The top two rice exporters, Vietnam and Thailand, are vying for a larger market share in the Philippines, where poor harvests have prompted increased imports and reduced tariffs to curb domestic prices.

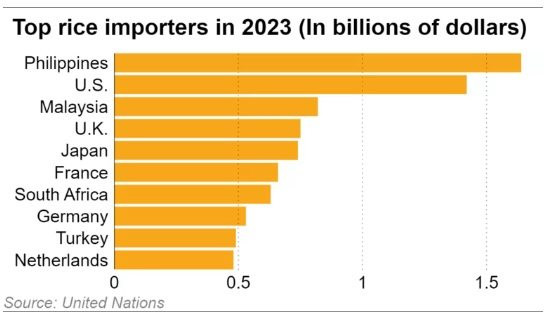

The Philippines, the world’s largest rice importer, is expected to import 4.1 million tons of rice this year, following 3.2 million tons in 2023, according to the US Department of Agriculture (USDA). These figures are significantly higher than the previous average of 2-2.5 million tons.

The El Niño phenomenon has severely impacted Philippine production, driving up food prices and inflation. To alleviate the burden on domestic consumers, Manila reduced rice import tariffs from 35% to 15% in June.

This move has prompted Vietnam and Thailand, the world’s third and second-largest rice exporters, respectively, to engage with Manila to capitalize on the growing demand from the Philippines.

Vietnam’s Agriculture Minister Le Minh Hoan and his Philippine counterpart, Dracisco Tiu Laurel Jr., agreed to enhance rice quality and increase production to meet the growing demands of the Southeast Asian nation.

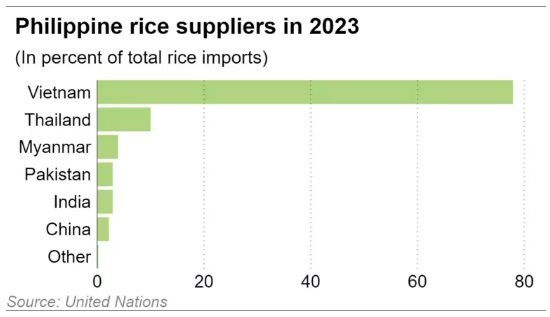

According to the USDA, Vietnam exported 3.2 million tons of rice to the Philippines in the first half of this year, an 11% increase from the same period last year. Vietnam typically supplies about 80% of the Philippines’ annual rice imports.

Meanwhile, senior officials from Thailand’s Ministry of Commerce and the Thai Rice Exporters Association met with the Philippine National Food Authority (NFA) on July 10 to sign a memorandum of understanding for the import of at least 130,000 tons of Thai rice for the remainder of the year.

According to the Thai Rice Exporters Association, Thailand exported 300,000 tons of rice to the Philippines in the first half of the year, a 388% increase from the approximately 62,000 tons exported during the same period last year, and about 100,000 tons for the whole of 2023.

“Thai rice exports to the Philippines have increased significantly in the first half of this year due to supply shortages, forcing the Philippines to rush imports, while the weak baht has allowed Thai exporters to offer competitive prices,” a trader at an international trading company told Nikkei Asia.

The Thai Ministry of Commerce stated last week that Thailand expects to export 8.2 million tons of rice this year, a 6.5% decrease from 2023, although this figure is 9% higher than the initial forecast for this year.

Traders noted that Thailand’s success in boosting exports to the Philippines would serve as a wake-up call for Vietnamese rice. “Although Vietnam is the traditional supplier to the Philippines, this year, Vietnam will have to be more aggressive due to increased competition,” they said.

However, Charoen Laothamatas, president of the Thai Rice Exporters Association, told Nikkei that Thailand would face tougher competition in the second half due to increased supply from Pakistan, and Thai rice may not be able to compete with Vietnam, which has higher rice yields, allowing for more competitive pricing.

According to the USDA, Thailand’s average rice yield is 400-500 kg/rai (1,600 m2), while Vietnam’s is 700-900 kg/rai. As a result, Vietnam’s 25% broken white rice is quoted at $520 per ton, about $30 lower than the equivalent Thai rice. This variety is also typically preferred by the Philippines.

“Price is the key factor in the Philippine market,” Charoen said. “If you can offer a lower price, you will win.”

Charoen also added that the global rice industry is keeping a close eye on India’s production, which is expected to increase this year. This suggests that India’s ban on white rice exports may end, leading to a greater influx of the grain into the global market. A price war in the second half of the year is also a possibility.

Source: Nikkei

Market Update on February 10th: Oil prices rise, gold falls, India’s rice reaches record high, cocoa hits 9th consecutive record

The closing session of 9/02 trading witnessed a surge in oil prices due to ongoing tensions in the Middle East. On the other hand, gold and copper experienced a decline, while Indian rice prices reached a record high. Additionally, cocoa prices achieved their 9th consecutive record-breaking session.

How to ensure Vietnamese rice always has the upper hand?

In 2023, Vietnam’s rice exports exceeded 8 million tons, with a total value of approximately 4.8 billion USD – the highest figure to date.