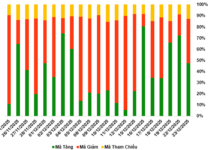

According to statistics from VietstockFinance, during the month of August over the past three consecutive years (2021-2023), the HOSE witnessed 77 stocks that consistently increased during this period. This included leading stocks such as: DGC, DCM, and DPM from the chemicals and fertilizers group; HVN from the aviation industry; DGW and MWG from the retail sector; GMD from transportation; real estate stocks like NVL, CII, and DXG; VNM from the food industry; and HSG from the galvanizing industry, among others.

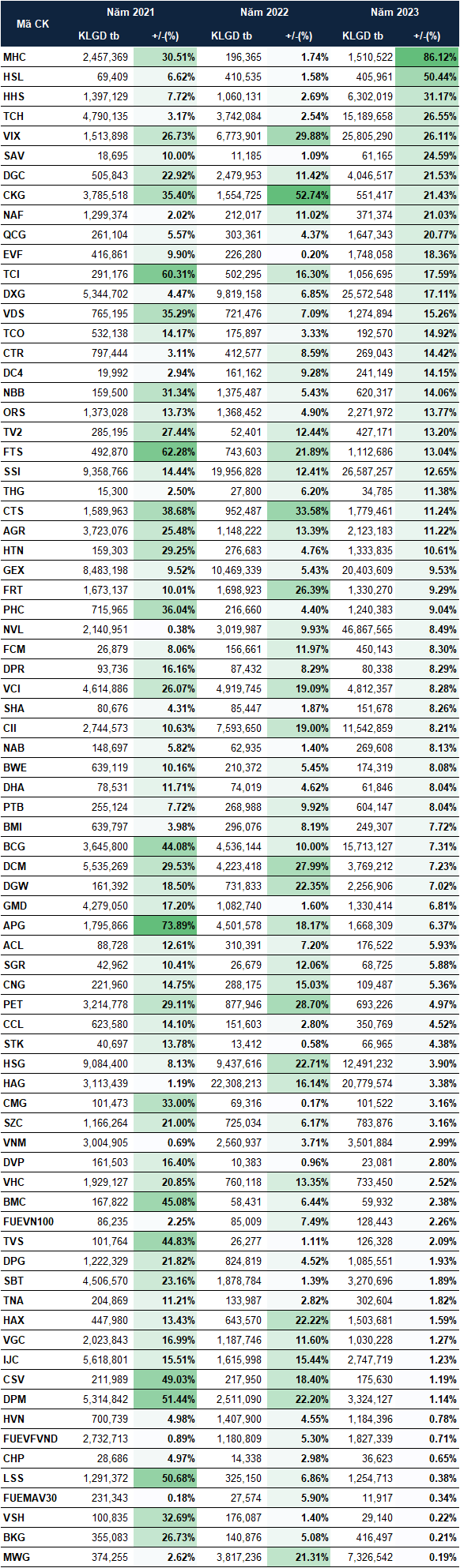

On the contrary, only four stocks experienced consistent declines during this month: KMR, RDP, VIB, and KDH.

|

Stocks on the HOSE that increased in price every August from 2021-2023

Source: VietstockFinance

|

|

Stocks on the HOSE that decreased in price every August from 2021-2023

Source: VietstockFinance

|

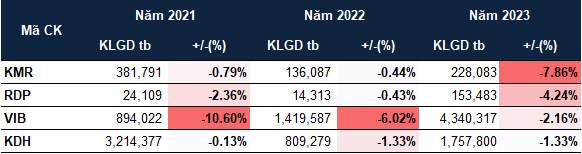

A similar trend was observed on the HNX exchange, with a dominant performance by the consistently rising group, comprising 28 stocks. Notable stocks from the exchange were part of this group, including: CEO, SHS, MBS, VCS, and IDC, to name a few. In contrast, only one stock consistently declined during this period, namely SD9.

|

Stocks on the HNX that increased/decreased in price every August from 2021-2023

Source: VietstockFinance

|

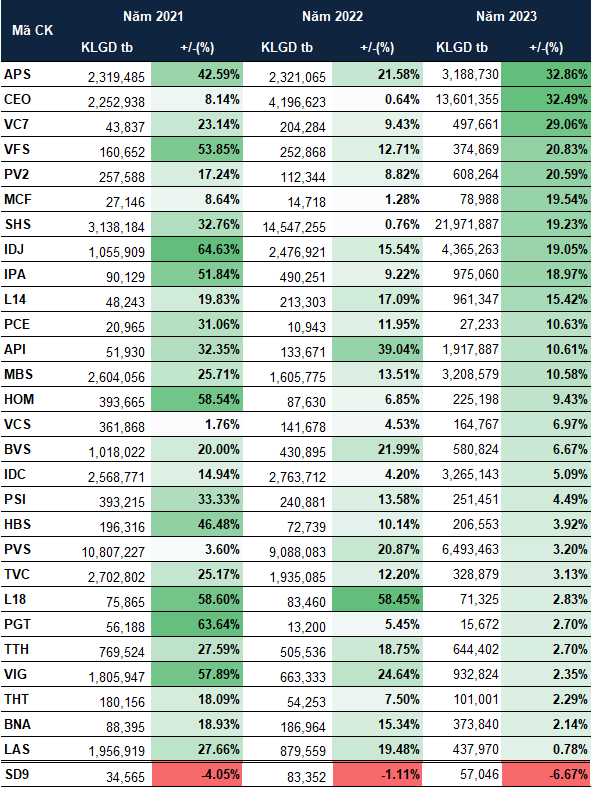

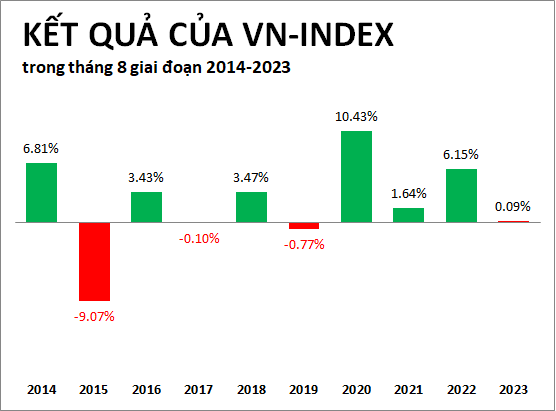

Additionally, when considering a broader timeframe of the past ten years (2014-2023), the VN-Index has ended in positive territory during August for seven out of those ten years. The last time the index turned red during this month was in 2019.

Source: VietstockFinance

|

With the recent conclusion of the second-quarter financial statement announcements by listed companies, investors now have additional insights into the performance of various sectors and specific companies of interest.

During the Livestream Radar Investment session held on July 31st, Mr. Cao Minh Hoang, Hanoi Senior Client Director at DNSE Securities Joint Stock Company, shared his perspective. He suggested that at the current valuation levels, investors can consider deploying capital but should focus on companies with a minimum growth rate of 20% annually. Alternatively, investors could wait for lower valuations before purchasing, but this approach may require a longer time horizon. Therefore, a potential strategy could involve dividing investments into two parts: one for immediate purchases of high-quality companies and the other for buying opportunities when valuations become more attractive. However, this waiting period could extend to two to four years.

At present, investors may consider sectors such as banking, given their positive growth prospects.

Secondly, the port and maritime transportation sector could be of interest. When the economic performance of major economies is relatively aligned, geopolitical developments can lead to disruptions in supply, causing freight rates to surge.

Thirdly, the public investment sector is worth considering, along with the oil and gas industry, which is expected to have a substantial workload over the next three to four years. However, investing in this sector requires a long-term perspective, and the results may take one to three years to materialize.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.