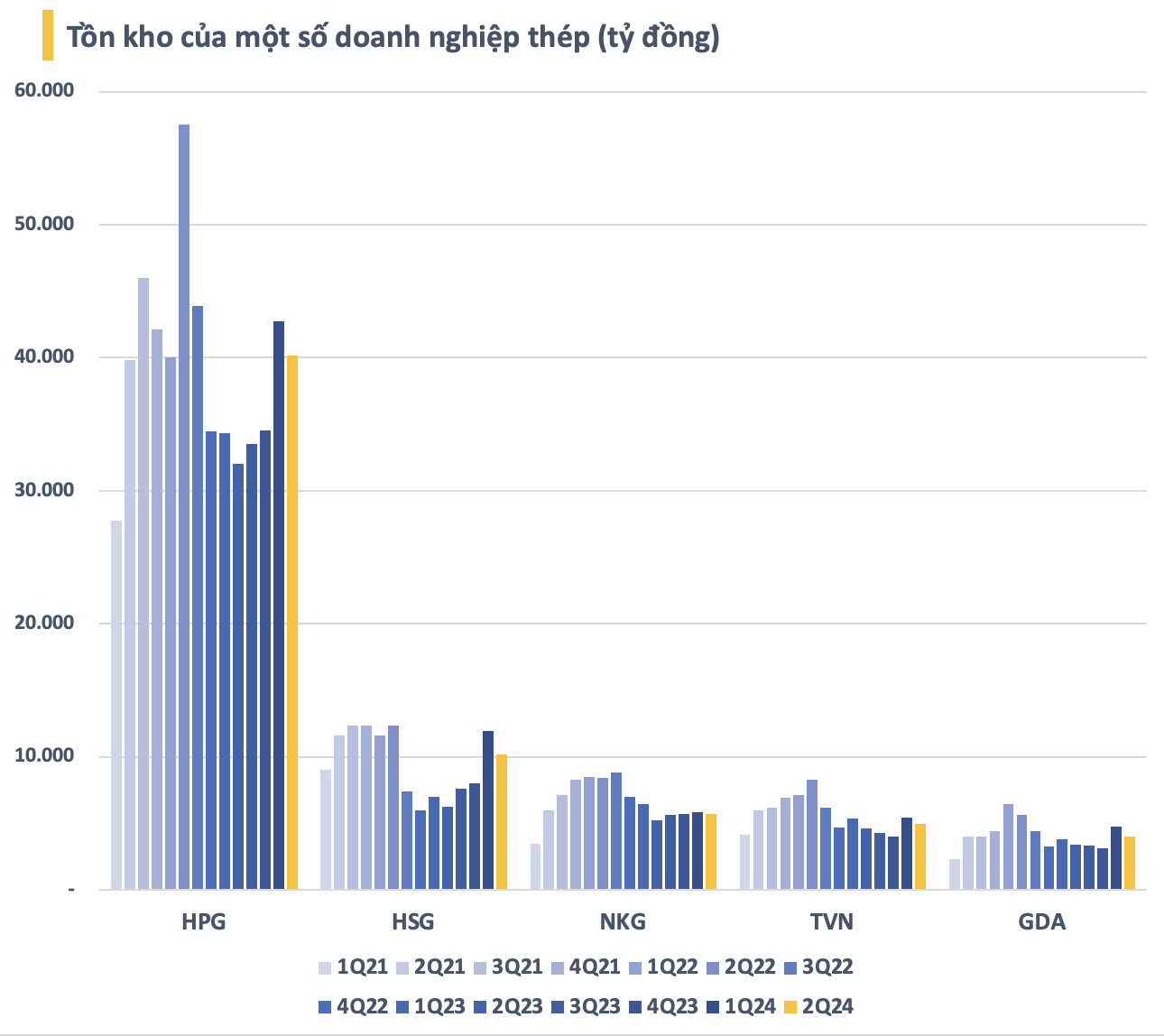

Most steel companies on the stock market reduced their inventory levels in Q2. Hoa Phat and Hoa Sen, in particular, decreased their inventory values by over VND 1,000 billion each compared to the previous quarter. Nonetheless, the current inventory levels of these companies remain significantly higher than the average in 2023.

In terms of structure, five companies, namely Hoa Phat, Hoa Sen, Nam Kim, VNSteel, and Ton Dong A, account for nearly 90% of the total inventory value of the steel industry on the stock market. Among them, Hoa Phat alone accounts for more than 53%, with an inventory value of over VND 40,000 billion as of the end of Q2 (including provisions for inventory devaluation).

The reduction in steel inventory comes amid an unfavorable global steel price trend. After a slight recovery in Q2, steel bar futures prices plummeted and fell below CNY 3,000 per ton for the first time since 2016. This is due to weakening demand and ample supply in China, the world’s top consumer.

The Chinese government implemented new quality standards for steel bars in September last year, prompting manufacturers and traders to flood the market with old stocks. Meanwhile, China’s economic growth in Q2 fell short of expectations, and a sluggish real estate market weakened steel demand.

In a recent report, Vietcap stated that steel exports from China are expected to continue rising in 2024, following a 25% year-on-year increase in the first five months. As the 2023 export volume is similar to the 2014-16 period when China’s cheap steel flooded global markets, concerns about dumping are resurfacing.

With unfavorable steel price trends, the still-high inventory levels despite the recent reduction will put significant pressure on steel companies in the coming months. In Q2, steel companies benefited from a slight recovery in steel prices and their large inventory levels.

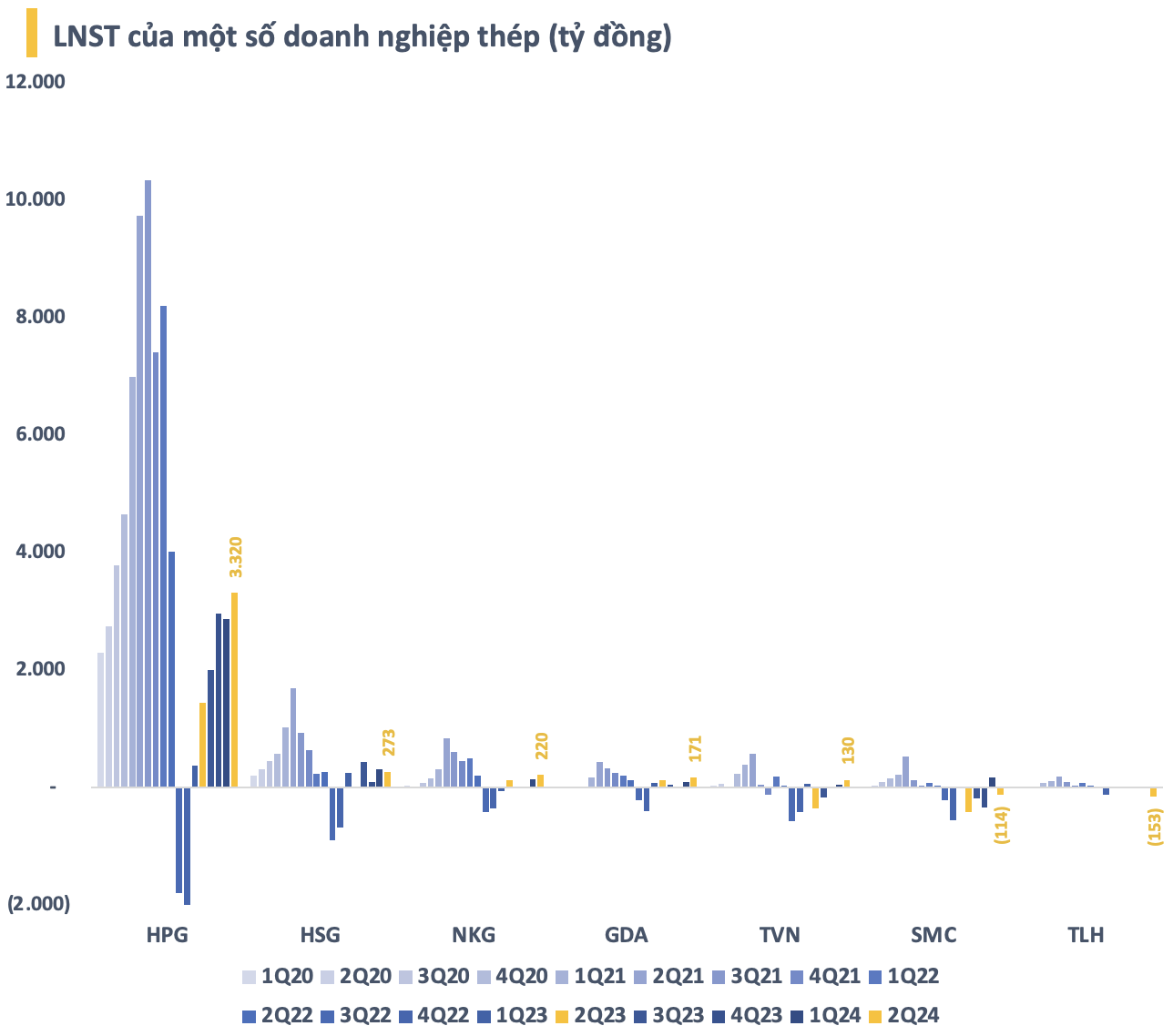

Most steel companies reported a strong recovery in profits in Q2. The after-tax profits of Hoa Phat, Nam Kim, VNSteel, and Ton Dong A reached their highest levels in two years, since Q2 2022. The total profit of the steel industry (excluding Pomina, which has not yet published its financial statements) in Q2 was approximately VND 3,900 billion, with the majority contributed by Hoa Phat.

Anticipating Anti-Dumping Decisions

Vietnam has been a primary destination for China’s increasing steel exports, with an 84% year-on-year increase in the first five months of 2024. This has prompted two domestic HRC manufacturers, Hoa Phat and Formosa, and five galvanized steel manufacturers, including Hoa Sen and Nam Kim, to petition the Ministry of Industry and Trade for anti-dumping investigations.

The investigations focus on imported HRC from China and India and galvanized steel from China and South Korea. However, Vietcap believes that the likelihood of anti-dumping duties on HRC is relatively low due to insufficient domestic supply to meet the demand for HRC in Vietnam. The annual HRC demand in Vietnam ranges from 12 to 14 million tons, far exceeding the domestic supply of 4 to 5 million tons and a maximum production capacity of 8 to 9 million tons.

According to Vietcap, the risk to galvanized steel manufacturers is significant, and the possibility of anti-dumping duties on these products is higher. If sufficient evidence of dumping is found, Vietcap expects temporary anti-dumping measures to be implemented as early as mid-September 2024. Hoa Phat would be the biggest beneficiary if anti-dumping duties are applied to both HRC and galvanized steel. Galvanized steel manufacturers, including Hoa Sen and Nam Kim, would only benefit from duties on galvanized steel.

In a separate development, on July 30, 2024, the Trade Remedies Authority (Ministry of Industry and Trade) received information that the European Commission (EC) had received a valid application requesting an investigation and application of anti-dumping measures on hot-rolled steel coils, whether alloyed or non-alloyed, imported from Vietnam. The list of complained manufacturers includes Hoa Phat and Formosa, the only two companies capable of producing hot-rolled steel coils in Vietnam.

Overall, the anti-dumping decisions, if approved, will have certain impacts on steel prices and the business operations of companies in the industry. At this point, it is challenging to predict the final decisions, and companies will need to prepare for various possible scenarios.

Mr. Ngo Dang Khoa (HSBC): Exchange rate under pressure in Q1, expected to stabilize around 24,400 dong/USD by end of 2024

Prior to the rising trend of the USD, Mr. Ngo Dang Khoa – Director of Foreign Exchange, Capital Markets and Securities Services, HSBC Vietnam, has shared some insights and forecasts regarding the upward momentum of the USD and exchange rates.

![[IR AWARDS] December 2024: A Month of Revealing Insights](https://xe.today/wp-content/uploads/2024/12/Screenshot_01-100x70.png)