Illustrative image

Joint Stock Commercial Bank of Vietnam, VietinBank (VietinBank – Code: CTG), has just announced the list of shareholders owning over 1% of the bank’s charter capital based on information provided by shareholders.

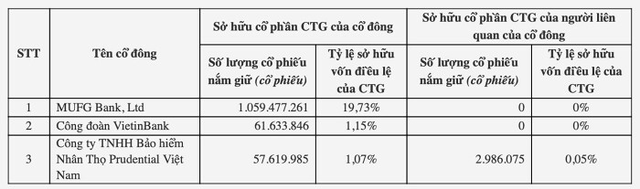

In the list announced by VietinBank, there are only three institutional shareholders: MUFG Bank, VietinBank Trade Union, and Prudential Vietnam Assurance Private Limited Company.

These shareholders hold a total of over 1,178 billion shares, equivalent to 21.95% of the bank’s charter capital.

Source: VietinBank

Specifically, MUFG Bank, Ltd., VietinBank’s strategic shareholder, holds 1,059 billion shares, equivalent to 19.73% of the bank’s charter capital.

VietinBank Trade Union holds over 61.6 million shares, with a capital ownership ratio of 1.15%.

Notably, Prudential Vietnam Assurance Private Limited Company reported owning 57.6 million shares, or 1.07% of VietinBank’s charter capital. Related parties of Prudential Insurance also own nearly 3 million bank shares, equivalent to 0.05%.

This is the third time this insurance company has reported owning over 1% of the shares in a bank. Previously, Prudential Vietnam Assurance Private Limited Company reported holding nearly 69.5 million ACB shares, equivalent to 1.555% of the bank’s charter capital. In addition, related parties of Prudential Insurance also owned nearly 351,000 ACB shares, or 0.008%.

At MB, Prudential Vietnam reported holding a total of nearly 65.7 million shares, equivalent to 1.24% of MB’s charter capital. In addition, related parties of Prudential Insurance also own nearly 1.5 million MBB shares, or 0.02%.

Based on the closing price on August 6, the value of VietinBank, ACB, and MB shares held by Prudential Vietnam is over VND 4,900 billion.

The above list does not mention the largest shareholder of VietinBank, which is the State Bank of Vietnam, with an ownership ratio of 64.46% of the charter capital.

Revealing the Income of Bank Employees

In 2023, amidst the challenging times for many businesses with labor cuts and reduced salaries, the banking sector continues to maintain a strong income level. Among them, Techcombank stands out with the highest average income of 540 million VND per person per year. Few banks have reduced salaries and benefits for their employees.