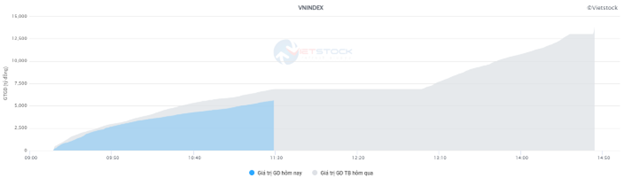

The morning trading session witnessed a lackluster market with a trading volume of nearly 255 million units for the VN-Index, equivalent to a value of nearly VND 5.6 trillion. The HNX-Index recorded a trading volume of over 25 million units, with a value of over VND 507 billion.

Source: VietstockFinance

|

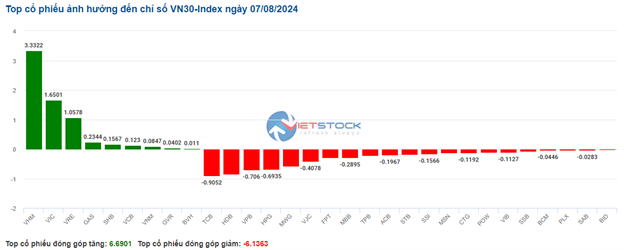

The three pillars of the Vingroup family “supported” the market during the morning session. Notably, VHM surged to the ceiling price right at the beginning of the session after the announcement of the decision to repurchase 370 million treasury shares, contributing more than 2.7 points to the VN-Index. However, foreign investors’ selling pressure was notable as they net sold VHM with a value of up to over VND 536 billion in the morning session alone. The other two stocks, VRE and VIC, also witnessed strong breakthroughs, rising by 5.9% and 2.5%, respectively.

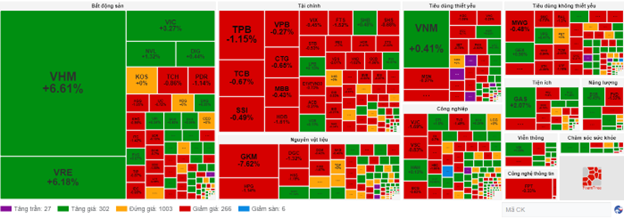

Sector stocks began to diverge. Specifically, the real estate sector led the market with a 1.88% increase, but stocks within the industry fluctuated. While VHM, VRE, VIC, SSH, NVL, SNZ, etc., rose positively, BCM, IDC, KDH, DIG, PDR, NLG, CEO, and others remained in the red.

The utilities sector followed a similar trajectory, with the industry index rising by 0.44% as many stocks witnessed positive trading, such as GAS, PGV, BWE, HND, NT2, etc. Nevertheless, a few codes were still dominated by sellers, including POW, REE, GEG, and PPC.

After a colorful session yesterday, securities stocks adjusted downward this morning, declining by 1.28%. Almost all stocks were in the red: SSI (-0.98%), VND (-1.36%), VCI (-0.93%), HCM (-0.82%), FTS (-1.89%), BSI (-1.08%), and so on. The banking group shared a similar fate, with many stocks falling by over 1%, including BID, CTG, TCB, VPB, HDB, STB, TPB, and OCB.

Foreign investors net sold over VND 1,029 billion on the HOSE exchange, focusing their selling pressure mainly on VHM stocks (accounting for more than 50% of the total value). Meanwhile, VNM continued to be the stock that foreign investors favored the most, with a net buy value of nearly VND 97 billion, far exceeding the other stocks. On the HNX exchange, foreign investors net sold nearly VND 13 billion, focusing their sales mainly on MBS stock.

10:30 am: Market Divergence

The market divergence, along with a decrease in trading volume compared to the previous morning session, indicated investors’ cautious sentiment, leading to a mixed performance among the major indices. As of 10:30 am, the VN-Index gained 1.9 points, hovering around 1,212 points. Meanwhile, the HNX-Index lost 0.24 points, trading at around 226 points.

The breadth of the stocks in the VN30 basket was tilted towards the downside. Notably, on the declining side, TCB, HDB, VPB, and HPG dragged the VN30 index down by 0.91 points, 0.85 points, 0.71 points, and 0.69 points, respectively. Conversely, VHM, VIC, VRE, and GAS remained in positive territory, contributing over 6 points to the index.

Source: VietstockFinance

|

Real estate stocks painted a bright picture right from the start of the session. Specifically, in the retail real estate group, VRE jumped by 6.18%, while residential real estate stocks like VHM hit the ceiling price, VIC climbed by 3.27%, NVL rose by 1.32%, and DXG inched up by 0.39%… A small portion of the remaining codes remained unchanged, while a few others faced mild selling pressure, including PDR, HDG, NTL, and DTD…

Following closely was the telecommunications services sector, which also contributed to the market’s upward momentum, with most stocks in the green, such as VGI surging by 1.44%, CTR climbing by 0.34%, TTN rising by 1.4%, and MFS advancing by 1.37%…

In contrast, the non-essential consumer goods sector exhibited a mixed performance, with slight declines in some stocks like MWG dropping by 0.48%, PLX falling by 0.53%, PNJ slipping by 0.63%, and TCM edging down by 0.22%…

Compared to the opening, the market continued to fluctuate, with reference codes accounting for a large proportion (over 1,000 codes), but buyers slightly dominated. There were more than 300 rising codes and over 260 declining codes.

Source: VietstockFinance

|

Opening: Maintaining a slight gain

At the start of the session on August 7, as of 9:30 am, the VN-Index rose over 5 points to 1,215.85 points. Conversely, the HNX-Index dipped slightly, settling at 226.44 points.

The green hue dominated most industry groups, with several large-cap stocks witnessing positive gains from the beginning of the session, such as VHM surging to the ceiling price of 6.9%, VRE climbing by 6.18%, VIC rising by 4.84%, BID advancing by 0.64%, and GAS inching up by 1.42%…

Stocks like VHM, VIC, and VRE propelled the market, contributing over 4.5 points to the rise. On the other hand, VCB, CTG, and ACB led the group of stocks negatively impacting the market, but the decline was limited to over 0.5 points.

Real estate stocks maintained stable growth from the beginning of the session, with codes like VHM soaring by 6.9%, VRE climbing by 6.18%, VIC rising by 4.84%, DIG advancing by 1.32%, KBC inching up by 1.42%, and so on.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.