The Trials and Tribulations of the Cuong “Do la” Family Dynasty

The unfortunate events at the Joint Stock Company Quoc Cuong Gia Lai, abbreviated as Quoc Cuong Gia Lai, have not only brought pain to the family of Ms. Nguyen Thi Nhu Loan but also negatively impacted thousands of investors holding QCG stocks.

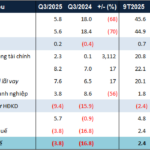

Assuming that a shareholder bought QCG stocks at the highest price since the beginning of the year, which was 18,000 VND per share in May, then by now, in less than three months, two-thirds of their asset value has been wiped out. It seemed that the selling frenzy of QCG stocks had stopped with numerous sessions of “floor-lying” in July, but as August began, this “ghost” seemed to continue to haunt investors.

QCG stock creates a “Christmas tree” chart (Picture: TradingView)

Today’s trading session (August 5th), the QCG code continued to fall dramatically, from 6,620 VND to 6,160 VND per share, shattering the faint hopes of thousands of shareholders who were expecting a vibrant and enthusiastic trading week. This also shows that the election of Mr. Nguyen Quoc Cuong (commonly known as Cuong “Do la”), the son of Ms. Nguyen Thi Nhu Loan, as the Director of Quoc Cuong Gia Lai when his mother met with an accident, was not enough to restore investor confidence.

In the eyes of investors, this enterprise lacks expectations and opportunities to return to the “race,” especially since the second quarter was the quarter in which Quoc Cuong Gia Lai suffered the heaviest loss in its operating history.

What about other enterprises within the ecosystem of this wealthy and famous family, known for their extravagant lifestyle, which is considered one of the most luxurious in the country? Will they be affected by similar bad luck?

For example, C-Holdings Joint Stock Company, considered the separate empire of tycoon Cuong “Do la,” where he is expected to create resounding success as an entrepreneur with a passion for cars, which is considered the number one in Vietnam.

C-Sky View is the only project that C-Holdings Joint Stock Company of Mr. Nguyen Quoc Cuong has completed and handed over to customers (Illustrative image)

It is known that Mr. Nguyen Quoc Cuong has been taking better care of C-Holdings since 2018 when he had time due to his departure from the leadership of Quoc Cuong Gia Lai. C-Holdings is in charge of focusing on developing real estate projects in Binh Duong province, with all activities separate and having their own path and development strategy, independent of Quoc Cuong Gia Lai.

After six years, C-Holdings has succeeded in bringing quality products to the market at the C-Sky View project (completed and handed over, with red books granted to customers), the The Maison project (formerly known as C-River View, being completed and ready for handover), and, in the future, the The Felix project (just granted a construction permit in August). Mr. Nguyen Quoc Cuong proudly stated that C-Holdings has built trust and goodwill with customers, so the following development steps are quite favorable, without many difficulties and challenges.

Mr. Cuong “Do la” also shared that C-Holdings differs from Quoc Cuong Gia Lai in that he has not managed Quoc Cuong Gia Lai for many years, and he is not a core member, so now he needs time to research, grasp, and build and organize strategic planning for the following period to revive the enterprise.

Therefore, Mr. Cuong “Do la” emphasized that the two enterprises operate independently, and his management at Quoc Cuong Gia Lai will not affect the development of C-Holdings in the future.

C-Holdings’ Obstacles

However, in reality, C-Holdings of Mr. Cuong “Do la” also has some unspeakable troubles, somewhat contrasting the optimism of the tycoon passionate about supercars. The situation of losses leading to shareholders losing capital is a typical example.

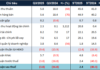

Documents from the Cong Thuong Newspaper show that from its establishment to 2021, C-Holdings just earned a limited revenue of about 2.5 billion VND, compared to a charter capital of 850 billion VND, which is not worth mentioning. However, for a project-based enterprise like C-Holdings, freezing revenue is understandable when the project has not been completed and handed over to customers.

In 2022, thanks to the recognition of revenue from the sale of houses in the C-Sky View project, C-Holdings brought in 1,950 billion VND, creating a large cash flow to sustain and restore the development of the investor. But from there, a challenging problem arose: C-Holdings did not make much profit from this project, with a reported after-tax profit of only 11 billion VND, while reporting accumulated losses of nearly 60 billion VND.

In 2023, the revenue from the C-Sky View project dried up, and C-Holdings’ revenue decreased significantly to 475 billion VND. In total, for the two years, the key project that brought in about 2,430 billion VND to the investor did not make any profit, and instead, 3.3 billion VND had to be deducted to compensate for the expensive costs.

Thus, at the end of last year, C-Holdings was carrying accumulated losses of 53 billion VND. It is unclear how the management will balance revenue and expenses, but with the numbers they submitted to the authorities, it is likely that the revenue recognition from The Maison will also be difficult to create a breakthrough and may even lead to losses, as was the case with the C-Sky View project.

Amidst the context of shareholders losing their capital contributions to the enterprise, the debt of 1,210 billion VND to be paid to customers, partners, and banks is also a challenge for C-Holdings. This debt figure is one and a half times higher than the equity, and it is expected to continue to increase to serve the investment and development strategy of the two critical projects, The Maison and The Felix, as mentioned above.

Hopefully, major “creditors” such as VPBank will accompany, support, and actively provide credit to C-Holdings, in particular, or entrepreneur Nguyen Quoc Cuong, in general, in the coming time, similar to how they did at the The Maison and C-Sky View projects through the form of project mortgage.

C-Holdings Joint Stock Company was established on September 25, 2018, initially named Chanh Nghia Quoc Cuong Joint Stock Company. At first, Ms. Nguyen Thi Nhu Loan was the legal representative and held the position of Chairman of the Board of Directors and Director.

The founding capital of the enterprise reached 1,169 billion VND, in which Quoc Cuong Gia Lai Joint Stock Company was the parent company, holding up to 74.68% of the shares, followed by two individuals, Vuong Kim Soa and Ly Kim Hoa.

At the beginning of 2019, Mr. Nguyen Quoc Cuong officially took over C-Holdings and became the legal representative. However, this was also when the registered charter capital decreased from 1,169 billion VND to 428 billion VND before increasing to 708 billion VND in March 2019, with 576 billion VND contributed in the form of land use rights value, equivalent to 81.4%.

In 2020, Quoc Cuong Gia Lai transferred all its capital in C-Holdings to its partner. The list of shareholders is not disclosed, but it is known that in August of the same year, C-Holdings’ capital was raised to 850 billion VND and has been maintained to the present.

A document reveals that the three members of the Board of Directors of C-Holdings include Chairman Nguyen Quoc Cuong, Ms. Dam Thu Trang (Mr. Cuong’s wife), and Mr. Hua Ha Phuong. Mr. Cuong and Mr. Phuong share a passion for supercars and are two famous names in the southern region.