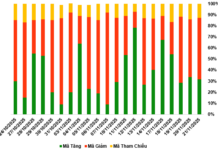

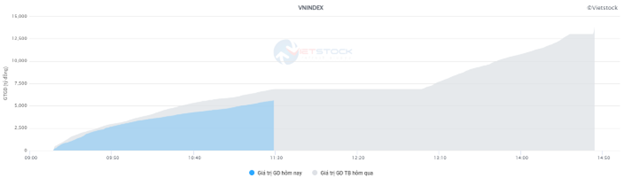

Liquidity in the market decreased compared to the previous trading session, with the VN-Index matching volume reaching over 510 million shares, equivalent to a value of more than VND 11.6 trillion; HNX-Index reached over 38.7 million shares, equivalent to a value of more than VND 738 billion.

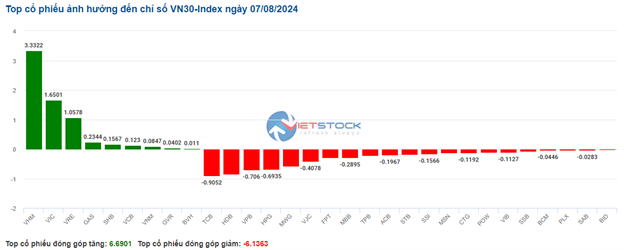

The VN-Index opened the afternoon session with the return of buyers, helping the index quickly surpass the reference level and close with a positive green color. In terms of impact, VHM, GVR, GAS and VIC were the codes that had the most positive impact on the VN-Index, with an increase of more than 6.2 points. On the contrary, TCB, VPB, BID and CTG were the codes that had the most negative impact, taking away more than 2.3 points from the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on August 07, 2024 |

The HNX-Index also had a positive performance, with the index being positively impacted by the codes NTP (+6.84%), DNP (+9.5%), DHT (+2.81%), PVI (+1.17%),…

|

Source: VietstockFinance

|

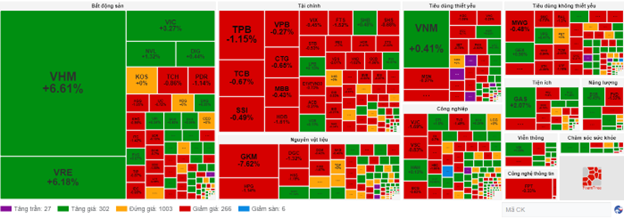

The real estate industry was the group with the strongest increase, up 2.53%, mainly from the codes VHM (+6.9%), VRE (+5.88%), VIC (+2.54%) and DIG (+0.88%). This was followed by the energy industry and the information technology industry, with increases of 2.28% and 1.03%, respectively. On the contrary, the financial industry had the strongest decrease in the market, down -0.39%, mainly from the code TCB (-2.24%), TPB (-1.73%), VPB (-1.91%) and MBB (-0.21%).

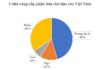

In terms of foreign trading, foreigners continued to sell a net of more than VND 1,396 billion on the HOSE exchange, focusing on the codes VHM (VND 719.67 billion), VPB (VND 116.89 billion), HPG (VND 111.54 billion) and TPB (VND 97.08 billion). On the HNX exchange, foreigners net sold more than VND 9 billion, focusing on the code MBS (VND 8.43 billion), DTD (VND 6.51 billion), SHS (VND 4.97 billion) and NTP (VND 2.72 billion).

| Foreign buying and selling movements |

Morning session: VN-Index turned down

Weak demand, positive signals at the beginning of the session thanks to a few pillar stocks could not spread, VN-Index gradually narrowed the increase and turned down. By the end of the morning session, the VN-Index temporarily stood at 1,207.3 points (-0.25%); HNX-Index decreased by 0.46%, to 225.4 points. Foreign investors net sold strongly on the HOSE exchange with a value of more than VND 1,029 billion.

The market traded quite gloomily in the morning session, with the trading volume of the VN-Index reaching nearly 255 million units, equivalent to a value of nearly VND 5,600 billion. The HNX-Index recorded a trading volume of more than 25 million units, with a value of more than VND 507 billion.

Source: VietstockFinance

|

Three pillars of the Vingroup family “supported” the market in the morning session. Notably, VHM surged to the ceiling price right from the beginning of the session after the news about the decision to buy back 370 million treasury shares, contributing more than 2.7 points to the increase of the VN-Index. However, the “escape” of foreign investors is a notable move when the group net sold VHM with a value of up to more than VND 536 billion in just the morning session. The two remaining stocks, VRE and VIC, also recorded strong breakthroughs, up 5.9% and 2.5%, respectively.

The industry groups began to show differentiation. Specifically, the real estate group led the market with a gain of 1.88%, but the stocks in the industry had mixed performances. While VHM, VRE, VIC, SSH, NVL, SNZ,… rose positively, BCM, IDC, KDH, DIG, PDR, NLG, CEO… still sank in red.

The utilities group also had a similar performance, with the industry index up 0.44% as many stocks were traded positively, such as GAS, PGV, BWE, HND, NT2… but there were still many codes under the control of the selling force, such as POW, REE, GEG, PPC…

The securities group, after a bright session yesterday, returned to correction this morning, down 1.28%. Almost all stocks sank into the red: SSI (-0.98%), VND (-1.36%), VCI (-0.93%), HCM (-0.82%), FTS (-1.89%), BSI (-1.08%)… The banking group shared the same fate, with many stocks falling more than 1%: BID, CTG, TCB, VPB, HDB, STB, TPB, OCB…

Foreigners net sold a value of more than VND 1,029 billion on the HOSE exchange, with the selling force focusing mainly on VHM stock (accounting for more than 50% of the total value). Meanwhile, VNM continued to be the stock that foreigners “favored” to net buy the most, with a value of nearly VND 97 billion, far exceeding the other stocks. On the HNX exchange, foreigners net sold nearly VND 13 billion, focusing on selling the MBS stock.

10:30 am: The market is differentiated

The market differentiated along with the decline in trading volume compared to the previous morning session, indicating that investors’ psychology is currently quite hesitant, causing the main indices to fluctuate and move in opposite directions. As of 10:30 am, the VN-Index increased slightly by 1.9 points, trading around 1,212 points. HNX-Index decreased by 0.24 points, trading around 226 points.

The breadth of the stocks in the VN30 basket is leaning towards the red. In the decrease, TCB, HDB, VPB, and HPG are taking away 0.91 points, 0.85 points, 0.71 points, and 0.69 points from the VN30 index, respectively. On the contrary, VHM, VIC, VRE, and GAS are the stocks that have maintained their green color and contributed more than 6 points to the index.

Source: VietstockFinance

|

The group of real estate stocks was brightly colored from the beginning of the session. Specifically, in the retail real estate group, VRE increased by 6.18%, and in the residential real estate group, VHM increased by the ceiling price, VIC increased by 3.27%, NVL increased by 1.32%, and DXG increased by 0.39%… A small portion of the remaining codes remained at a standstill, and some codes still faced selling pressure, such as PDR, HDG, NTL, DTD…

Following this was the telecommunications services group, which also contributed to the market’s upward momentum, with most of the stocks in the group trading positively, such as VGI up 1.44%, CTR up 0.34%, TTN up 1.4%, and MFS up 1.37%…

On the contrary, the non-essential consumer goods group is showing mixed performances, with stocks slightly decreasing, such as MWG down 0.48%, PLX down 0.53%, PNJ down 0.63%, and TCM down 0.22%…

Compared to the beginning of the session, the market continued to fluctuate with the reference codes accounting for the majority (more than 1,000 codes), but the buying force still had the upper hand. The number of rising codes exceeded 300, while the number of falling codes exceeded 260.

Source: VietstockFinance

|

Opening: Maintaining a slight increase

At the beginning of the August 07 session, as of 9:30 am, the VN-Index increased by more than 5 points, reaching 1,215.85 points. On the other hand, the HNX-Index slightly decreased, reaching 226.44 points.

The green color dominated most industry groups, with some pillar stocks increasing positively right from the beginning of the session, such as VHM surging to the ceiling price of 6.9%, VRE increasing by 6.18%, VIC increasing by 4.84%, BID increasing by 0.64%, GAS increasing by 1.42%…

Large-cap stocks such as VHM, VIC, VRE, are pulling the market with a total increase of more than 4.5 points. On the contrary, VCB, CTG, ACB led the group with a negative impact on the market, but the decrease was only more than 0.5 points.

The real estate group maintained a stable growth rate right from the beginning of the session, with stocks such as VHM increasing by 6.9%, VRE increasing by 6.18%, VIC increasing by 4.84%, DIG increasing by 1.32%, KBC increasing by 1.42%,…