Since the mid-April phase to the present, deposit interest rates at most banks have shown signs of growth, with an increase of 0.5% – 1%. With the momentum of interest rate hikes, bank deposits have also seen more positive growth. As of the first six months, total deposits at 29 banks that have published financial statements reached nearly VND 12,200 trillion, an increase of VND 473,000 billion, or 4%, compared to the end of 2023.

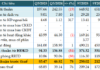

In terms of scale, the group of state-owned banks still leads the entire system with a total deposit balance of more than VND 6,400 trillion. Among them, Agribank continues to hold the “deposit champion” position with VND 1,830 trillion, up 0.9% from last year.

Agribank has the largest deposit balance in the system.

BIDV ranked second with total deposits of VND 1,810 trillion, an increase of more than VND 102,200 billion from the beginning of the year, equivalent to a 6% increase – the highest increase in the Big 4 group. This is followed by Vietinbank with a balance of VND 1,470 trillion, up 4%.

The group of four state-owned banks has a significant gap in deposit size compared to private banks. Meanwhile, these banks are still maintaining deposit interest rates at the lowest level in the system, at only about 2.9% for short-term and 4.7% for terms of 18 to 36 months or more.

In the group of private banks, MB ranked fifth with more than VND 618,618 billion in deposits, up 9% from the beginning of the year. This is the highest growth rate in the top 10 banks with the largest deposit amounts in the system.

Sacombank followed with VND 549,184 billion, up 7.5% from the beginning of the year, equivalent to an increase of about VND 38,440 billion.

Three banks, including ACB, Techcombank, and VPBank, all grew by about 6%. ACB and Techcombank respectively reached VND 515,696 billion and VND 481,806 billion in deposits, up 6% compared to the balance at the end of 2023.

VPBank recorded a deposit growth rate of 6.6%, reaching VND 471,349 billion. Thus, it created a gap of more than VND 12,000 billion compared to the 10th-ranked SHB bank, which reached VND 459,296 billion.

Outside the top 10, four banks achieved double-digit growth in deposits: LPBank, up 21.4%, equivalent to VND 50,700 billion; MSB increased by 14.7%, equivalent to VND 19,400 billion; OCB increased by 12.4%, equivalent to VND 15,600 billion; and NCB increased by 11.1%, equivalent to VND 8,600 billion.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.