Illustration

Oil rebounds from multi-month lows as tighter supply comes into view

Oil prices bounced off multi-month lows reached in the previous session as investor attention shifted to tightening supply and a recovery in financial markets following a recent rout. Brent crude futures rose 18 cents, or 0.2%, to settle at $76.48 a barrel. U.S. West Texas Intermediate (WTI) crude futures gained 26 cents, or 0.4%, to close at $73.20. Both benchmarks broke a three-session losing streak.

Iran’s vow to retaliate against Israel and the U.S. after the killing of two militia leaders raised concerns that a wider war is smoldering in the Middle East, which could directly impact supplies from the region.

Lower output at Libya’s 300,000-barrel-per-day Sharara oil field also added to supply concerns. The National Oil Corporation said on Tuesday that it would start reducing production at the field due to protests.

Recent drawdowns in crude and fuel inventories at major trading hubs are also supporting oil prices. Global oil inventories fell by about 400,000 barrels per day in the first half of this year, according to estimates from the U.S. Energy Information Administration (EIA) released on Tuesday. They are expected to drop by about 800,000 barrels per day in the second half.

Gold falls as dollar, yields firm; focus on Fed, Mideast

Gold prices edged lower on Wednesday, pressured by a stronger dollar and higher bond yields, although expectations of a U.S. rate cut in September and escalating geopolitical tensions in the Middle East kept bullion on track for its first gain in four sessions.

Spot gold was down 0.6% at $2,393.98 per ounce by 1843 GMT. The metal fell 1.5% in the previous session on a global sell-off as fears of a looming U.S. recession took center stage. U.S. gold futures settled down 0.5% at $2,431.60.

Fed policymakers pushed back against the notion that weaker-than-expected July jobs data meant the economy was falling into a recessionary spiral, but also warned that a rate cut would be necessary to avoid that outcome.

Spot silver fell 0.4% to $27.16 per ounce, while platinum rose 1.2% to $917.10. Palladium jumped 3.6% to $880.25 after hitting its lowest since 2017 on Monday on recession fears.

Copper rebounds, zinc falls

Copper prices turned positive along with financial markets as central bank comments eased concerns about a potential recession. Zinc, however, fell after inventories surged, highlighting ample supplies.

Three-month copper on the London Metal Exchange (LME) rose 0.4% to $8,923 a tonne at the close after falling 1.8% to its lowest since mid-March.

LME copper has fallen 21% from a record above $11,100 in March.

Analysts forecast a market surplus of 19,000 tonnes for zinc this year, leaping to 229,800 tonnes in 2025, a Reuters poll showed.

Among other metals, LME aluminum rose 2% to $2,294 a tonne, tin gained 1% to $29,770, and nickel climbed 0.3% to $16,330. Lead added 1.2% to $1,954 a tonne after falling 4.6%.

Iron ore falls on weak near-term demand, high port stocks

Iron ore futures fell as weak near-term demand and prolonged high port stocks weighed on sentiment.

The January 2025 iron ore contract on the Dalian Commodity Exchange (DCE) fell 1.42% to 763 yuan ($106.78) a tonne, after rising nearly 2% on Monday. September iron ore on the Singapore Exchange fell 0.83% to $102.95 a tonne as of 0700 GMT.

Prices were impacted by weak near-term demand after many Chinese steelmakers reported losses, analysts said.

On the Shanghai Futures Exchange, steel contracts were lower across the board. Rebar fell 1.78%, hot-rolled coil dropped 0.97%, stainless steel lost 1.35%, and wire rod dipped 1.5%.

Soybeans, corn fall; wheat rises

Chicago soybeans and corn fell on weak demand and a stronger dollar as financial markets recovered from a previous session rout. Wheat futures rose after Egypt’s major purchase of 3.8 million tonnes for delivery from October 2024 to April 2025 – the largest ever.

At the Chicago Board of Trade, soybeans fell 14 cents to $10.26-3/4 a bushel, after 12 straight sessions of gains. Corn dropped 2 cents to $4.05 a bushel and wheat rose 3-3/4 cents to $5.43-1/4 a bushel.

Coffee jumps 4% on worsening production outlook

Coffee prices surged in New York and London as signs of declining output in Brazil, the world’s biggest producer and exporter, pointed to an increasingly tight global supply.

ICE futures rose 4.5% to $2.3595 per lb, while London robusta coffee jumped 5% to $4,383 per tonne. Robusta has gained 44% so far this year, after climbing 63% in 2023.

Brazil’s production woes follow difficulties in Asia, where robusta output suffered from unfavorable weather, leading to tight supplies. Coffee stocks remain tight in major consuming regions. European coffee inventories fell 27% in June from a year earlier, while Japan’s coffee stocks were down 12% from the five-year average.

London cocoa rose 1.5% to £5,426 per tonne, while New York cocoa gained 1.4% to $6,770 per tonne. Raw sugar fell 0.21 cents, or 1.2%, to 17.87 cents per lb and white sugar dropped 1.6% to $507.60 per tonne.

Japanese rubber futures rebound on supply concerns

Japanese rubber futures rose, buoyed by supply concerns in Thailand, a weaker yen, and stronger oil prices.

The most active rubber contract on the Osaka Exchange (OSE) for January 2025 delivery rose 5.1 yen, or 1.63%, to 317.3 yen ($2.19) per kg. The most-traded January 2025 rubber contract on the Shanghai Futures Exchange (SHFE) gained 20 yuan, or 0.13%, to 15,675 yuan ($2,190.90) per tonne.

Current supplies from non-Japanese producing regions are limited, and processing costs for rubber factories have increased. With raw material prices steady and a stronger dollar against a weaker yen, rubber prices continue to be supported by solid demand and lower-than-expected supplies, a Singapore-based trader said.

The September rubber contract on the SICOM exchange in Singapore last traded at 167.4 U.S. cents per kg, up 0.2%.

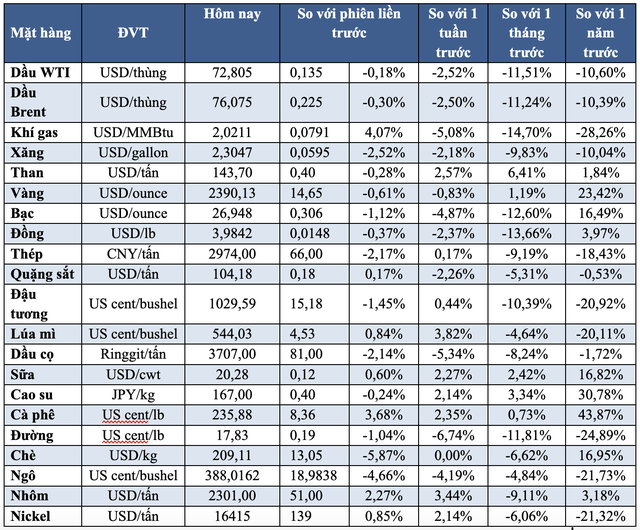

Key commodity prices on August 07, 2024

The Golden Fever of Mini Lucky Wealth to Experience Gold Accumulation

Understanding the increasing demand of the younger generation for investment and wealth accumulation, PNJ introduces the Mini Gold Line – Thanh Loc Dai Phat, a meaningful gold gift that inspires young people to experience wealth accumulation.