Joint Stock Company Investment Group IPA (code: IPA, on HNX) has just announced the Board of Directors’ decision to issue private placement of shares in the second phase.

Accordingly, IPA will issue bonds with the code IPAH2429003 with a maximum value of VND 1,096 billion, and the face value of the bonds is VND 100 million each.

These are non-convertible bonds, without warrants, unsecured, and not a company’s subordinated debt. The bond term is 5 years from the issuance date, with a fixed interest rate of 9.5%/year. The latest issuance date is August 15, 2024.

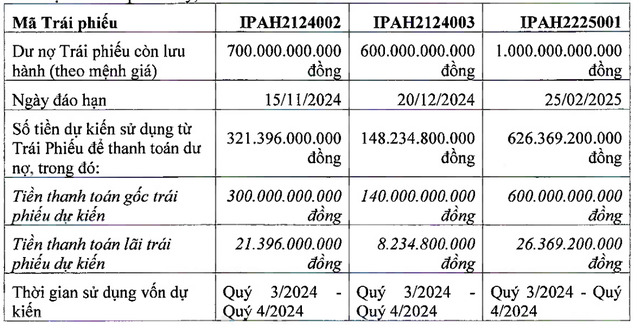

The purpose of the bond issuance, as stated by IPA, is to restructure the bond debts for the codes IPAH2124002, IPAH2124003, and IPAH2225001 currently in circulation.

Source: IPA

The issuance of this bond is part of the roadmap to issue a maximum of 5 bond phases in 2024 that Investment IPA has approved to raise a maximum of VND 3,210 billion.

In the first phase, on June 27, 2024, IPA successfully issued bonds with the code IPAH2429002, with a value of VND 735 billion.

IPA’s subsidiary, North Ha Energy Joint Stock Company, also raised VND 325 billion after issuing bonds with the code BHBCH2429001. Both bond batches have a term of 5 years, with a total issuance value of VND 1,060 billion.

In addition to the recently issued IPAH2429002, IPA currently has four other bond batches in circulation, with a total value of VND 2,717 billion. Among these, the code IPAH2429001, worth VND 317 billion, was issued by the company in early June to repay debts to Can Tho Investment and Development Joint Stock Company.

As of the second quarter of 2024, IPA’s total short-term and long-term debt amounted to VND 4,137 billion, equivalent to 47.5% of total capital sources. Of this, bond debt stood at VND 4,077 billion, with the remainder being bank loans and other personal loans.

In terms of business performance, in the first half of 2024, IPA recorded net revenue of VND 249 billion, up 120% over the same period. Gross profit also increased significantly from VND 49 billion to VND 114 billion.

Notably, the company’s share of profits in joint ventures and associates reached VND 260 billion. As a result, IPA’s after-tax profit reached nearly VND 193 billion, a significant increase compared to the same period last year when it made a profit of VND 17 billion.

For the full year 2024, IPA sets a target of VND 1,080 billion in total revenue and VND 425 billion in pre-tax profit, down 5.7% and up 23.7%, respectively, from the previous year. With a pre-tax profit of VND 209 billion achieved in the first half of 2024, IPA has completed 49% of its profit target and 23% of its revenue plan.