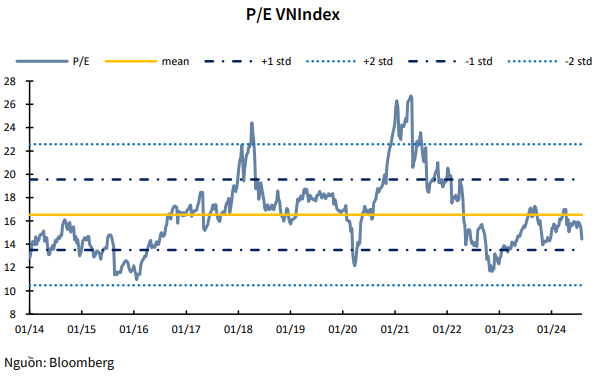

In terms of valuation, the current P/E ratio of the VN-Index is approximately 14 times (according to Bloomberg data), which is significantly lower than the two-year average of 14.9. Looking at the mid- to long-term picture, KBSV Research believes that maintaining low-interest rates will be a key supportive factor for the recovery of domestic production, industry, investment, and consumption.

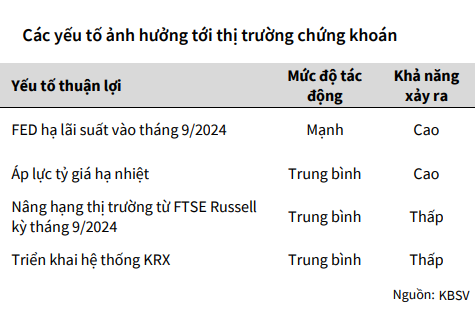

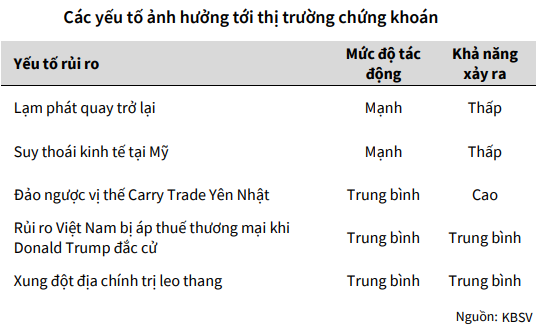

However, in the short term, there is a potential risk of negative market reaction to concerns about escalating conflicts in the Middle East, recession risks in the US, and the state of reversal of the Japanese Yen Carry trade position.

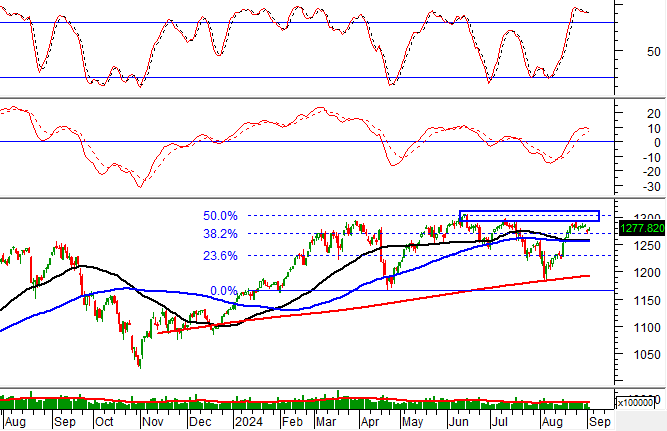

From a technical perspective, most technical momentum indicators suggest consolidating signals for the market’s downward trend. Combined with the current fundamental factors, KBSV Research leans towards the scenario (70% probability) that the VN-Index will continue its downward momentum and may start to recover when the index retreats to the near-term support area of around 1,150 (+/-10).

In a negative scenario, if the index continues to decline and breaks below this support area (30% probability), the VN-Index will lose its mid-term upward trend and may enter a sideways phase on a monthly chart, forming a triangular pattern from the peak at the beginning of 2022 to the deeper support area around 1,080 (+/-15) before having a chance to recover.

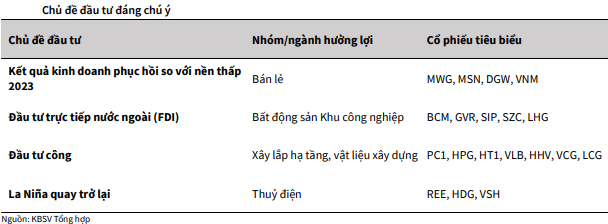

Regarding investment themes, KBSV believes that the short-term market correction presents a good opportunity for investors who have not yet taken a position or for those who wish to increase their existing holdings.

The analysis group removes the sea transport sector from the list of investment themes with potential to drive stock prices further, as many businesses in this sector have already experienced a rapid rise in stock prices within a short period.

The remaining investment themes for the latter part of 2024 include business recovery, FDI, public investment, and the approaching La Nina phase, which are expected to continue offering positive prospects for the corresponding stock groups.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.