In a recent development, the State Bank of Vietnam has approved GELEX’s acquisition of Eximbank shares through matching and/or agreement transactions on the Ho Chi Minh City Stock Exchange’s trading system in 2024.

As a result, GELEX is poised to become the largest institutional shareholder of the bank, with an expected ownership stake of up to 10% of its charter capital. This percentage also represents the maximum ownership allowed for a single institutional shareholder in a credit institution under the Law on Credit Institutions of 2024.

Prior to this, on July 1, 2024, Eximbank disclosed a list of shareholders owning over 1%. At that time, GELEX already held 4.9% of the bank’s shares.

GELEX poised to become Eximbank’s largest shareholder.

|

Established in 1990, GELEX Group operates in two core sectors: Electrical Equipment Manufacturing and Infrastructure & Industrial Parks. It boasts a strong ecosystem of brands, including renowned names such as CADIVI, THIBIDI, and Viglacera.

Currently, GELEX has over 50 member and affiliated companies, with total assets reaching VND 52,442 billion as of June 30, 2024.

For the first half of the year, GELEX recorded a consolidated pre-tax profit of VND 1,770 billion, achieving 92.1% of its full-year profit target. This impressive performance was largely driven by financial profits from the completion of 3 out of 4 renewable energy projects for partner Sembcorp.

Eximbank, on the other hand, has been witnessing a positive trajectory in its business operations. In the first six months of the year, the bank posted a pre-tax profit of VND 1,475 billion, completing 28% of its annual plan. Moreover, its profit trend has been improving quarter-on-quarter.

According to a recent report by MBS Securities, Eximbank’s credit growth in the first five months of the year reached 5.3% year-to-date, significantly outpacing the industry average of 2.4%.

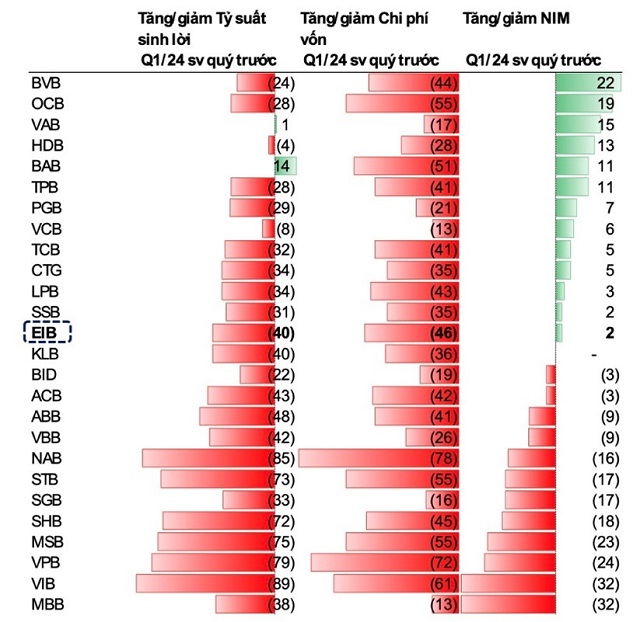

Eximbank is among the banks with the most improved NIM compared to 2023. (Source: MBS Securities)

|

As of June 30, 2024, Eximbank’s total assets stood at VND 211,999 billion, reflecting a 5.3% increase compared to the end of 2023.

HAGL’s Billion Dollar “Weapon”

Eximbank might not be the only bank that will waive the interest on HAGL’s loans in the near future.